India Imposes 30% Tariff on US Pulses: Implications & US-India Pulse Trade Insights 2025

India imposed 30% tariffs on US pulses. Learn does India have tariffs on the US, Indian tariff on US pulses, and current duties on US pulse crops.

India’s decision to impose a 30% import tariff on pulses originating from the United States has added a new layer of complexity to one of the world’s most important agricultural trade relationships. While pulses may appear to be a niche commodity in global trade discussions, they sit at the intersection of food security, farmer protection, inflation control, and geopolitics for both nations. According to the latest US export data & pulses export data of the USA, the total value of US pulses exports to India reached $80.21 million in 2024, a 39% increase from the previous year. According to the US-India trade data, the US exported pulses worth $4.19 million to India in the first three quarters of 2025.

India is the world’s largest producer, consumer, and importer of pulses, while the United States is among the 4th largest pulses exporter & global exporter of peas, lentils, and dry beans, as per the global trade data. Any tariff change between the two, therefore, carries implications far beyond bilateral trade numbers. It affects global pulse prices, farmer incomes, alternative sourcing patterns, and the broader tone of US-India trade negotiations. While pulses rarely dominate headlines compared to oil, semiconductors, or defense equipment, this move has triggered political reactions in the US, trade recalibrations in India, and price signals across global pulse markets.

What makes this development notable is not just the tariff itself, but who is reacting to it and why. Senators from major US pulse-producing states such as North Dakota and Montana have formally urged former US President Donald Trump to intervene directly with Indian Prime Minister Narendra Modi, highlighting the growing economic pressure on American farmers. This article examines why India imposed the tariff, how the US-India pulse trade has evolved, what the data reveals about import dependence and export exposure, and what this policy shift means for 2025 and beyond.

Why Pulses Matter — In India and the US

United States: A Major Global Pulse Supplier

The United States is among the top pulse-producing and exporting countries, with states like North Dakota and Montana especially prominent in pea and lentil cultivation. However, US pulses historically haven’t dominated India’s import mix due to tariffs and market access constraints.

India: World’s Largest Pulse Consumer

India is by far the biggest consumer and one of the largest importers of pulses in the world. Pulses such as lentils, chickpeas, peas, pigeon peas (arhar), and urad (black gram) are staple sources of protein across the country. India accounts for about 27 % of global pulse consumption, according to recent trade data.

Despite substantial domestic production, India often faces production shortfalls due to weather and yield issues, prompting heavy reliance on imports to meet demand.

US-India Pulse Trade: Where Things Stand

The US as a Pulse Exporter

The United States is a major supplier of:

-

Yellow peas

-

Green peas

-

Lentils

-

Dry beans

Pulse production is concentrated in North Dakota, Montana, Washington, and Idaho, with exports playing a critical role in farm incomes.

In recent years:

-

The US exported $2.5–3 billion worth of pulses annually

-

India accounted for 8–12% of US pulse exports by value, depending on policy conditions

-

The US exported pulses to India worth over $80 million in 2024, as per the data on US pulse exports to India by HS code.

-

Yellow peas dominated shipments to India due to strong demand and price competitiveness

Trade Structure Before the Tariff

Before the 30% tariff:

-

US pulses entered India at low or zero duty, depending on the variety

-

American exporters benefited from predictable demand during India’s supply gaps

-

Indian importers used US peas as a hedge against price volatility in other origins

The tariff has disrupted this balance.

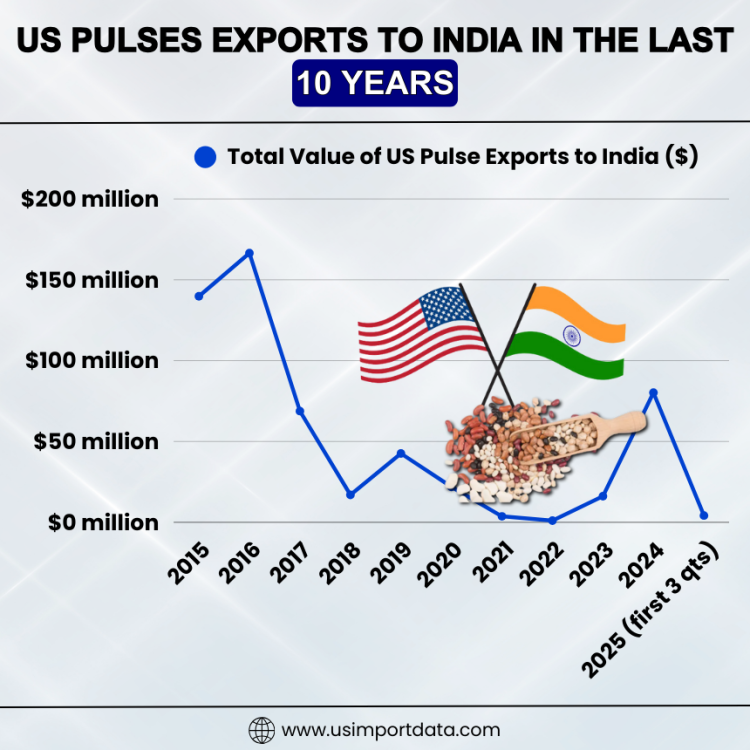

US Pulses Exports to India in the Last 10 Years

|

Year of Exports |

Total Value of US Pulse Exports to India ($) |

|

2015 |

$139.77 million |

|

2016 |

$166.52 million |

|

2017 |

$68.77 million |

|

2018 |

$16.94 million |

|

2019 |

$42.57 million |

|

2020 |

$21.93 million |

|

2021 |

$3.69 million |

|

2022 |

$1.01 million |

|

2023 |

$16.15 million |

|

2024 |

$80.21 million |

|

2025 (first 3 quarters) |

$4.19 million |

The 30% Tariff: What Changed in 2025

In early 2025, India imposed a 30% tariff on US pulse imports, composed of:

-

Basic customs duty

-

Agriculture Infrastructure and Development Cess (AIDC)

-

Applicable surcharges

While India did not announce a blanket ban, the tariff effectively priced US pulses out of the Indian market for many buyers.

Why India Took This Step

Several factors explain the timing and severity:

1. Protecting Domestic Farmers

With domestic pulse prices softening after heavy imports in 2024, farmer groups raised concerns about:

-

Price crashes during harvest season

-

Rising input costs

-

Reduced profitability

The tariff serves as a buffer against cheap imports during peak arrival periods.

2. Managing Import Surges

India’s pulse import bill surged sharply, putting pressure on:

-

Trade balances

-

Port trade

-

Domestic mandi prices

The government has historically used tariffs as a quick corrective tool.

3. Strategic Trade Signaling

The tariff also reflects broader trade negotiations with the US, where agriculture remains a sensitive area. India has consistently resisted opening its farm sector without reciprocal concessions.

Political Fallout in the United States: Senators Step In

According to the latest report, the tariff sparked immediate concern among US lawmakers, particularly those representing pulse-producing states.

Senators’ Letter to Donald Trump

Senators from North Dakota and Montana wrote to former President Donald Trump, urging him to:

-

Raise the issue directly with Prime Minister Narendra Modi

-

Seek tariff relief for US pulse exports

-

Protect American farmers facing declining export opportunities

Their concerns centered on:

-

Falling farmgate prices

-

Rising input and borrowing costs

-

Limited alternative export markets comparable to India

The letter underscores that the tariff is not merely a trade statistic, but a politically sensitive issue in rural America, especially in election-relevant states.

Immediate Impact on Trade Flows

For US Exporters

The tariff has had an immediate chilling effect:

-

The landed cost of US yellow peas increased by 25–30%

-

Indian buyers shifted orders to Canada, Russia, and Black Sea suppliers

-

US shipments to India declined sharply within one quarter

-

Inventory buildup risk increased for American growers

The loss of India as a major outlet is significant for US farmers already dealing with:

-

High interest rates

-

Rising fertilizer costs

-

Soft global demand

For Indian Importers

Indian importers responded by:

-

Renegotiating contracts

-

Accelerating shipments from non-US origins

-

Passing part of the cost increase to wholesalers

However, alternative suppliers also saw price upticks as demand concentrated elsewhere.

Global Pulse Market Repercussions

The US-India tariff has ripple effects beyond bilateral trade.

Price Volatility

-

Spot prices for yellow peas firmed globally

-

Freight costs rose due to longer trade routes

-

Arbitrage opportunities narrowed

Supplier Diversification

India increased sourcing from:

-

Canada

-

Russia

-

Ukraine

-

Australia

This diversification reduces dependency but increases exposure to geopolitical and logistics risks.

Shift in US Export Strategy

US exporters are exploring:

-

Southeast Asian markets

-

Middle East demand

-

Domestic value-added processing

However, none offer the scale or consistency of India.

Food Inflation and Consumer Impact in India

From a consumer standpoint, the tariff presents mixed outcomes.

Short-Term Effects

-

Wholesale pulse prices showed moderate firmness

-

Retail prices remained largely stable due to buffer stocks

-

The government releases through public channels, limited sharp spikes

Medium-Term Risks

If domestic output underperforms or global prices rise:

-

Retail inflation risk increases

-

Policy pressure to relax tariffs may re-emerge

-

Import dependency becomes more pronounced

India’s policymakers are walking a tightrope between farmer welfare and consumer affordability.

Trade Deficit and Currency Implications

Pulses may form a small share of India’s total imports, but they matter strategically:

-

Lower imports support foreign exchange stability

-

Reduced dollar outflows help manage the current account

-

Agriculture tariffs signal protectionism without targeting high-value sectors

For the US, reduced exports widen the agricultural trade gap and intensify pressure on Washington to negotiate access.

US-India Trade Relations: The Bigger Picture

The pulse tariff fits into a broader pattern:

-

India remains cautious about agricultural liberalization

-

The US seeks deeper market access for farm goods

-

Negotiations continue on technology, defense, and services, where trade-offs may emerge

Agriculture often becomes a bargaining chip rather than a standalone issue.

What Happens Next: Scenarios for 2025–26

Scenario 1: Tariff Relaxation

If:

-

Domestic prices rise

-

Inflation pressures return

-

Diplomatic engagement improves

India may reduce or suspend the tariff temporarily.

Scenario 2: Status Quo

The tariff remains, pushing the US out of the Indian pulse market and reshaping trade flows permanently.

Scenario 3: Bilateral Trade Adjustment

Pulse tariffs could be adjusted as part of a broader US-India trade understanding involving:

-

Market access concessions

-

Regulatory alignment

-

Strategic cooperation

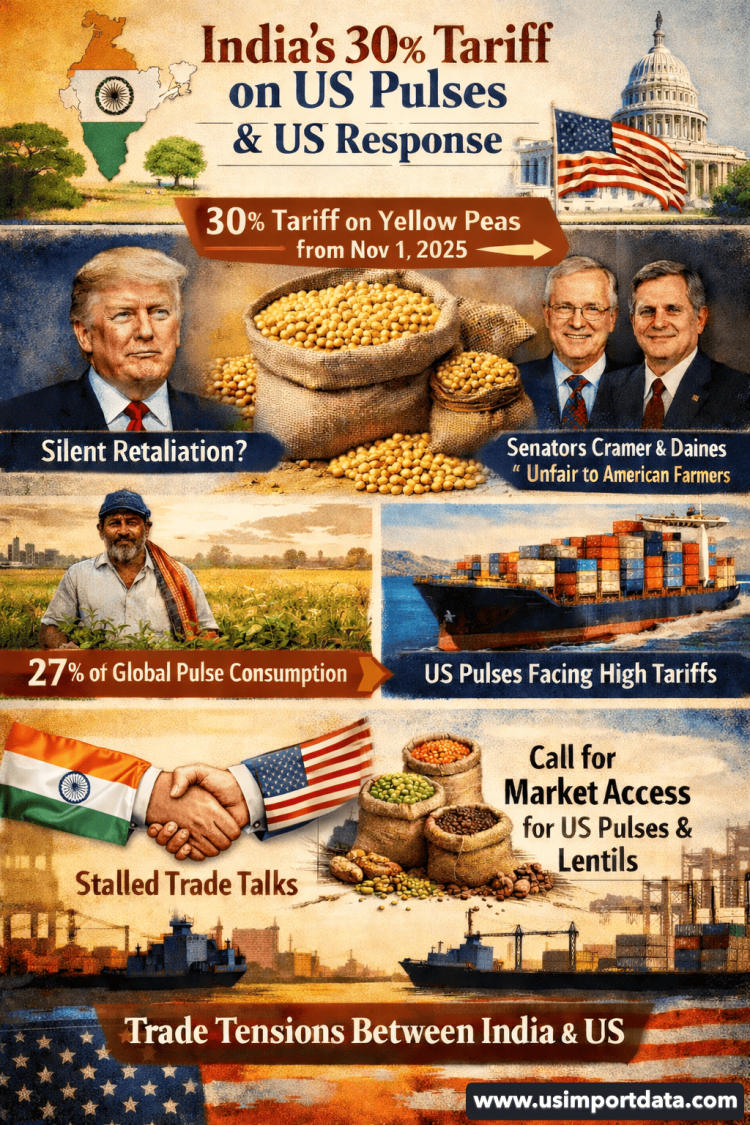

Key Highlights: India’s 30% Tariff on US Pulses & US Response

-

India imposed a 30% import duty on pulse imports from the United States, especially targeting yellow peas, taking effect from November 1, 2025.

-

The tariff was introduced quietly, without much public announcement, leading observers to label it a “silent” retaliation to earlier US tariff actions.

-

This move has become a contentious issue in stalled US-India trade negotiations, potentially delaying progress on a comprehensive bilateral trade deal.

-

Two Republican U.S. senators, Kevin Cramer (North Dakota) and Steve Daines (Montana), wrote to President Donald Trump calling the tariff “unfair” to American pulse farmers and urging its rollback.

-

The senators represent major pulse-producing states where peas, lentils, and other pulses are significant agricultural outputs; they argue India is a critical export market for these crops.

-

They noted that India is the world’s largest consumer of pulses, accounting for about 27% of global consumption, yet it has levied high duties on US pulse exports.

-

US lawmakers want better market access for American pulses and lentils to be included as part of any future trade agreement with India.

-

Analysts view the tariff as part of broader trade tensions between the two countries, where tariff actions and counter-measures occur quietly amid broader diplomatic cooperation.

-

Pulses are politically sensitive for India; New Delhi adjusts import duties to manage domestic supply, protect farmers, and stabilise consumer prices, making trade decisions in this sector particularly delicate.

-

The tariff controversy illustrates that trade disputes can escalate even among strategic partners when domestic agricultural interests and export opportunities are at stake.

Key Takeaways

-

India’s 30% tariff on US pulses reflects economic, political, & strategic priorities.

-

The move protects domestic farmers but reshapes global pulse trade.

-

US exporters face revenue pressure and market reorientation.

-

India continues to rely on imports, but with tighter control mechanisms.

-

Pulse trade remains a sensitive lever in US-India trade relations.

Conclusion and Final Verdict

The 2025 tariff on US pulses is not just about peas or lentils. It is about how nations balance food security, farmer interests, trade diplomacy, and global market exposure. For India, the decision underscores a cautious, data-driven approach to managing agricultural imports. For the US, it highlights the vulnerabilities of export-led farm models dependent on policy-sensitive markets. As global food systems face climate stress and geopolitical uncertainty, pulse trade between India and the US will remain a closely watched barometer of how economic pragmatism and political strategy intersect.

Understanding these trends through trade data and policy analysis is essential for exporters, importers, policymakers, and investors navigating the evolving landscape of global agricultural trade.

For more information on the latest US import-export data, or to search live data on US pulses exports by country, visit USImportdata. Contact us at info@tradeimex.in for customized trade reports, market insights, and a verified database of the top pulse exporters in the USA, tailored to your requirements.

Also Read about:

US-Chile Free Trade Agreement & Trade Insights

What's Your Reaction?