US Corn Import Data 2025: Top Corn Importers & Buyers in USA

Discover US corn import data with insights on corn importers and buyers in the USA, plus US corn imports by country. Get accurate & up-to-date US import data.

Corn is the backbone of the U.S. agricultural economy. From livestock feed and ethanol production to food processing and industrial use, corn plays a central role in domestic supply chains and global trade. In the 2024-25 marketing year, the United States maintained its position as the world’s largest producer and one of the largest exporters of corn, while importing only limited quantities for specific use cases. According to the latest US import data and Corn import data of the USA, the US corn imports reached $281.69 million in 2024, a 35% decline from the previous year. According to the US corn import data, the US imported corn worth $190.28 million in the first three quarters of 2025.

The USA is the 36th largest corn importer in the world, as per the global trade data. Despite a record corn harvest in the United States in 2025, imports were required due to high consumer demand for food, seeds, utilization in industry, and ethanol. This blog provides a comprehensive, data-driven analysis of U.S. corn import data for 2024-25, explains why the U.S. imports corn despite its massive production, and identifies the top international buyers of U.S. corn, which is often what global trade stakeholders actually mean when they discuss corn importers linked to the USA.

Understanding the U.S. Corn Trade Structure

Before diving into the numbers, it’s important to clarify how the U.S. fits into the global corn trade.

Does the US import corn? Yes. Although the United States is one of the world’s largest producers and net exporters of corn, it does import some corn, largely to meet specific quality or regional supply needs rather than to fill large shortages, and these imports are relatively small compared with domestic production.

In terms of volume, how much corn does the US import varies by year, but data for recent years show that U.S. corn imports have generally been modest, for example, U.S. imports of corn were around 25 million bushels in 2023 according to USDA-based figures, and in the 2024-25 period total imports amounted to just over 1 million metric tons (less than about 0.5 % of total U.S. corn supply).

-

The United States is a net exporter of corn, meaning it exports far more corn than it imports.

-

Imports into the U.S. account for less than 1% of domestic consumption.

-

Exports are a major price-setting factor for U.S. farmers and global grain markets.

This distinction matters because discussions about “top corn importers” often confuse countries importing corn into the U.S. with countries importing U.S. corn. This article covers both, with clear separation.

U.S. Corn Imports in 2024-25: A Niche Market

Total U.S. Corn Imports

In the 2024-25 marketing year, U.S. corn imports remained relatively small:

-

Import volume: Just over 1 million metric tons

-

Import value: USD 281million

-

Share of total U.S. corn supply: Less than 0.5%

These figures highlight that imports are not driven by supply shortages, but by specific quality, trade, or pricing considerations, as per the USDA corn import report.

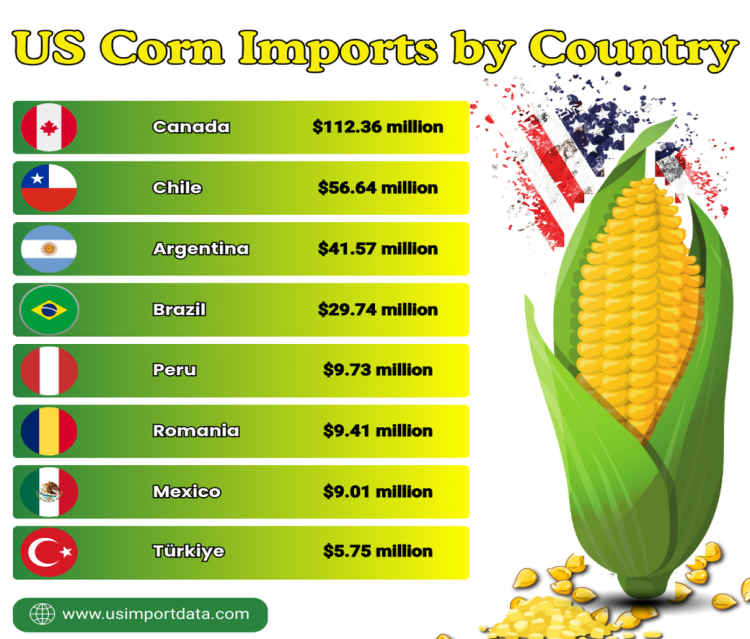

US Corn Imports by Country: Where Does the US Import Corn From?

In the context of US corn imports, understanding where the United States sources its corn supply from is crucial for assessing trade dynamics. The top countries from which the US imports corn include major players such as Canada, Chile, Argentina, & Brazil. Each of these countries plays a significant role in contributing to the overall corn import landscape of the United States. The top 10 corn-supplying countries to the US, as per the data on US corn imports by country & US shipment data for 2025, include:

1. Canada: $112.36 million (39.9%)

Canada is the leading supplier of corn to the United States, accounting for nearly 40% of total corn imports. The proximity between the two countries makes Canada a convenient and reliable source of corn for the US market.

2. Chile: $56.64 million (20.1%)

Chile is another significant supplier of corn to the United States, making up over 20% of total corn imports. The favorable trade relations between the two countries contribute to Chile's strong position as a corn exporter to the US.

3. Argentina: $41.57 million (14.8%)

Argentina is a major player in the global corn market and a key supplier of corn to the United States, accounting for nearly 15% of total corn imports, as per the data on US corn imports from Argentina by HS code. The fertile agricultural lands of Argentina ensure a steady supply of high-quality corn to meet the demand in the US.

4. Brazil: $29.74 million (10.6%)

Brazil is another important source of corn for the United States, providing over 10% of total corn imports. The vast agricultural lands of Brazil and its efficient farming practices contribute to its ability to meet the corn demand in the US market.

5. Peru: $9.73 million (3.5%)

Peru may be a smaller player in the global corn market, but it still plays a significant role in supplying corn to the United States, accounting for 3.5% of total corn imports. The trade relationship between the US and Peru ensures a consistent supply of corn to meet the demand.

6. Romania: $9.41 million (3.3%)

Romania may not be a top corn exporter globally, but it still manages to supply a considerable amount of corn to the United States, making up 3.3% of total corn imports. The agricultural capabilities of Romania contribute to its ability to export corn to the US market.

7. Mexico: $9.01 million (3.2%)

Mexico is a neighboring country to the United States and a significant supplier of corn, accounting for 3.2% of total corn imports. The geographical proximity and strong trade relations between the US and Mexico ensure a steady flow of corn to meet the demand.

8. Türkiye: $5.75 million (2%)

Turkey, also known as Türkiye, is a lesser-known source of corn for the United States but still manages to supply 2% of total corn imports. The trade relations between the US and Türkiye enable the smooth import of corn to meet the US market demand.

9. France: $4.78 million (1.7%)

France may be famous for its wine and cheese, but it is also a supplier of corn to the United States, making up 1.7% of total corn imports. The agricultural expertise of France ensures a supply of high-quality corn to the US market.

10. United Kingdom: $451K (0.2%)

The United Kingdom may have a smaller share of the US corn import market, but it still plays a role in meeting US demand for corn, accounting for 0.2% of total corn imports. The trade relationship between the US and the UK supports the import of corn to the US market.

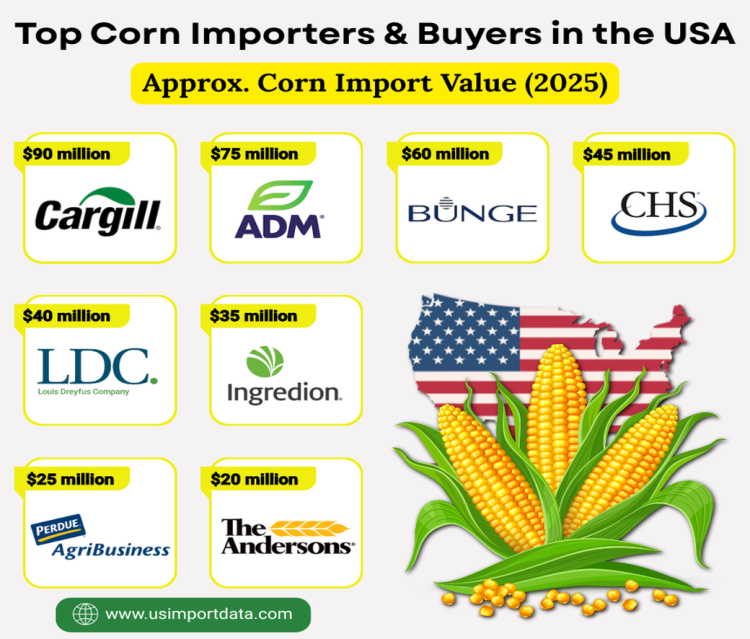

Top Corn Importers & Buyers in the USA: US Corn Importers Database

The US Corn Importers Database offers valuable insights into the leading players in the US corn import industry. This database provides a comprehensive view of the key importers and buyers in the market, facilitating strategic decision-making for businesses involved in the corn trade. The leading corn-importing companies in the US, as per the US corn importers data & corn buyers list for 2025, include:

|

Rank |

Company Name |

Approx. Corn Import Value (2025) |

Primary Import Sources |

Main Use |

|

1 |

$90 million |

Canada, Argentina |

Feed, food processing, trading |

|

|

2 |

Archer Daniels Midland (ADM) |

$75 million |

Canada, Brazil |

Milling, sweeteners, ethanol blending |

|

3 |

Bunge North America |

$60 million |

Canada, Argentina |

Food ingredients, feed |

|

4 |

CHS Inc. |

$45 million |

Canada |

Feed, cooperative supply |

|

5 |

Louis Dreyfus Company (USA) |

$40 million |

Canada, Brazil |

Trading, feed grain distribution |

|

6 |

Ingredion Incorporated |

$35 million |

Canada |

Food-grade corn, starch production |

|

7 |

Perdue Agribusiness |

$25 million |

Canada |

Poultry feed |

|

8 |

The Andersons Inc. |

$20 million |

Canada |

Feed, grain merchandising |

|

9 |

Seaboard Corporation |

$18 million |

Argentina, Brazil |

Feed milling, livestock |

|

10 |

Scoular Company |

$15 million |

Canada |

Specialty grain, feed applications |

Key Notes for Accuracy and Context

1. Why These Companies Dominate Corn Imports

-

These firms already operate large domestic grain networks, making them best positioned to import corn when needed.

-

Imports are often used to:

-

Balance regional shortages

-

Source specific grades or moisture profiles

-

Serve food or feed contracts with fixed specifications

2. Canada Is the Primary Import Source

Across nearly all major importers:

-

Canada accounts for 60–75% of U.S. corn imports

-

Proximity, rail connectivity, and integrated supply chains make Canadian corn the most economical option

3. Import Volumes Are Strategically Small

Even for the largest companies:

-

Imported corn typically represents less than 2–3% of their total corn handling

-

Imports are tactical, not structural

4. Food vs Feed Importers

-

Ingredion and ADM import more food-grade corn

-

Perdue, Seaboard, and CHS focus more on feed corn

-

Trading houses (Cargill, Bunge, LDC) import opportunistically based on price spreads

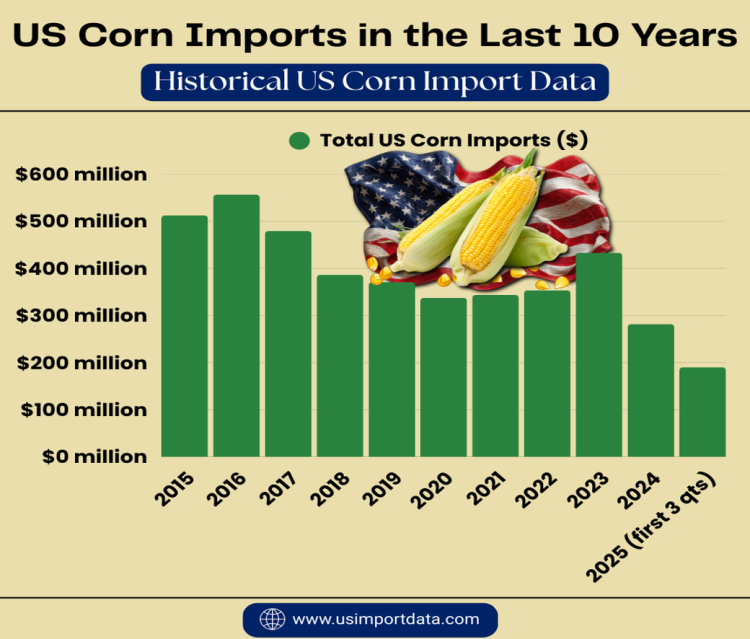

US Corn Imports in the Last 10 Years: Historical US Corn Import Data

|

Year of Imports |

Total US Corn Imports ($) |

|

2015 |

$512.51 million |

|

2016 |

$556.53 million |

|

2017 |

$479.34 million |

|

2018 |

$386.32 million |

|

2019 |

$370.95 million |

|

2020 |

$337.40 million |

|

2021 |

$343.52 million |

|

2022 |

$353.28 million |

|

2023 |

$433.05 million |

|

2024 |

$281.69 million |

|

2025 (first 3 quarters) |

$190.28 million |

Why Does the U.S. Import Corn?

Despite producing hundreds of millions of metric tons annually, the U.S. imports corn for several practical reasons:

1. Geographic and Trade Efficiency

Border states sometimes import corn from nearby regions in Canada or Mexico when it is cheaper to transport than domestic grain from the Midwest.

2. Specialty and Food-Grade Corn

Certain food manufacturers require specific varieties, moisture levels, or non-GMO certifications that are easier to source from niche suppliers abroad.

3. Seasonal Price Arbitrage

Short-term pricing differences and currency fluctuations occasionally make imports economically viable.

4. Processing Needs

Some imported corn is used for specific milling, brewing, or food processing applications that require unique grain characteristics.

US Corn Exports: The Real Trade Driver

While imports are small, exports define the U.S. corn market. In 2024-25:

-

Total exports: Approximately 2.5 to 2.7 billion bushels

-

Export value: Roughly USD 14 billion

-

Global reach: Over 100 destination countries

US corn exports support domestic corn prices, farm income, and rural economies.

Key Trends Shaping the 2024-25 Corn Trade

1. Strong Export Commitments

Export sales covered most of the projected annual total early in the season, signaling strong global demand.

2. Increased Competition

Brazil and Argentina remain strong competitors, especially in Asia and the Middle East.

3. Diversification of Buyers

As China reduced imports, demand from Latin America and smaller Asian markets increased.

4. Domestic Use vs. Exports

Ethanol production continues to compete with exports for corn supplies, influencing price dynamics.

What This Means for the U.S. Corn Market

-

Imports will remain limited, focused on specialty and trade needs.

-

Exports will continue to dominate trade volumes, with Mexico as the anchor buyer.

-

Price volatility will remain sensitive to export demand, weather, and global competition.

-

Market diversification reduces dependence on any single buyer, strengthening long-term resilience.

Conclusion and Final Summary

In conclusion, the US corn import data is expected to show steady imports of corn from countries around the world into the US. Canada, Chile, and Argentina are projected to be the top corn suppliers to the USA, while food manufacturers, the livestock industry, and ethanol producers are expected to be the top buyers of imported corn.

-

The United States imports very small quantities of corn, mainly from Canada.

-

Imports are niche, not supply-driven.

-

The real story of the U.S. corn trade lies in exports, not imports.

-

Mexico, Japan, and Colombia are the top buyers of U.S. corn in 2024-25.

-

Despite shifting global dynamics, U.S. corn remains a cornerstone of global feed and food supply chains.

For more insights into the latest US export-import data, or to search live data on US corn imports by country, visit USImportdata. Contact us at info@tradeimex.in for customized trade reports, market insights, and a verified database of the top corn importers in the USA, tailored to your requirements.

What's Your Reaction?