Breaking Down US Aircraft Exports to Mexico: Key Trade Insights of US Aircraft Export Data

Explore the latest trends in US aircraft exports to Mexico, including export value, top suppliers, market trends, and projections for 2025. Get key insights from US aircraft export data.

The United States has seen a steady increase in its aircraft exports to Mexico in recent years. This trend has raised eyebrows among trade analysts and industry experts, who are keen to understand the dynamics behind this surge in exports. The USA has been the biggest aircraft and spacecraft exporter in the world for a long time.

According to the US export data and the USA aircraft export data, the total value of US aircraft exports to Mexico reached $6.30 billion in 2024, an increase of 28% from the previous year. The US exports the most aircraft to China, while Mexico ranks at number 7th for US aircraft exports by country in 2024. Aircraft is the 12th most exported commodity by the US to Mexico, as per the latest US shipment data & US trade data for 2024. The total value of US aircraft exports accounted for $134.23 billion in 2024, a 7% increase from the previous year.

In global trade, aircraft come under the 2-digit HS code chapter 88. By delving into the US aircraft export data, we can uncover valuable insights into the factors driving this trade and its implications for both countries.

The Rise of US Aircraft Exports to Mexico

The United States has long been a dominant player in the global aerospace industry, with its Boeing and Airbus leading the way in commercial and military aircraft production. In recent years, Mexico has emerged as a key market for US aircraft exports, with an increasing number of airlines and defense forces in the country opting for US-made aircraft, as per Mexico customs import data. This growth can be attributed to several factors, including the expansion of Mexican airlines, the modernization of the Mexican defense forces, and the increasing preference for US-made aircraft in the Mexican market.

One of the key drivers of this trend is the close economic ties between the US and Mexico. The two countries share a strong trade relationship, with the North American Free Trade Agreement (NAFTA) (now replaced by the USMCA) facilitating the flow of goods and services across their borders. As a result, US aircraft manufacturers have found a receptive market in Mexico, where demand for new aircraft is on the rise.

Top US Aircraft Exports to Mexico: Aircraft and Parts Exports by Type

In the realm of aircraft exports to Mexico, the United States stands as a prominent figure, with its top exports including various types of aircraft and parts. These products play a pivotal role in bolstering aerospace industries, forging closer economic ties between the two nations. The top aircraft and parts that the US exports to Mexico, as per the US-Mexico trade data and US export data by country for 2024, include:

1. Parts of aircraft and spacecraft (HS code 8807): $68.84 million

2. Unmanned aircraft (HS code 8806): $8.89 million

3. Parachutes and paragliders (HS code 8804): $2.12 million

4. Aircraft launching gear (HS code 8805): $2.08 million

5. Balloons and dirigibles (HS code 8801): $437K

6. Powered aircraft like helicopters and airplanes (HS code 8802): $136K

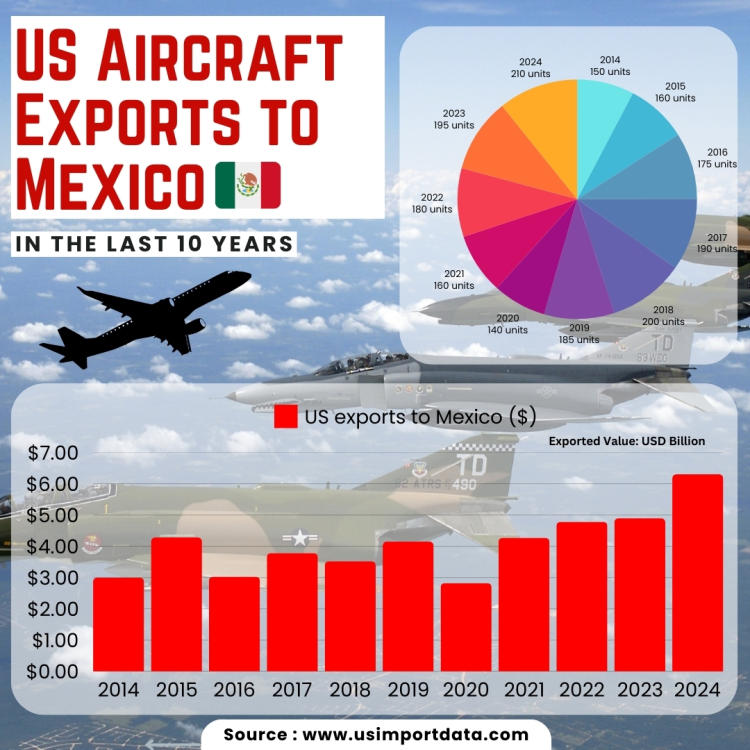

US Aircraft Exports to Mexico in the Last 10 Years: Yearly US Aircraft Export Data

|

Year of Exports |

US exports to Mexico ($) |

Exported Quantity (Units) |

|

2014 |

$3 billion |

150 units |

|

2015 |

$4.28 billion |

160 units |

|

2016 |

$3.03 billion |

175 units |

|

2017 |

$3.78 billion |

190 units |

|

2018 |

$3.52 billion |

200 units |

|

2019 |

$4.15 billion |

185 units |

|

2020 |

$2.82 billion |

140 units |

|

2021 |

$4.27 billion |

160 units |

|

2022 |

$4.78 billion |

180 units |

|

2023 |

$4.90 billion |

195 units |

|

2024 |

$6.30 billion |

210 units |

U.S. Aircraft Shipments to Mexico in 2024

|

Month |

Total Shipments (units) |

Export Value ($ million) |

|

January |

14 units |

$345.40 million |

|

February |

13 units |

$478.75 million |

|

March |

15 units |

$589.58 million |

|

April |

12 units |

$471.91 million |

|

May |

14 units |

$636.43 million |

|

June |

13 units |

$433.41 million |

|

July |

14 units |

$556.67 million |

|

August |

13 units |

$555.80 million |

|

September |

14 units |

$558.20 million |

|

October |

20 units |

$515.52 million |

|

November |

23 units |

$573.31 million |

|

December |

45 units |

$592.65 million |

|

Total |

210 units |

$6.30 billion |

List of Top US Aircraft Exporters that Supply Aircraft to Mexico

When it comes to the list of top US aircraft exporters who supply aircraft to Mexico, several prominent companies stand out for their expertise and commitment to quality. Companies such as Boeing, Lockheed Martin, and Northrop Grumman have solidified their positions as key players in the aircraft export industry. The top 10 US aircraft-exporting companies who export aircraft to Mexico, as per the US aircraft exporters data for 2024, include:

-

Boeing: $2.5 billion (50 units)

-

Lockheed Martin: $1.2 billion (30 units)

-

Northrop Grumman: $600 million (20 units)

-

Raytheon Technologies: $550 million (25 units)

-

General Dynamics: $500 million (18 units)

-

Textron Aviation: $350 million (12 units)

-

Gulfstream Aerospace: $300 million (10 units)

-

Sikorsky Aircraft: $250 million (15 units)

-

Bell Textron: $250 million (15 units)

-

Honeywell Aerospace: $210 million (10 units) (engines & avionics systems)

Price Trends

-

In the broader context of export prices, US bill of lading data from July 2024 indicates that export air freight prices increased by 0.9% compared to July 2023.

-

While this data pertains to air freight services, it reflects a general trend of modest price increases in the aviation sector.

Market Trends

Mexico's aerospace industry has experienced significant growth, driven by factors such as the expansion of low-cost carriers like Volaris and Viva Aerobus, the Delta-Aeroméxico partnership, increased use of Mexico as a regional hub, and the U.S.-Mexico Bilateral Air Transport Agreement concluded in 2015. These developments have boosted demand for Maintenance, Repair, and Overhaul (MRO) services and new aircraft acquisitions.

Overview & Market Report for US Aircraft Exports to Mexico

-

Total U.S. Aircraft Exports to Mexico (2024): $6.30 billion

-

US Aircraft Shipments Deliveries to Mexico: In 2024, the number of aircraft shipments & deliveries in Mexico was around 210 units.

-

Average Price per Aircraft (2024): In 2024, the average price per aircraft was $13.09 million.

-

Price Trends: Aircraft export prices increased 2.67% YoY due to rising material costs and supply chain factors.

-

Key Growth Drivers: Expansion of Mexican airlines, aerospace investments, and U.S.-Mexico trade agreements.

US Aircraft Exports to Mexico with Price Trends (2024)

|

Category |

Value/Quantity |

|

Total Export Value (2024) |

$6.30 billion |

|

Total Export Quantity (2024) |

210 units |

|

Average Price per Aircraft |

$13.09 million |

|

Key US Aircraft Importers in Mexico |

Aeroméxico, Volaris, Viva Aerobus |

|

Top U.S. Aircraft Exporters to Mexico |

Boeing, Lockheed Martin, Gulfstream |

|

Average Export Price per aircraft in 2023 |

$12.75 million |

|

Export Price change % from 2023 to 2024 |

+2.67% |

Market Trends & Insights

-

Rising Demand: Mexican airlines are expanding fleets, increasing demand for U.S. aircraft.

-

MRO Growth: Mexico's Maintenance, Repair, and Overhaul (MRO) sector is expanding, supporting aircraft acquisitions.

-

U.S.-Mexico Aerospace Trade: Strong partnerships through NAFTA/USMCA agreements drive stable export growth.

US Aircraft Exports to Mexico: Projection & Outlook for 2025

-

Projected Growth: 5-7% increase in U.S. aircraft exports to Mexico in 2025.

-

Demand Drivers: Mexican aviation expansion, airline modernization, and fleet renewals.

-

Challenges: Global supply chain disruptions, inflationary pressures.

Implications of the US Aircraft Exports to Mexico

The surge in US aircraft exports to Mexico has several implications for both countries. For the United States, this trend represents a valuable opportunity to expand its market share in Mexico and strengthen its position as a global leader in the aerospace industry. By catering to the growing demand for aircraft in Mexico, US manufacturers can boost their sales and profits while also supporting job growth and economic development at home.

On the other hand, Mexico stands to benefit from the influx of US-made aircraft, which offer advanced technology, superior performance, and enhanced safety features. By investing in US aircraft, Mexican airlines and defense forces can improve their operational efficiency, enhance their competitiveness, and meet the growing demands of their customers and constituents.

Conclusion and Final Thoughts

To conclude, the surge in US aircraft exports to Mexico is a testament to the close economic ties between the two countries and the strong demand for US-made aircraft in the Mexican market. By analyzing the US aircraft export data, we can gain valuable insights into the factors driving this trade and its implications for both countries. As the aerospace industry continues to evolve, US manufacturers and Mexican buyers must collaborate and innovate, ensuring a bright future for aircraft exports between the two nations.

We hope that you gained insightful knowledge and market trends for US aircraft exports to Mexico with our interactive blog report on US aircraft export data. Visit USImportdata and contact us at info@tradeimex.in to get a list of top aircraft suppliers in the US and the top US aircraft exporting companies supplying aircraft and parts to Mexico.

What's Your Reaction?