US-China Trade War 2024-25: Reciprocal Tariffs Shape US-China Import Export

Get the latest insights on US China trade covering the US and China trade war reciprocal tariffs and key US and China imports and exports.

In recent years, the US-China trade war has been a hot topic of discussion in the global economic landscape. On 9th April 2025, the United States implemented a 125% tariff on products from China, and in response, China imposed an 84% tariff on goods from the US. With tensions between the two economic powerhouses escalating a trade war between the US and China, it is crucial to keep abreast of the latest developments in trade policies, tariffs, and the impact on imports and exports due to the US trade war with China. The US-China trade war intensified in 2025, marked by escalating tariffs and reciprocal tariff countermeasures that have significantly impacted bilateral trade, pricing, and shipment trends. China exports to US continue to grow despite fluctuations in demand, while top Chinese imports to US include electronics, machinery, and textiles. On the other hand, the biggest US exports to China are soybeans, aircraft, and automobiles, reflecting the complementary trade relationship between the two economies.

Analyzing US and China imports and exports provides insight into global supply chains and economic interdependence. However, recent US China trade war tariffs have affected pricing and market access, showing the lasting impact of the US and China trade war on businesses and consumers in both countries. This report provides an enhanced, detailed, and data-driven analysis of the current trade landscape between the United States and China, focusing on China tariffs, US tariffs on China, recent reciprocal tariff updates, and their broader economic implications on the US trade war with China. In this article, we will delve into the key updates on the US-China trade war for 2024-25, including top imports, exports, US trade in goods with China, and reciprocal tariff updates.

US President Trump Hits China with a 104% Reciprocal Tariff

The US replied to China with massive reciprocal tariffs of 104% on Chinese imports, which took effect on April 9, 2025. As an aspect of President Trump’s reciprocal tariffs package, it was originally planned for China to experience a 34% increase in tariffs. However, after Beijing rejected the idea of retracting its commitment to impose 34% reciprocal tariffs on US goods, the US president intensified the situation by introducing an additional 50% in duties as per the latest reports of US tariffs on China.

The total increase in US tariffs on China amounts to a massive 84 percent as a result of this. This increase in tariffs is part of a wider strategy by President Donald Trump aimed at addressing what he terms “long-term trading abuses” inflicted by China. This action comes in response to growing complaints about ongoing trade deficits and, most recently, fentanyl trafficking that is purportedly connected to Chinese entities.

China hits back with 84% tariffs on US goods after Trump’s 104% reciprocal duties

The United States and China are currently engaged in a new round of tariff warfare. Only a day following U.S. President Donald Trump’s approval of a last-minute amendment that raised duties on imports from China, Beijing retaliated by imposing steep new tariffs of its own. Effective from April 10, 2025, China has announced an increase in the tariff on U.S. goods to 84%, up from the previously stated rate of 34%.

China has also imposed export control-related blacklists on 12 US companies and included an additional 6 US companies in its “unreliable entity” list, subjecting them to restrictions and possible penalties in China, along with China tariffs. In response to the Trump administration's implementation of a large 104% tariff on Chinese imports, China took retaliatory measures. The US reciprocal tariffs targeting various nations became effective on Wednesday, escalating a global trade war, especially with China.

Trump Declares 90-Day Tariff Pause but China Tariff Hike to 125%

-

President Donald Trump declared a 90-day pause on reciprocal tariffs for countries affected by increased US tariffs, except for China, resulting in an intensified trade war between the US and China.

-

Trump announced he was authorizing a universal "lowered reciprocal tariff of 10%" just hours after levies against about 60 of America's trading partners began, in a dramatic policy shift as negotiations were ongoing.

-

Simultaneously, he raised tariffs on Chinese goods to 125%, accusing Beijing of a "lack of respect" after it responded with plans for 84% tariffs on US imports.

-

This follows Trump’s announcement of import duties on all products coming into the US, which is the largest disruption to international trade in decades.

China hits back at the US with Additional 125% Tariffs on US Imports

On Friday, China retaliated against President Donald Trump's decision to raise duties on Chinese goods to 145% by increasing its tariffs on U.S. imports to 125%. This escalation in the trade war could disrupt global supply chains. The increase follows the White House's continued pressure on China, the second-largest source of U.S. imports, by targeting it for an additional tariff hike while pausing most of the "reciprocal" tariffs placed on various other nations.

US-China Import-Export Bilateral Trade: China and America Trade Data

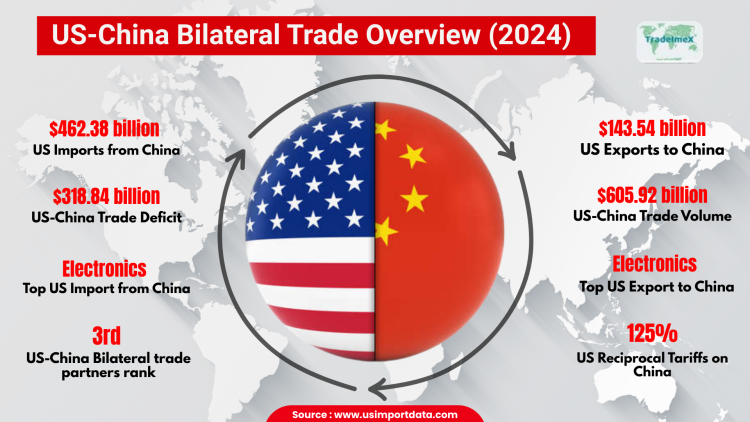

The total bilateral trade volume between the US and China reached $605.92 billion in 2024. According to the US import data and China export data, the US imported goods worth $462.38 billion from China in 2024, a 2.8% increase from the previous year. The US exports to China reached a total value of $143.54 billion in 2024, a decline of 2.9% from the last year, as per the US export data and China import data.

Top US Imports from China: US-China Goods Trade 2024-25

The US-China goods trade for 2024-25 highlights the top US imports from China, shedding light on the evolving economic landscape between the two powerhouse economies. As we delve into the trade dynamics, it becomes evident that certain products continue to dominate the imports from China to the US market. The top 10 commodities that the US imports from China, as per the US import shipment data for 2024, include:

1. Electrical machinery and equipment (HS code 85): $127.05 billion

2. Nuclear reactors and machinery (HS code 84): $85.12 billion

3. Toys, games, and sports requisites (HS code 95): $32.04 billion

4. Plastics and articles thereof (HS code 39): $21.52 billion

5. Furniture, bedding, and mattresses (HS code 94): $20.93 billion

6. Vehicles (HS code 87): $17.98 billion

7. Articles of iron or steel (HS code 73): $13.17 billion

8. Optical, medical, and surgical instruments (HS code 90): $12.33 billion

9. Articles of apparel and clothing, knitted (HS code 61): $10.63 billion

10. Footwear (HS code 64): $10.27 billion

Top US Exports to China: US-China Export Trade 2024-25

In the dynamic landscape of US-China export trade in 2024-25, the top US exports to China play a crucial role in forging economic ties between the two nations. These exports encompass a diverse range of industries, reflecting the robust trading relationship between the United States and China. The top 10 goods that the US exports to China, as per the US export shipment data and China and America trade data for 2024, include:

1. Electrical machinery and equipment (HS code 85): $15.27 billion

2. Mineral fuels and oils (HS code 27): $14.72 billion

3. Oil seeds and oleaginous fruits (HS code 12): $13.35 billion

4. Nuclear reactors and machinery (HS code 84): $12,85 billion

5. Aircraft, spacecraft, and parts thereof (HS code 88): $11.53 billion

6. Optical, medical, and surgical instruments (HS code 90): $11.22 billion

7. Pharmaceutical products (HS code 30): $9.49 billion

8. Plastics and articles thereof (HS code 39): $7.45 billion

9. Vehicles (HS code 87): $6.39 billion

10. Organic chemicals (HS code 29): $3.98 billion

US-China Bilateral Trade Overview (2024)

|

Trade Metric |

Value (USD Billion) |

Notes |

|

U.S. Imports from China |

$462.38 billion |

China accounted for 13.3% of total U.S. imports. Imports grew by 2.8% y-o-y. |

|

U.S. Exports to China |

$143.54 billion |

Declined by 2.9% from the last year. |

|

Trade Deficit |

$318.84 billion |

Increased by 6% from 2023 |

Top US Imports from China (2024)

-

Electronics: Smartphones, computers, toys, and video game consoles constituted 55.5% of imports, as per B/L data on US imports from China by HS code.

Top US Exports to China (2024)

-

Aerospace: Aircraft and related parts.

-

Agriculture: Soybeans and other agricultural products.

-

Semiconductors: Integrated circuits and related technologies.

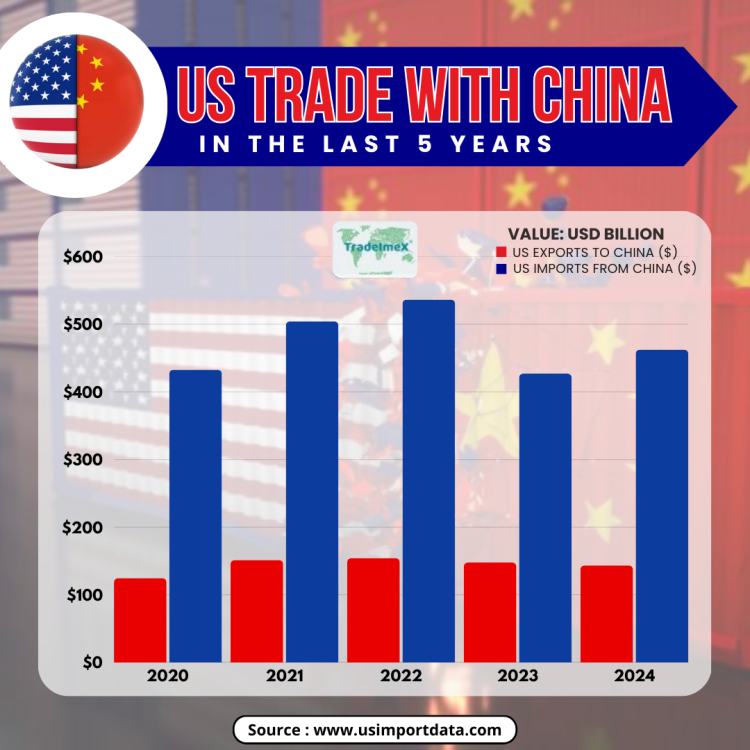

US Trade with China in the Last 5 Years & US-China Trade Deficit Trends (2020-2024)

|

Year |

US Exports to China (USD Billion) |

US Imports from China (USD Billion) |

US-China Trade Deficit (USD Billion) |

|

2020 |

$124.58 billion |

$432.55 billion |

-$307.97 billion |

|

2021 |

$151.44 billion |

$504.25 billion |

-$352.81 billion |

|

2022 |

$154.13 billion |

$536.26 billion |

-$382.13 billion |

|

2023 |

$147.78 billion |

$426.89 billion |

-$279.11 billion |

|

2024 |

$143.54 billion |

$462.38 billion |

-$318.84 billion |

Pricing and Shipment Trends

-

Consumer Goods: Tariff increases have led to higher prices for consumer goods such as iPhones, toys, clothing, and footwear, with potential cost increases of 50% or more.

-

Energy Products: China's additional tariffs on U.S. coal, LNG, and crude oil may accelerate China's diversification of energy imports toward suppliers like Russia and Qatar.

-

U.S. Consumer Prices of Chinese goods (e.g., toys, tech, apparel) have risen 30–50%.

-

Shipping volumes between the U.S. and China have declined by 15% since Q4 2024.

-

Port rerouting: U.S. companies increasingly shift supply chains to Vietnam, Mexico, and India.

-

China turns to Russia, Brazil, and Qatar for oil, soybeans, and gas to replace U.S. sources.

Strategic Shifts

-

Supply Chain Diversification: Both nations are exploring alternative supply chains to mitigate tariff impacts, with the US seeking suppliers in Latin America and Southeast Asia and China turning to other energy partners.

-

Policy Adjustments: Ongoing negotiations and policy shifts continue to influence trade dynamics, with both countries leveraging tariffs as strategic tools in the trade war.

U.S.-China Trade War 2025: Tariffs & Reciprocal Tariffs Timeline

|

Date |

U.S. Tariff Actions |

China’s Reciprocal Tariffs |

Key Notes & Additional Countermeasures |

|

Feb 4, 2025 |

Trump administration imposes new 10% blanket tariff on all Chinese imports. |

China announces tariffs on $23.6B of U.S. goods, including coal, LNG, crude oil, vehicles, and machinery. |

Tariff range: 10–15%, effective Feb 10, 2025 (SP Global) |

|

Mar 4, 2025 |

U.S. escalates tariffs to 20% on all Chinese goods. |

China raises agricultural tariffs: 15% on wheat, chicken, corn, cotton. 10% on soybeans, beef, pork. |

China suspends lumber imports, revokes soybean licenses for 3 U.S. firms. Investigates U.S. optical fiber dumping. |

|

Apr 2, 2025 |

U.S. declares National Emergency: - Imposes an additional 34% tariff on China under trade powers. - Effective U.S. tariff = minimum 54% on Chinese goods. |

China imposes 34% retaliatory tariffs on U.S. goods. |

China restricts U.S. companies in key infrastructure and AI sectors. |

|

Apr 9, 2025 |

U.S. raises tariffs on Chinese goods from 104% to 125%, focusing on high-tech products. |

China retaliated with 84% tariffs on selected U.S. goods. |

Adds 12 U.S. companies to the export control blacklist and Unreliable Entities List. |

|

Apr 10, 2025 |

Trump issues 90-day pause on tariffs over 10% — excluding China. |

China maintains aggressive tariffs and increases inspection delays on U.S. shipments. |

China launches propaganda campaign mocking U.S. trade strategy via social media and state media. |

|

April 11, 2025 |

Trump raised tariffs on Chinese goods to 145%. |

China retaliates with 125% tariffs on US imports |

This increase in tariffs happened due to the US pressure on China. |

Summary of Reciprocal Tariff Coverage by Sector (2024–2025)

|

Sector |

U.S. Tariffs on China |

China Tariffs on U.S. |

|

Tech & Electronics |

Smartphones, laptops, chips (up to 125%) |

Semiconductor machinery, processors (25–40%) |

|

Energy |

Rare earths, solar panels (30–40%) |

Crude oil, LNG, coal (10–15%) |

|

Agriculture |

Processed foods, fertilizers (10–20%) |

Soybeans, pork, beef, dairy, sorghum (10–15%) |

|

Vehicles & Machinery |

EVs, auto parts, industrial machinery (35–50%) |

Heavy vehicles, construction equipment (15%) |

|

Apparel & Toys |

Textiles, toys, footwear (10–20%) |

Branded U.S. apparel and entertainment products (20%) |

Recent Tariff Escalations and Reciprocal Measures

-

U.S. Actions:

-

On April 9, 2025, President Donald Trump announced a 90-day pause on tariffs exceeding 10% for most trading partners. However, tariffs on Chinese imports were increased from 104% to 125%, affecting approximately $600 billion in bilateral trade.

-

China's Response:

-

In retaliation, China imposed additional tariffs, including a 15% tariff on U.S. coal and liquefied natural gas (LNG) products and a 10% tariff on crude oil and other products.

Impacted US Industries from Tariffs

-

Aerospace: Companies like Boeing face risks due to pending aircraft deliveries to Chinese airlines.

-

Automobiles: Manufacturers such as Ford and General Motors may experience cost increases and production slowdowns.

-

Agriculture: The sector, with over $27 billion in exports to China, including $13 billion in soybeans, may lose market share to competitors like Brazil.

-

Semiconductors: Companies like Intel risk significant revenue losses, as China was Intel's largest market in 2024.

Financial Market Reactions to the US-China Trade War

Following the tariff announcements on April 9, 2025, US financial markets experienced a historic rally:

-

Dow Jones Industrial Average: Surged nearly 3,000 points, reversing one of the most significant selloffs in history.

-

S&P 500: Climbed 9.5%, its largest gain since 2008.

-

Nasdaq: Led gains with a 12% rise, marking its strongest performance in 24 years.

The Impact on Global Supply Chains

The US-China trade war has not only affected the two countries involved but has also had a ripple effect on global supply chains and global trade data. As two of the world's largest economies, disruptions in trade between the US and China can impact industries and businesses worldwide. The uncertainty surrounding trade policies and tariffs has forced companies to reassess their supply chain strategies and diversify their sourcing to mitigate risks.

Conclusion and Final Verdict

In conclusion, the US-China trade war continues to shape the economic landscape in 2024-25, with updates on top imports, exports, and reciprocal tariff policies. We conclude that with careful consideration and strategic negotiation, a mutually beneficial trade agreement can be achieved to optimize trade relations between the United States and China amid tariff tensions and trade wars.

In the end, we hope that you gained insightful knowledge from our interactive blog report on the US-China trade war 2025, tariff tensions, and reciprocal tariff counters. To learn more about the latest US trade data and market trends, visit USImportdata. Contact us at info@tradeimex.in and get a list of top US importers, US exporters, and import-export shipment data.

What's Your Reaction?