US Oil Imports from Canada: How will Trump's Tariffs affect North American oil markets?

Explore the impact of Trump's tariffs on US oil imports from Canada and how it could shape North American oil markets. Understand the key factors influencing trade and pricing

In recent years, the United States has significantly increased its oil imports from Canada, making it one of the largest sources of oil for the country. However, with the recent implementation of tariffs by President Trump on Canadian goods, including oil, many are wondering how these tariffs will affect the North American oil markets. This move has raised concerns among industry experts and stakeholders about the impact on oil prices, supply chains, and overall market dynamics. Canada is the largest supplier of oil to the US in terms of US oil imports, as the US imports a significant amount of crude oil and petroleum products from Canada. In this article, we will delve into how these tariffs could affect US oil imports from Canada and the broader North American oil market.

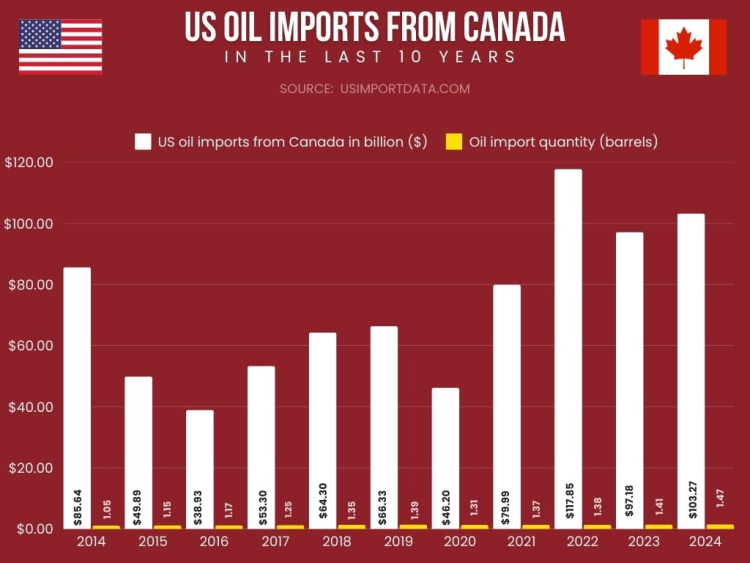

According to the US import data and US-Canada trade data, the US oil imports from Canada accounted for $97.18 billion in 2023 amounting to a total quantity of 223.85 million cubic meters. As per the US shipment data and US oil import data, the US oil imports from Canada reached $103.27 billion in 2024, an increase of 12% from the previous year.

The impact of Trump's tariffs on Canadian oil

With President Trump's imposition of tariffs on Canadian goods, including a 25% tariff on steel and a 10% tariff on aluminum, many are concerned about the potential impact on Canadian oil exports to the US amidst Trump’s tariff threats. These tariffs are intended to protect American industries, but they could have unintended consequences for the oil markets.

US Oil Imports from Canada in the Last 10 Years: Yearly US-Canada Oil Trade Data

|

Year of Exports |

US oil imports from Canada |

Oil import quantity (barrels) |

|

2014 |

$85.64 billion |

1.05 billion barrels |

|

2015 |

$49.89 billion |

1.15 billion barrels |

|

2016 |

$38.93 billion |

1.17 billion barrels |

|

2017 |

$53.30 billion |

1.25 billion barrels |

|

2018 |

$64.30 billion |

1.35 billion barrels |

|

2019 |

$66.33 billion |

1.39 billion barrels |

|

2020 |

$46.20 billion |

1.31 billion barrels |

|

2021 |

$79.99 billion |

1.37 billion barrels |

|

2022 |

$117.85 billion |

1.38 billion barrels |

|

2023 |

$97.18 billion |

1.41 billion barrels |

|

2024 |

$103.27 billion |

1.47 billion barrels |

Potential disruptions in the supply chain

One of the main concerns with Trump's tariffs on Canadian oil is the potential disruptions it could cause in the supply chain. Canada is a reliable supplier of oil to the US, and any disruptions in this supply could lead to volatility in the oil markets. This could result in price hikes for consumers and businesses that rely on Canadian oil.

Impact of Trump's Tariffs on the North American Oil Trade

A substantial change in North American crude flows would be brought about by US oil tariffs on Canada and Mexico, as rising prices would force some US imports into foreign markets. Crude flows for all three nations would change as a result of the US imposing 10% and 25% tariffs, respectively, on Canadian and Mexican oil products. Demand in the US would eventually be impacted by higher resulting prices; however, this effect is anticipated to be less severe than that of a more disruptive 25% levy on Canadian oil.

Impacts of US oil tariffs on Mexico

-

Mexico's exports would mostly move from the US to other markets in Europe and Asia if there were 25% tariffs on its oil.

-

This might affect about 600 kb/d of Mexican shipments into the US.

-

The closure of the Lyondell refinery in Houston and the opening of Pemex's Dos Bocas plant, however, might lessen the impact.

-

Regional prices would still be somewhat impacted, but the effect on supplies to the US would be less severe if Mexico were subject to a 10% tariff scenario.

Impacts of US oil tariffs on Canada

-

The US midcontinent and the US Gulf Coast would continue to use the majority of Canadian crude oil under a 10% tariff scenario.

-

Canadian barrels traveling via the US would have the opportunity to re-export their crude, which is exempt from duties.

-

A 10% tax, however, would not be significant enough to cause Canadian oil barrels to move into Asia from the US Gulf Coast.

Key Points for US Tariff Impacts on the North American Oil Trade

-

Nearly half of Canadian crude is consumed in landlocked US markets with limited alternate supply sources.

-

In a 10% tariff scenario, Canada-to-US crude movements are expected to persist to existing markets and the US Gulf Coast.

-

Producers using the Trans Mountain Pipeline System (TMX) may shift focus to Asian markets, affecting US West Coast refineries.

-

A 25% tariff on Mexican crude would lead to significant trade flow changes.

-

Large volumes currently sent to the Gulf Coast would be redirected to Europe and Asia.

-

Coastal refiners may seek seaborne imports from the Middle East (notably Iraq) and Latin America, excluding Venezuela due to US sanctions.

-

The recently completed TMX enhances access to non-US markets for Canadian oil.

-

Strong flow volumes since its service commencement in 2024, reaching new heights recently.

-

Additional capacity may be limited, but volumes could increase if oil tariffs are imposed.

-

Current law exempts volumes moving through the US solely for export from tariffs, allowing the re-export of Canadian oil barrels.

-

A 10% tariff is unlikely to significantly shift the volume of Canadian oil processed in Gulf Coast refineries for re-export due to infrastructure constraints.

-

In a 10% tariff scenario, limited re-exports would keep the benchmark price for Western Canada Select (WCS) set by US Gulf Coast refiners.

-

A 25% tariff may result in slight increases in US Gulf Coast prices for heavy crudes as supply is redirected.

-

Steeper WCS discounts could negatively impact profitability for Canadian producers.

-

A 10% tariff is not expected to cause widespread shut-ins at Canadian wells due to minimal impact on margins.

Market reactions to the tariffs

The oil markets have already shown some reaction to the tariffs imposed by President Trump. Following the announcement of the tariffs, oil prices rose as investors worried about the impact on supply. However, some experts believe that the long-term effects of the tariffs may not be as severe as initially feared.

Shifts in trade dynamics

The imposition of tariffs on Canadian oil could also lead to shifts in trade dynamics within North America. Canada may look to diversify its export markets, potentially reducing its reliance on the US. This could open up opportunities for other oil-producing countries to increase their exports to the US, leading to a reconfiguration of the North American oil markets.

Will US Oil Imports from Canada Decrease as a result of the Tariffs?

One question on everyone's mind is whether the tariffs will lead to a decrease in US oil imports from Canada. While it is still too early to determine the exact impact of the tariffs, there is a possibility that US oil imports from Canada could indeed decrease if the cost of importing Canadian oil becomes too high. This could have far-reaching consequences for both countries' economies and the overall North American oil market.

The Ripple Effect on North American Oil Markets

The imposition of tariffs on Canadian oil imports could have a ripple effect on the broader North American oil market and NAFTA. As the US seeks out alternative sources of oil to mitigate the impact of the tariffs, other oil-producing countries could see an increase in demand for their oil. This could lead to shifts in global oil prices, supply chains, and trade relationships, affecting the stability and competitiveness of the North American oil market.

Conclusion

In conclusion, Trump's tariffs on Canadian goods, including oil, have the potential to disrupt the North American oil markets. However, with careful planning and collaboration between the US and Canada, it is possible to minimize these disruptions and ensure stability in the oil markets. Only time will tell how these tariffs will ultimately affect US oil imports from Canada.

Contact USImportdata at info@tradeimex.in for more information on US oil import data & trade data on US oil imports from Canada. Get access to exclusive US market trends.

Frequently Asked Questions: US-Canada Oil Trade and Tariff Tensions

1. How much Canadian oil is imported by the US?

About 6.5 million barrels of crude oil per day, or roughly 60% of all US crude oil imports, came from Canada in 2024. Over 4 million barrels of crude oil were shipped daily from Canada to the United States in November 2024.

2. Why does the United States import Canadian oil?

Because of its integrated pipeline network, refinery designs, crude oil quality, and geographic proximity, the US imports oil from Canada. Many US oil refineries, particularly those in the Midwest, are designed to process higher-grade Canadian crude oil.

3. What possible effects might tariffs have on Canada?

Higher tariffs on Canada could have an impact on consumer fuel prices and the US crude oil market. Canada's trade surplus with the US has long been a source of Trump's complaints.

4. What could happen if Canada halted exporting oil to the United States?

When US refineries ran out of oil, they would have to find new supplies, which would raise expenses. Reversing pipelines or modifying crude oil refineries to handle lighter American oil would come with longer-term expenditures.

5. What impact will Trump's tariffs have on the oil markets in North America?

As one of the largest suppliers of oil to the US, Canada plays a crucial role in ensuring a stable oil supply. The tariffs could potentially lead to higher prices for consumers in the US, as well as disrupt the well-established trade relationship between the two countries. This move could also trigger retaliatory measures by Canada, further escalating trade tensions and creating uncertainties within the North American oil markets.

6. How can US tariffs impact the demand for oil at the national level?

Planned tariffs would result in somewhat higher refined product prices in the US and slow GDP growth for Canada and Mexico. Taken together, these factors would lower North American oil consumption by about 100,000 barrels per day (b/d). With demand about 50,000 b/d lower than the base case estimate, the US would be the primary affected country.

What's Your Reaction?