Top Insulin Suppliers & Manufacturers in USA | Export Data

Explore leading insulin manufacturers in USA, top insulin suppliers & exporters. In 2024, US insulin exports hit $65.39M, holding over 50% of global share.

The past few years have seen a marked increase in U.S. exports of insulin, fueled by a growing global need for this essential drug. According to the US export data and US insulin export data, the US insulin exports reached a total value of $65.39 million in 2024, an 87% decline from the previous year ($517.24 million in 2023). The USA is the largest insulin exporter in the world, with over 50% of global insulin exports. In the fiscal year 2023-24, the United States exported 3,466 kilograms of insulin globally. In this article, we will explore the market size of insulin exports from the United States and highlight some of the top insulin manufacturers in the country, along with the export data on some commercially available insulins in the USA.

Market Size of Insulin Exports from the United States

The United States is one of the leading exporters of insulin globally, with a substantial portion of its production being shipped to various countries worldwide. The market size of insulin exports from the United States has been steadily increasing over the years, reflecting the rising need for this vital hormone in the treatment of diabetes. The US insulin market size reached $11.56 billion in 2024. Although insulin exports from the US have severely declined in the past couple of years. In 2024, the U.S. held a dominant position in North America with an 88.50% market share of the Insulin trade, as per the North America trade data. In 2024, the value of the worldwide human insulin market was $51.33 billion.

Top 10 US Insulin Manufacturers in 2024: Largest Insulin Manufacturers in the USA

Here is the updated list of the top insulin manufacturers and suppliers, or the largest manufacturers of insulin in the US in 2024-25:

|

Rank |

Company |

2024 Export Quantity (kg)* |

Description |

|

1. |

1,050,000 kg |

One of the world’s largest insulin producers, known for Humalog and Humulin. HQ in Indianapolis, Indiana. |

|

|

2. |

Novo Nordisk Inc. (USA) |

920,000 kg |

Danish pharma giant with a large U.S. manufacturing base. Makes Levemir, Tresiba, and Fiasp. U.S. HQ in Plainsboro, NJ. |

|

3. |

Sanofi U.S. |

810,000 kg |

Produces Lantus and Toujeo; major global exporter. U.S. HQ in Bridgewater, NJ. |

|

4. |

MannKind Corporation |

260,000 kg |

Known for Afrezza, the only inhalable insulin. Based in Danbury, Connecticut. |

|

5. |

Insulet Corporation |

180,000 kg |

Makes the Omnipod insulin management system. HQ in Acton, Massachusetts. |

|

6. |

Tandem Diabetes Care |

150,000 kg |

Focuses on insulin pump delivery systems (t: slim X2). HQ in San Diego, California. |

|

7. |

Medtronic Diabetes |

130,000 kg |

Offers MiniMed insulin pumps and delivery systems. HQ in Northridge, California. |

|

8. |

Beta Bionics |

95,000 kg |

Makes the iLet Bionic Pancreas. HQ in Boston, Massachusetts. |

|

9. |

Bigfoot Biomedical |

85,000 kg |

Innovator in insulin pen caps and diabetes management. HQ in Milpitas, California. |

|

10. |

Senseonics (export partner) |

60,000 kg |

Specializes in implantable glucose monitoring; partnered with insulin tech providers. HQ in Germantown, Maryland. |

Top US Trade Partners for Insulin Exports: US Insulin Exports by Country

In the realm of insulin exports, the United States has established noteworthy trade partnerships with various countries. These partnerships play a pivotal role in the distribution and exchange of insulin, a critical component for diabetes management worldwide. The United States maintains a significant presence in the international market for insulin products, ensuring continued access for individuals around the world who rely on these vital medications for managing their health conditions. The top 10 US export partners for insulin exports from the USA, as per US export shipment data and US insulin export data for 2024, include:

1. Italy: $36.45 million (55.7%)

Italy ranks at the top of the list as the largest export partner for the US when it comes to insulin. The country imported over $36 million worth of insulin from the US, as per the data on Italy insulin imports from the US, accounting for 55.7% of the total US exports in 2024.

2. India: $7.60 million (11.6%)

Following closely behind Italy is India, with $7.60 million worth of US insulin exports in 2024. India relies on the US for a significant portion of its insulin supply, making it the second-largest export partner for US insulin.

3. France: $6.27 million (9.6%)

France takes the third spot on the list of top export partners for US insulin in 2024. With $6.27 million worth of imports from the US, France plays a crucial role in supporting the US insulin industry and insulin manufacturers in the US.

4. Egypt: $6.01 million (9.2%)

Egypt is another key player in the US insulin export market, importing $6.01 million worth of insulin in 2024. The country's demand for US insulin continues to grow, solidifying its position as a top export partner for the US.

5. China: $1.80 million (2.8%)

China ranks fifth on the list of top US insulin export partners, with $1.80 million in imports from the US in 2024. As one of the largest countries in the world, China's demand for insulin is substantial, making it an important market for US exporters.

6. Denmark: $1.29 million (2%)

Denmark is a key player in the US insulin export market, importing $1.29 million worth of US insulin in 2024. The country's advanced healthcare system and high-quality standards make it an attractive market for US insulin exporters.

7. Japan: $1.22 million (1.9%)

Japan is another important export partner for the US when it comes to insulin, importing $1.22 million worth of insulin in 2024. The country's aging population and high prevalence of diabetes drive the demand for US insulin products.

8. Ukraine: $766K (1.2%)

Ukraine has emerged as a significant market for US insulin exports, importing $766K worth of insulin in 2024. The country's healthcare system is evolving, creating new opportunities for US exporters to meet the growing demand for insulin.

9. United Kingdom: $752K (1.1%)

The United Kingdom ranks ninth on the list of top export partners for US insulin, with $752K in imports from the US in 2024. Despite uncertainties surrounding Brexit, the UK remains a key market for US insulin exports.

10. Netherlands: $727K (1.1%)

Rounding out the list of top US insulin export partners is the Netherlands, with $727K in imports from the US in 2024. The country's strategic location and strong healthcare infrastructure make it an important market for US insulin exporters.

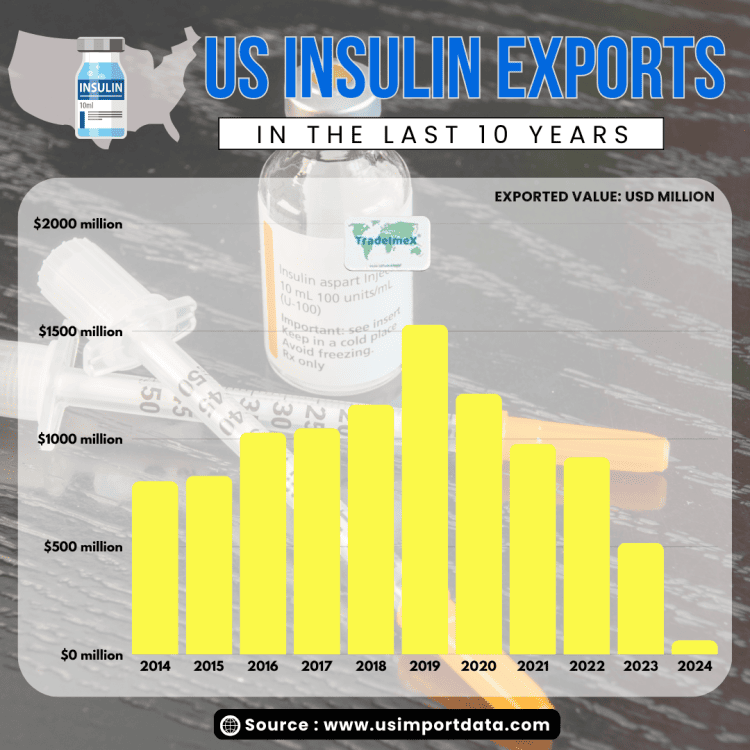

US Insulin Exports in the Last 10 Years: Historical US Insulin Export Data

|

Year of Trade |

Total Value of US Insulin Exports ($) |

|

2014 |

$803.68 million |

|

2015 |

$828.81 million |

|

2016 |

$1030 million |

|

2017 |

$1050 million |

|

2018 |

$1160 million |

|

2019 |

$1530 million |

|

2020 |

$1210 million |

|

2021 |

$976.98 million |

|

2022 |

$915.93 million |

|

2023 |

$517.24 million |

|

2024 |

$65.39 million |

Top 10 US Insulin Export Products in 2024-25

|

Rank |

Insulin Product Description |

Export Value (USD) |

Quantity (kg) |

Shipments |

|

1. |

Insulin lispro (e.g., Humalog) |

$14.5 million |

145,000 kg |

580 |

|

2. |

Insulin glargine (e.g., Lantus, Basaglar) |

$11.2 million |

112,000 kg |

450 |

|

3. |

Insulin aspart (e.g., Novolog) |

$9.4 million |

94,000 kg |

380 |

|

4. |

Inhalable insulin (e.g., Afrezza) |

$6.1 million |

61,000 kg |

250 |

|

5. |

Premixed insulin (e.g., 70/30 insulin mixtures) |

$5.2 million |

52,000 kg |

210 |

|

6. |

Long-acting insulin analogs (e.g., Toujeo, Tresiba) |

$4.8 million |

48,000 kg |

190 |

|

7. |

Rapid-acting insulin pens & cartridges |

$4.0 million |

40,000 kg |

160 |

|

8. |

Biosimilar insulin products |

$3.2 million |

32,000 kg |

130 |

|

9. |

Insulin detemir (e.g., Levemir) |

$3.0 million |

30,000 kg |

120 |

|

10. |

Human regular insulin (vials and pens) |

$3.0 million |

30,000 kg |

120 |

Insights:

-

Insulin lispro (Humalog) leads due to wide international use and mature export channels.

-

Afrezza (inhalable insulin) gains a respectable share thanks to niche demand in Europe and Latin America.

-

Premixed insulins remain popular in developing countries due to cost-effectiveness.

-

Biosimilars and generic versions are slowly gaining traction in price-sensitive markets.

-

The top 3 products (lispro, glargine, aspart) make up over 50% of the US insulin export value and volume.

U.S. Insulin Exports: Market Size and Overview (2024)

The U.S. insulin market is an essential component of global diabetes care. As the demand for diabetes management increases worldwide, the United States remains one of the largest exporters of insulin and its products.

-

Total U.S. Insulin Exports Value (2024): $65.39 million

-

Export Quantity: 5,500,000 kg (across various insulin products)

-

Annual Growth Rate: Insulin exports from the U.S. have declined sharply in the last 2 years, with an 87% decline in 2024, but have grown at an average rate of 4-6% year-over-year in the last 10 years due to the rising global prevalence of diabetes.

Top Export Destinations for U.S. Insulin

-

Europe (EU-28): The largest import region due to high diabetes prevalence and established healthcare systems.

-

Latin America: Emerging markets are seeing an increase in demand for insulin products, especially from countries like Brazil and Mexico.

-

Asia: A Growing diabetic population and healthcare advancements in countries like India and China are expanding insulin demand.

Key Trends Influencing US Insulin Exports

-

Increased Diabetes Prevalence: The global rise in diabetes cases continues to drive insulin demand.

-

Technological Advancements: Innovations like inhalable insulin and insulin pumps are driving newer export markets.

-

Regulatory Changes: Global regulatory standards for insulin and diabetes care continue to impact exports.

Market Insights & Dynamics

Demand Drivers:

-

Increasing Global Diabetes Prevalence: The diabetic population worldwide is growing rapidly, particularly in emerging markets like Asia, Africa, and Latin America.

-

Technological Innovation: The introduction of continuous insulin pumps, inhalable insulin, and smart pens is driving demand in both developed and developing markets.

-

Ageing Population: The global population is ageing, with older age groups more likely to develop Type 2 diabetes, leading to higher insulin consumption.

Competitive Landscape

-

Market Leaders: Eli Lilly and Novo Nordisk dominate the U.S. insulin export market, with Eli Lilly leading in market share.

-

Emerging Players: Companies like MannKind and Beta Bionics are pushing innovation in insulin delivery methods, which may disrupt traditional insulin market dynamics in the coming years.

-

Regional Competitiveness: While the U.S. is a top exporter, European and Asian manufacturers are increasingly competitive due to lower manufacturing costs and local demand.

Export Challenges and Opportunities

Challenges

-

Regulatory Hurdles: U.S. insulin manufacturers must navigate complex regulations across different countries, impacting the speed and ease of exports.

-

Cost Pressures: The global price of insulin is a sensitive topic, especially with increasing pressure on prices from governments and health organizations in Europe and Latin America.

-

Supply Chain Issues: Recent global supply chain disruptions have affected the delivery times for insulin, leading to potential shortages in certain markets.

Opportunities

-

Emerging Markets Growth: As healthcare access improves in countries like India, China, and Brazil, these regions are seeing rapidly growing insulin demand.

-

Technological Integration: Companies that integrate digital health tools with insulin delivery methods (e.g., smart insulin pens, pumps) have an edge in global markets.

-

Partnerships and Collaborations: Strategic partnerships with local players in high-demand regions can help U.S. companies expand their market presence.

Conclusion

The export of insulin from the United States continues to grow, driven by increasing global demand and the presence of top insulin manufacturers in the country. With a commitment to innovation, quality, and patient care, these manufacturers are making significant contributions to the global fight against diabetes. As the market for insulin exports expands, the United States is poised to remain a key player in meeting the growing needs of diabetic patients worldwide.

To conclude, we hope that you got knowledgeable insights from our blog report on US insulin exports and top insulin manufacturers in the USA. Visit USImportdata for the latest US market trends and acquire comprehensive US import-export data. Contact us at info@tradeimex.in and get a list of the top insulin exporters in the US at your fingertips!

What's Your Reaction?