Explore US Import Data for HS Code 8708 Motor Vehicle Parts & Accessories

Explore US import data for HS Code 8708 auto spare parts, including US vehicle parts imports and motor vehicle parts imports by country. Get accurate US trade insights.

The United States automotive industry is one of the largest and most complex manufacturing ecosystems in the world. While finished vehicles often attract the most attention, the real backbone of the industry lies in motor vehicle parts & accessories, classified under HS Code 8708. These components include everything from braking systems and gearboxes to steering assemblies, suspension parts, and other critical accessories that enable vehicle production, maintenance, and aftermarket services. According to the latest US import data and motor vehicle parts import data of the USA under HS code 8708, reached $89.90 billion in 2024, a 2% increase from the previous year. According to the US motor vehicle parts import data by HS code 8708, the US imported vehicle parts worth $65.04 billion in the first three quarters of 2025.

The USA is the largest importer of motor vehicle parts in the world, according to global trade data. In 2025, HS Code 8708 continued to represent a strategic import category for the U.S. economy, reflecting global supply chain dependencies, shifting trade policies, cost pressures, and the ongoing transformation of the automotive sector toward electrification and advanced mobility technologies.

This blog offers a deep, data-driven exploration of U.S. import trends for HS Code 8708, covering total import value, country-wise sourcing patterns, product-level segmentation, policy impacts, and strategic implications for businesses and policymakers.

Understanding HS Code 8708: Scope and Classification

HS Code 8708 falls under Chapter 87 of the Harmonized System, which covers motor vehicles and related components. Specifically, HS 8708 includes:

-

Parts and accessories suitable for use solely or principally with motor vehicles

-

Components used in passenger cars, commercial vehicles, buses, and trucks

-

Both OEM (original equipment manufacturer) and aftermarket parts

Common Products under HS 8708

Some of the most frequently traded items under this classification include:

-

Gearboxes and transmission parts

-

Drive axles, differentials, and non-driving axles

-

Brakes and servo-brakes

-

Steering wheels, columns, and steering mechanisms

-

Suspension systems and shock absorbers

-

Road wheels, rims, and parts

-

Clutches and clutch components

-

Other structural and functional vehicle accessories

Because HS 8708 covers such a wide range of products, it serves as a strong indicator of automotive production activity, replacement demand, and cross-border manufacturing integration.

Total US Import Value of HS Code 8708 (Recent Overview)

Import Performance in 2023–24

In 2023, U.S. imports of motor vehicle parts and accessories under HS Code 8708 reached approximately USD 87 billion, making it one of the largest individual HS categories by import value. This figure represented roughly 2.7–2.8% of total U.S. merchandise imports, highlighting the sector’s scale, as per the US Automotive Trade Data.

By 2024, preliminary trade estimates showed continued growth, with total HS 8708 imports reaching around USD 87.5–88 billion. Despite global economic uncertainty, inflationary pressures, and interest rate tightening, demand for automotive components remained resilient.

Early Indicators for 2025

While complete year-end data for 2025 is still evolving, early monthly trends suggest:

-

Stable to slightly increasing import volumes

-

Imports reached over $65 billion in the first three quarters

-

Strong demand from OEMs and aftermarket distributors

-

Continued dependence on international suppliers for high-volume and specialized parts

These trends indicate that HS 8708 imports are likely to remain near record levels in 2025, barring major disruptions in trade policy or global manufacturing.

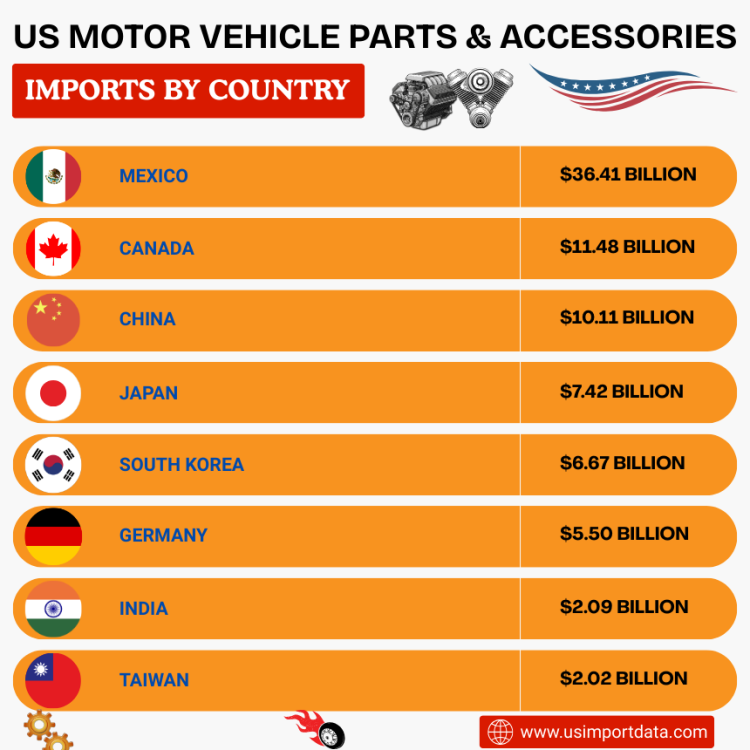

US Motor Vehicle Parts & Accessories Imports by Country

The United States imports motor vehicle parts and accessories from various countries worldwide. The U.S. sources HS 8708 products from over 150 countries, but a small group dominates the total import value. Some of the top countries from which the US imports these goods include Canada, Mexico, China, Japan, and Germany. Each of these countries plays a crucial role in the supply chain, providing essential components and accessories that contribute to the American automotive industry's success. The US needs to import auto parts from these countries for its auto sector growth. The top 10 countries that supply motor vehicle parts to the US under HS code 8708, as per the US shipment data for 2025, include:

1. Mexico: $36.41 billion (40.5%)

Mexico holds the top spot as the leading source of motor vehicle parts and accessories for the United States. With a whopping $36.41 billion in imports, Mexico accounts for 40.5% of the total imports in this category. The proximity of Mexico to the US, as well as the existing trade agreements between the two countries, makes it a prime destination for sourcing automotive components.

2. Canada: $11.48 billion (12.8%)

Neighboring Canada comes in second on the list of top countries from which the US imports motor vehicle parts and accessories. With $11.48 billion worth of imports, Canada holds a significant share of 12.8%. The strong economic ties and integrated supply chains between the US and Canada make it a natural choice for sourcing automotive parts.

3. China: $10.11 billion (11.2%)

Despite being halfway across the globe, China remains a key player in the US motor vehicle parts and accessories market. With $10.11 billion in imports, China accounts for 11.2% of the total imports, as per the data on US imports from China by HS code 8708. The competitive pricing and diverse range of parts available in China make it an attractive option for US importers.

4. Japan: $7.42 billion (8.3%)

Renowned for its high-quality automotive components, Japan is another essential source for motor vehicle parts and accessories for the United States. With $7.42 billion in imports, Japan holds a significant share of 8.3%. The reputation for reliability and innovation in the Japanese automotive industry makes it a preferred choice for US importers.

5. South Korea: $6.67 billion (7.4%)

South Korea rounds out the top five countries from which the US imports motor vehicle parts and accessories. With $6.67 billion in imports, South Korea accounts for 7.4% of the total imports. The advanced technology and efficient production processes in South Korea make it a valuable source for high-quality automotive components.

6. Germany: $5.50 billion (6.1%)

Known for its precision engineering and high standards of quality, Germany is a significant player in the US motor vehicle parts and accessories market. With $5.50 billion in imports, Germany holds a share of 6.1%. The reputation for excellence in German automotive manufacturing makes it a sought-after source for US importers.

7. India: $2.09 billion (2.3%)

India may be a lesser-known player in the US motor vehicle parts and accessories market, but it is steadily gaining recognition as a reliable source for automotive components. With $2.09 billion in imports, India holds a share of 2.3%, as per the data on US motor vehicle parts imports from India by HS code. The cost-effective manufacturing processes and skilled workforce in India make it an increasingly popular choice for US importers.

8. Taiwan: $2.02 billion (2.2%)

Taiwan is another emerging source for motor vehicle parts and accessories for the United States. With $2.02 billion in imports, Taiwan holds a share of 2.2%. The expertise in electronics and precision engineering in Taiwan makes it a valuable source for specialized automotive components.

9. Thailand: $1.29 billion (1.4%)

Thailand may be a smaller player in the US motor vehicle parts and accessories market, but it still contributes significantly to the overall imports. With $1.29 billion in imports, Thailand holds a share of 1.4%. The cost-competitive manufacturing processes and skilled labor force in Thailand make it an attractive destination for sourcing automotive components.

10. Italy: $804.43 million (0.9%)

Italy completes the list of the top countries from which the US imports motor vehicle parts and accessories. With $804.43 million in imports, Italy holds a share of 0.9%. The reputation for design excellence and craftsmanship in the Italian automotive industry makes it a unique source for specialized and luxury automotive components.

Why the US Imports So Many Motor Vehicle Parts

Globalized Automotive Supply Chains

Modern vehicle manufacturing is not confined to one country. A single vehicle assembled in the U.S. may include:

-

Transmissions manufactured in Mexico

-

Electronic steering components from Japan

-

Brake assemblies from China

-

Precision suspension parts from Germany or South Korea

This fragmentation allows manufacturers to optimize cost, quality, and specialization, but it also makes the U.S. heavily reliant on imported parts.

Domestic Production Gaps

Although the U.S. has a strong automotive manufacturing base, certain components are:

-

Cheaper to produce abroad

-

Highly specialized and concentrated in specific countries

-

Integrated into long-standing supplier ecosystems outside the U.S.

As a result, imports under HS 8708 are not merely supplementary; they are structurally embedded in U.S. vehicle production.

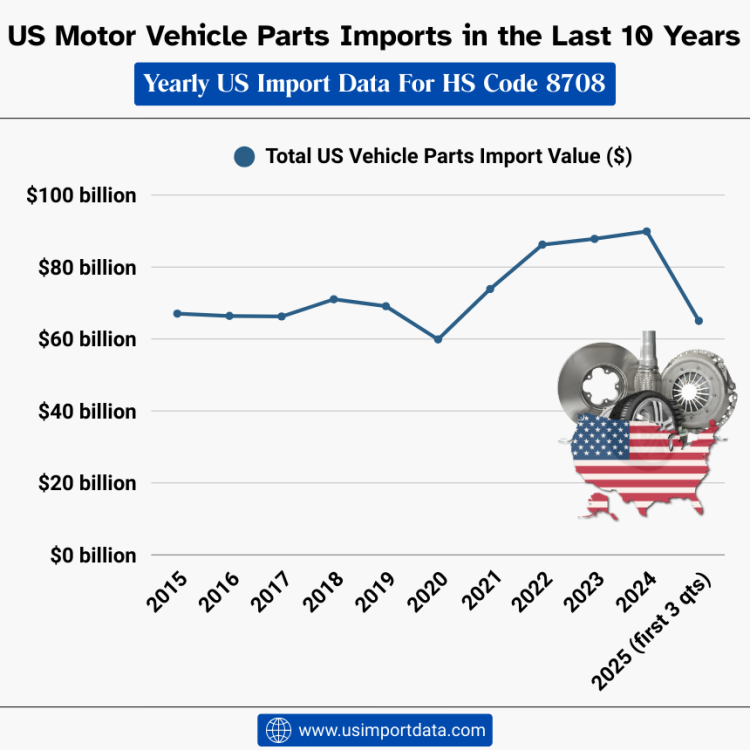

US Motor Vehicle Parts Imports in the Last 10 Years: Yearly US Import Data For HS Code 8708

|

Year of Imports |

Total US Vehicle Parts Import Value ($) |

|

2015 |

$67.05 billion |

|

2016 |

$66.41 billion |

|

2017 |

$66.26 billion |

|

2018 |

$71.04 billion |

|

2019 |

$69.12 billion |

|

2020 |

$59.89 billion |

|

2021 |

$73.91 billion |

|

2022 |

$86.22 billion |

|

2023 |

$87.83 billion |

|

2024 |

$89.90 billion |

|

2025 (first 3 quarters) |

$65.04 billion |

Product-Level Breakdown of US Imports under HS Code 8708

Gearboxes and Transmission Parts

Gearboxes represent the largest sub-category within HS 8708, accounting for roughly 16–18% of total import value.

These parts are essential for:

-

Internal combustion vehicles

-

Hybrid drivetrains

-

Electric vehicle reduction gear systems

Mexico, Japan, and Germany dominate this segment.

Axles, Differentials, and Drive Units

Drive axles and differentials account for USD 3–4 billion annually. These components are critical for vehicle mobility and durability, especially in trucks and SUVs.

Suspension Systems and Shock Absorbers

Suspension components represent another major import segment, valued at over USD 2.5 billion annually. This category is heavily influenced by consumer demand for comfort, safety, and vehicle handling.

Steering Systems

Steering parts, including electronic power steering assemblies, are increasingly complex and technology-driven. Imports in this segment have steadily grown due to the integration of sensors and control modules.

Brakes, Wheels, and Other Accessories

Brake components, wheels, and miscellaneous accessories collectively represent a significant share of HS 8708 imports, particularly for the aftermarket.

Impact of Trade Policy and Tariffs on HS 8708 Imports

Tariffs and Cost Pressures

Recent U.S. trade measures introduced or expanded tariffs on various automotive components, with rates reaching up to 25% on certain imported parts. These measures:

-

Increase landed costs for importers

-

Pressure profit margins for distributors and manufacturers

-

Encourage sourcing diversification or nearshoring

However, many HS 8708 products imported under trade agreements remain tariff-advantaged.

USMCA and Regional Trade Benefits

Under the USMCA:

-

Qualifying parts from Mexico and Canada enjoy reduced or zero tariffs

-

Rules of origin encourage regional content

-

Automotive manufacturers are incentivized to maintain North American sourcing

This has strengthened Mexico’s position as the top supplier.

Historical Growth Trends (2020–2024)

Looking back over the last five years:

-

2020: Imports fell sharply due to pandemic disruptions

-

2021–2022: Strong rebound as vehicle demand surged

-

2023–2024: Stabilization at historically high levels

HS 8708 imports grew from around USD 60 billion in 2020 to nearly USD 88 billion by 2024, reflecting the long-term expansion of the U.S. automotive market.

Strategic Implications for Businesses

For Importers and Distributors

-

HS 8708 data helps identify sourcing risks and cost pressures

-

Country-level analysis supports supplier diversification

-

Product-level data informs inventory planning and pricing strategies

For Manufacturers

-

Import trends signal component availability and cost volatility

-

Data supports decisions on localization versus outsourcing

-

Tariff exposure analysis is critical for margin management

For Policymakers and Analysts

-

HS 8708 imports reflect manufacturing dependency levels

-

Data informs trade negotiations and industrial policy

-

Import shifts can signal broader changes in automotive production

Outlook for HS Code 8708 Imports in 2025 and Beyond

Looking ahead, several factors will shape U.S. imports of motor vehicle parts:

-

Growth in electric and hybrid vehicle production

-

Increased use of electronics and advanced materials

-

Ongoing trade policy adjustments

-

Supply chain resilience and nearshoring efforts

Despite these changes, HS Code 8708 is expected to remain one of the most important and resilient import categories in U.S. trade.

Conclusion and Final Thoughts

The data surrounding U.S. imports of motor vehicle parts and accessories under HS Code 8708 reveals a deeply interconnected global supply chain that continues to support one of America’s most critical industries. With annual imports nearing USD 90 billion, HS 8708 is more than just a trade classification. It is a window to manufacturing strategy, economic integration, and the future direction of mobility. For businesses, analysts, and policymakers, tracking HS 8708 import data is not optional. It is essential.

We hope that you liked our interactive blog report on the US import data of HS code 8708 motor vehicle parts & accessories in 2025. To access the latest US export-import data, or to search live data on US motor vehicle parts imports by country, visit USImportdata. Contact us at info@tradeimex.in for customized trade reports, market insights, & a verified database of the top motor vehicle parts importers & buyers in the USA, as per your needs.

What's Your Reaction?