Top Soybean Oil Suppliers & Exporters in USA: US Soybean Oil Export Data by Country 2025

Discover top soybean oil exporters and suppliers in the USA with soybean oil exports by country, plus 2024–25 US trade data & global market trends

The United States is one of the world’s most important producers and processors of soybeans, and soybean oil remains a strategic export product within the global edible oil and industrial oils market. While whole soybeans and soybean meal dominate overall export value, soybean oil plays a critical role in meeting international demand for vegetable oils used in food manufacturing, retail cooking, animal feed blends, and increasingly, biofuel production. According to the latest US export data and soybean oil export data of the USA, the total value of US soybean oil exports reached $520.21 million in 2024, a 22% increase from the previous year. According to the US soybean oil export data, the US exported soybean oil worth $1.01 billion in the first three quarters of 2025.

The USA is the 3rd largest exporter of soybean oil, as per the global trade data. In the 2024–25 period, U.S. soybean oil exports reflected shifting global trade patterns, steady demand from neighboring markets, and growing competition from South American producers. This blog provides an in-depth, data-driven analysis of U.S. soybean oil exports, including export volumes, values, destination countries, and the leading suppliers and exporters operating in the U.S. market.

Overview of the U.S. Soybean Oil Market

Soybean oil is produced through the crushing of soybeans, yielding two primary co-products: soybean meal and soybean oil. The U.S. crush industry is highly developed, supported by extensive soybean production across the Midwest, advanced processing infrastructure, and access to export terminals on the Gulf Coast, Atlantic Coast, Great Lakes, and Pacific Northwest.

The global trade in edible oils highlights the US as the third largest exporter of soybean oil among leading soybean oil exporting countries, where compliance and classification often reference the soybean oil hs code for trade, while buyers frequently seek reliable soybean oil suppliers USA that work directly with a certified soybean oil manufacturer, especially those recognized as reputable soybean oil manufacturers in USA serving domestic and international markets.

Key characteristics of the U.S. soybean oil market:

-

Large-scale industrial crushing capacity

-

Vertically integrated agribusiness exporters

-

Strong domestic demand from the food and renewable fuel sectors

-

Stable export flows to nearby and emerging markets

Although domestic consumption absorbs a significant portion of U.S. soybean oil output, exports remain an essential outlet, especially for refined and semi-refined soybean oil grades, as per the USDA report on US soybean oil exports.

US Soybean Oil Export Performance in 2024–25

Export Volume and Value

In calendar year 2024, U.S. soybean oil exports totaled approximately 460,000 metric tons, with an export value of roughly USD 520–525 million. This marked a stable year-on-year performance compared to recent averages, though below peak export years earlier in the decade, as per the U.S. Soybean Export Council.

Key export metrics (2024):

-

Export volume: 460,000 metric tons

-

Export value: $520 million

-

Average export price: $1,135 per metric ton

-

Share of global soybean oil exports: 4%

The relatively modest global share reflects the dominance of South American suppliers, particularly Argentina and Brazil, which benefit from large surplus production and export-oriented crushing industries.

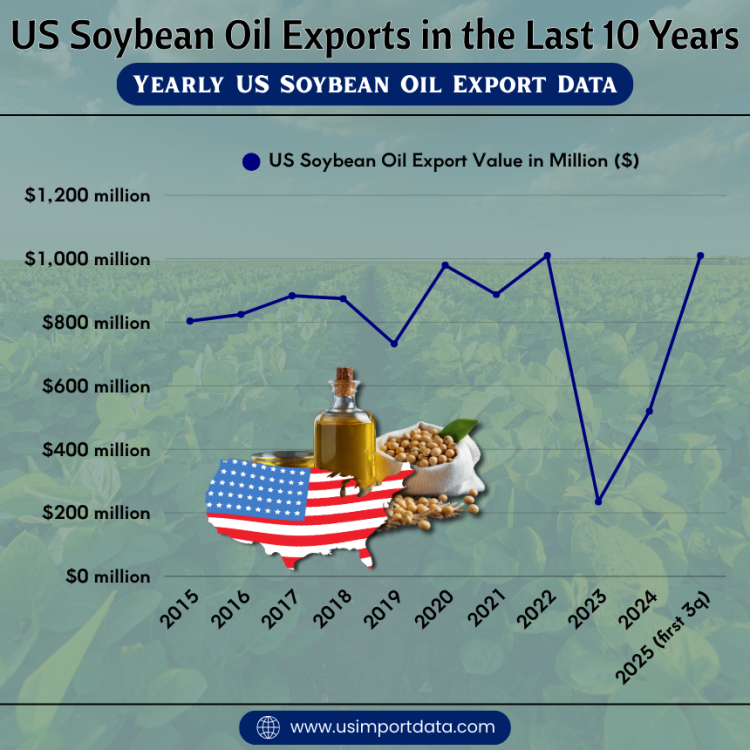

Export Growth Trends

Over the past ten years, U.S. soybean oil exports have shown moderate volatility. Export values peaked during periods of high vegetable oil prices and supply disruptions, while volumes softened when domestic demand for renewable diesel and biodiesel increased.

Key influences on export trends include:

-

Global vegetable oil price cycles

-

Competition from palm, sunflower, and rapeseed oils

-

Biofuel mandates are increasing domestic soybean oil usage

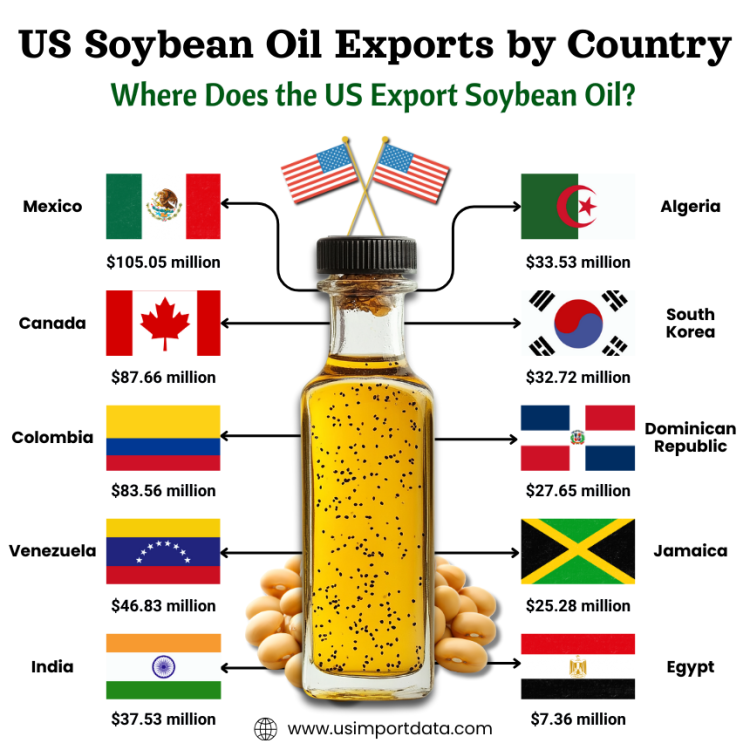

US Soybean Oil Exports by Country: Where Does the US Export Soybean Oil?

US soybean oil exports are an essential component of the global agricultural trade landscape, with the United States being a key player in this market. The US exports soybean oil to various countries worldwide to meet the demand for this versatile commodity. Some significant destinations for US soybean oil exports include Mexico, China, the European Union, Japan, and South Korea. These export destinations illustrate the widespread reach and importance of US soybean oil in international markets. The top 10 export destinations for American soybean oil exports, as per the data on US soybean oil exports by country and US shipment data for 2024-25, include:

1. Mexico: $105.05 million (20.2%)

Mexico stands out as one of the leading importers of US soybean oil, with a staggering value of $105.05 million, accounting for 20.2% of total exports. The proximity between the US and Mexico, along with the strong trade relations between the two countries, has facilitated the smooth flow of soybean oil exports.

2. Canada: $87.66 million (16.9%)

Canada follows closely behind Mexico in terms of US soybean oil exports, with a value of $87.66 million, representing 16.9% of total exports. The demand for soybean oil in Canada is driven by its diverse applications in the food industry, as well as in the production of animal feed and biofuels.

3. Colombia: $83.56 million (16.1%)

Colombia emerges as another key market for US soybean oil exports, with a substantial value of $83.56 million, making up 16.1% of total exports. The growing economy of Colombia, along with the increasing awareness of the health benefits of soybean oil, has contributed to the surge in demand for this product.

4. Venezuela: $46.83 million (9%)

Despite facing economic challenges, Venezuela remains a significant importer of US soybean oil, with an export value of $46.83 million, accounting for 9% of total exports. The affordability and versatility of soybean oil make it a sought-after commodity in Venezuela.

5. India: $37.53 million (7.2%)

India has been steadily increasing its imports of US soybean oil, with a value of $37.53 million, representing 7.2% of total exports. The large population of India, coupled with the growing demand for healthy cooking oils, has paved the way for the rise in US soybean oil exports to this country.

6. Algeria: $33.53 million (6.4%)

Algeria features as a prominent market for US soybean oil exports, with a notable value of $33.53 million, making up 6.4% of total exports. The culinary tradition in Algeria, which heavily relies on vegetable oils like soybean oil, drives the demand for this product.

7. South Korea: $32.72 million (6.3%)

South Korea emerges as a significant player in the US soybean oil export market, with a value of $32.72 million, accounting for 6.3% of total exports. The preference for healthy and high-quality cooking oils in South Korea has bolstered the demand for US soybean oil.

8. Dominican Republic: $27.65 million (5.3%)

The Dominican Republic stands out as an important destination for US soybean oil exports, with a value of $27.65 million, representing 5.3% of total exports, as per the data on US soybean oil exports to the Dominican Republic by HS code. The tropical climate of the Dominican Republic makes it conducive for the consumption of vegetable oils like soybean oil.

9. Jamaica: $25.28 million (4.9%)

Jamaica plays a significant role in the US soybean oil export market, with a value of $25.28 million, making up 4.9% of total exports. The use of soybean oil in Jamaican cuisine, as well as in the production of cosmetics and biodiesel, drives the demand for this versatile product.

10. Egypt: $7.36 million (1.4%)

Egypt rounds up the list of top countries where the US exports soybean oil, with a value of $7.36 million, accounting for 1.4% of total exports. The growing population of Egypt, along with the increasing awareness of the health benefits of soybean oil, has led to a surge in demand for this essential commodity.

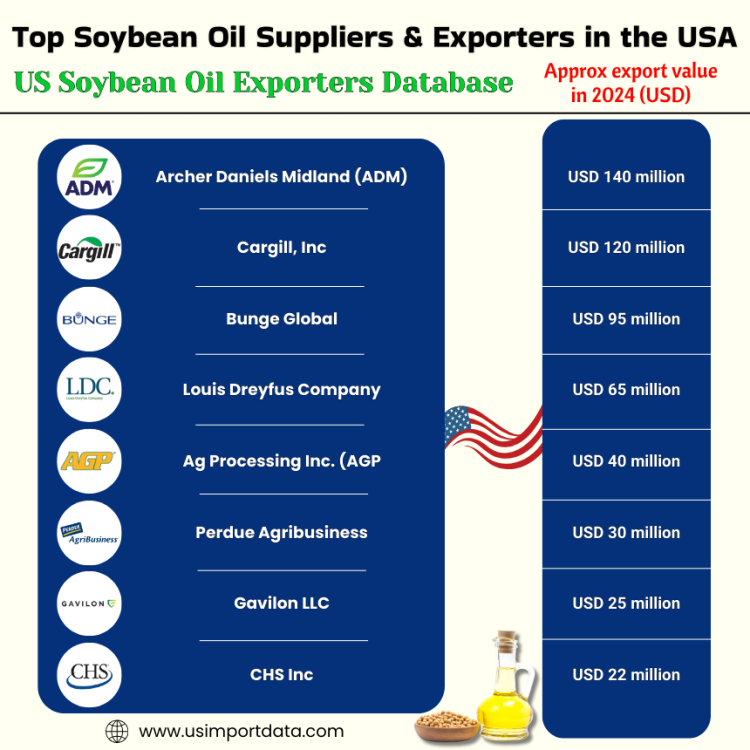

Top Soybean Oil Suppliers & Exporters in the USA: US Soybean Oil Exporters Database

U.S. soybean oil exports are dominated by large agribusiness firms with integrated crushing, refining, and global trading operations. The US Soybean Oil Exporters Database is a valuable resource for businesses looking to source high-quality soybean oil. This database offers comprehensive information on top suppliers and exporters in the United States, enabling you to easily identify trusted partners for your soybean oil needs. The leading soybean oil suppliers in the USA, as per the US soybean oil exporters data & soybean suppliers list for 2024-25, include:

|

Rank |

Company Name |

Approx. Soybean Oil Export Value (2024) |

Top Export Markets |

|

1 |

USD 140 million |

Mexico, Canada, Colombia |

|

|

2 |

Cargill, Inc. |

USD 120 million |

Mexico, Venezuela, Jamaica |

|

3 |

Bunge Global |

USD 95 million |

Colombia, Dominican Republic, Mexico |

|

4 |

Louis Dreyfus Company |

USD 65 million |

Mexico, Canada, Algeria |

|

5 |

Ag Processing Inc. (AGP) |

USD 40 million |

Mexico, Caribbean countries |

|

6 |

Perdue Agribusiness |

USD 30 million |

Canada, Mexico |

|

7 |

Gavilon LLC |

USD 25 million |

Mexico, Central America |

|

8 |

CHS Inc. |

USD 22 million |

Canada, Mexico |

|

9 |

Healthy Brand Oil Corp. |

USD 18 M |

Caribbean, Central America |

|

10 |

Global River Food Ingredients |

USD 15 M |

Caribbean, Africa |

Insights into the Top US Soybean Oil Exporters

1. Archer Daniels Midland (ADM)

ADM is one of the largest soybean processors in the world. The company operates extensive crushing and refining facilities across the U.S., producing refined soybean oil for domestic and export markets.

Key strengths:

-

Large processing capacity

-

Global export network

-

Long-term contracts with international buyers

2. Cargill, Inc.

Cargill plays a central role in U.S. soybean oil exports through its oilseed processing and trading divisions. The company exports refined and crude soybean oil to Latin America, Asia, and Africa.

Key strengths:

-

Vertical integration from farm to export

-

Advanced supply chain management

-

Strong presence in emerging markets

3. Bunge

Bunge operates crushing and refining facilities in the U.S. and is a major exporter of soybean oil. Its global trading network allows efficient market access.

Key strengths:

-

Competitive pricing strategies

-

Strong Latin American market connections

-

Experience in vegetable oil trading

4. Louis Dreyfus Company

Louis Dreyfus is active in oilseed processing and soybean oil exports, supplying food manufacturers and industrial users worldwide.

Key strengths:

-

Global merchandising expertise

-

Risk management capabilities

-

Diverse customer base

5. Mid-Sized and Regional Exporters

In addition to multinational firms, several mid-sized processors and regional suppliers export soybean oil, often serving niche markets or regional buyers. These companies typically focus on refined or specialty soybean oil grades.

US Soybean Oil Exports in the Last 10 Years: Yearly US Soybean Oil Export Data

|

Year of Exports |

US Soybean Oil Export Value ($) |

|

2015 |

$803.86 million |

|

2016 |

$824.68 million |

|

2017 |

$883.47 million |

|

2018 |

$874.49 million |

|

2019 |

$731.99 million |

|

2020 |

$979.64 million |

|

2021 |

$887.44 million |

|

2022 |

$1.01 billion |

|

2023 |

$234.65 million |

|

2024 |

$520.21 million |

|

2025 (first 3 quarters) |

$1.01 billion |

Regional Breakdown of US Soybean Oil Exports

North America

North America accounts for more than one-third of U.S. soybean oil exports. Strong trade agreements, efficient trade, and stable demand support long-term trade flows.

Latin America & Caribbean

This region represents the single largest export destination block. Demand is driven by population growth, food processing expansion, and limited domestic oilseed production in several countries.

Asia

Asian markets are smaller but strategic. Imports are sensitive to price competition with palm and sunflower oils. Demand fluctuates based on tariff structures and domestic oilseed production.

Africa & Middle East

Exports are modest but growing in select countries where food security and edible oil imports are government priorities.

Supply Chain Dynamics: From Soybean to Export Market

The U.S. soybean oil export supply chain involves several stages:

-

Soybean production in the Midwest states

-

Crushing and extraction of oil and meal

-

Refining and packaging

-

Bulk storage and transportation

-

Export shipment via ports and terminals

Efficiency at each stage is critical for maintaining export competitiveness, particularly against low-cost global suppliers.

Market Trends Impacting 2024–25 Exports

Biofuel Demand

Rising renewable diesel and biodiesel production in the U.S. has increased domestic soybean oil consumption. This can tighten export availability during periods of strong biofuel demand.

Price Competition

Soybean oil faces stiff competition from palm oil, which is often cheaper, and sunflower oil, which is preferred in some premium food markets.

Trade Policy and Tariffs

Import tariffs, export regulations, and trade agreements significantly influence demand patterns, particularly in Asia and Africa.

Sustainability Considerations

Some importing countries are increasingly focused on traceability and sustainable sourcing, which may benefit U.S. suppliers due to established compliance standards.

Outlook for U.S. Soybean Oil Exports (2025–26)

Looking ahead, U.S. soybean oil exports are expected to remain stable to moderately growing, supported by:

-

Continued demand from Mexico, Canada, and Latin America

-

Gradual expansion in select Asian and African markets

-

Strong reputation for quality and consistency

However, growth will likely be constrained by:

-

Strong competition from South America

-

Higher domestic usage of renewable fuels

-

Sensitivity to global vegetable oil price movements

Key Takeaways

-

The U.S. exported around 460,000 metric tons of soybean oil in 2024, valued at over $520 million, as per US soybean oil export data by HS code.

-

Mexico, Canada, and Colombia are the top export destinations

-

Exports are dominated by large agribusiness firms such as ADM, Cargill, Bunge, and Louis Dreyfus

-

Latin America and the Caribbean represent the core export market

-

Future growth depends on balancing domestic demand with global competitiveness

Conclusion and Final Note

In conclusion, the US soybean oil exports may not dominate global trade, but they remain strategically important. With reliable supply chains, strong quality standards, and established trading relationships, the U.S. continues to be a trusted soybean oil supplier in key international markets. U.S. soybean oil exports remain an important component of the country’s agricultural trade portfolio. While not as dominant as whole soybeans or soybean meal, soybean oil supports global supply chains, especially in Latin America, the Caribbean, and select regions in Asia and Africa.

For suppliers and exporters, success in 2025–26 will hinge on navigating global competition, strengthening trade relationships, and aligning production to meet evolving international demand.

We hope that you liked our insightful blog report on the US soybean oil export data 2025. For more information on the latest US import-export data, or to search live data on US soybean oil exports by country, visit USImportdata. Contact us at info@tradeimex.in for customized trade reports, market insights, and a verified database of the top soybean oil exporters & suppliers in the USA, tailored to your needs.

What's Your Reaction?