US-Taiwan Trade Relations: Trade Agreement Insights, Top US Imports From Taiwan, & Semiconductor Chips in Focus

Explore US–Taiwan trade relations with insights on bilateral trade agreement, US imports from Taiwan, & the role of semiconductors in bilateral trade.

The economic relationship between the United States and Taiwan has long been anchored in technology, investment, and mutual strategic interests. In 2024–2025, this partnership surged to new prominence as both governments negotiated landmark trade agreements, expanded market access, and aligned economic interests around critical technologies like semiconductor chips. As global demand for chips accelerates, driven by artificial intelligence, electric vehicles, cloud computing, and defense systems, the US–Taiwan trade has taken on new urgency. According to the latest US import data and Taiwan export data, the total value of US imports from Taiwan reached $118.73 billion in 2024 and $136.92 billion in the first three quarters of 2025.

The total US-Taiwan trade value accounted for $161.06 billion in 2024 and a record high of $176.07 billion in the first three quarters of 2025, as per the US trade data. Taiwan is the 7th largest trading partner of the USA, as per the global trade data. Recent trade agreements, investment commitments, and industrial coordination efforts signal a shift away from traditional tariff-focused trade toward deeper integration built on shared production, technology, and strategic trust. This blog unpacks the latest developments, underlying trade data, and what they mean for economic, industrial, and geopolitical futures.

Trade Ties in Numbers – A Snapshot of US-Taiwan Trade

Growing Trade Volume

Recent U.S. government data shows how vibrant this bilateral trade has become:

-

Total U.S.–Taiwan trade in 2024 was around $185.7 billion, up 22% from the previous year. Of that, goods trade totaled about $161 billion, with exports of $42.5 billion and imports of $118.7 billion. This resulted in a U.S. goods trade deficit of $73.7 billion in 2024.

-

Services trade was also significant, with the U.S. exporting about $13.7 billion in services to Taiwan and importing $13.2 billion from Taiwan in 2024.

-

Taiwan is now among the top 10 trading partners of the U.S. when taken as a standalone partner (excluding Europe as a bloc).

Trade Imbalance and Long-Term Trends

Historically, the U.S. has run a trade deficit with Taiwan in goods, a pattern dating back decades. For example, earlier data shows U.S. imports from Taiwan consistently outpaced exports, with large balances in technology and industrial goods.

Taiwan’s total exports hit a record high in 2025, nearly $641 billion, driven by AI and semiconductor demand. The United States remained one of the top export markets, with U.S.-bound shipments up sharply, especially in late 2025.

The US-Taiwan Trade Agreement: What Changed?

New US-Taiwan Trade Framework

In early 2026, the United States and Taiwan finalized a landmark trade deal, hailed by Taiwanese officials as one of the “best tariff deals” the island has secured with a major economy.

Key components include:

-

Tariff Reductions:

-

General tariffs on most Taiwanese exports to the U.S. were reduced from 20% to 15%.

-

Certain goods, including generic pharmaceuticals, aircraft components, and some natural resources, will face zero tariffs.

-

Specific Section 232 (national security) tariffs on autos, lumber, and other products were also set to 15% under the agreement framework.

-

Investment Commitments:

-

Taiwanese tech companies, especially in semiconductors and AI technologies, are committed to investing at least $250 billion in U.S. production capacity.

-

The Taiwanese government pledged another $250 billion in credit guarantees to support this investment.

-

Semiconductor Tariff Treatment:

-

Taiwanese firms that build chip manufacturing capacity in the U.S. can import certain equipment and materials duty-free under negotiated quotas during and after facility construction.

-

This mitigates concerns about punitive tariffs on semiconductors and supports U.S. reshoring efforts.

Strategic Aims Behind the Agreement

Beyond routine tariff changes, this deal reflects strategic goals on both sides:

-

For the United States, expanding domestic chip production and technology capacity has become a priority in the face of global supply-chain risks and geopolitical competition with China.

-

For Taiwan, deepening economic ties with the U.S. provides market stability and reduces economic reliance on Mainland China amid heightened political tensions.

A Semiconductor-Focused Trade Deal

In January 2026, the United States and Taiwan reached a targeted trade deal that further formalized this strategic approach for American Semiconductor Manufacturing Through an Agreement on Trade & Investment with Taiwan. The agreement placed semiconductors and advanced manufacturing at its core, reflecting their central role in both economies. US officials described the deal as a way to deepen cooperation in critical technologies while reducing friction around chip production, equipment sourcing, and supply-chain security. Taiwan is one of the most important sources of semiconductor chips for the U.S. market:

-

According to recent reports, Taiwan accounted for nearly 19% of U.S. semiconductor imports in 2024, as per the data on US imports from Taiwan by HS code, second only to Malaysia.

-

Many chips are embedded in finished products (like servers and advanced computing devices), meaning raw chip values can understate the real impact of Taiwanese components in U.S. imports.

Rather than functioning as a traditional free trade agreement, the deal focuses on aligning industrial policies and providing predictable regulatory treatment for semiconductor-related trade and investment. It clarifies market access conditions for chipmakers, streamlines regulatory pathways for manufacturing expansion, and supports coordinated supply-chain planning.

The agreement also reflects a broader shift in US trade policy toward Taiwan. Semiconductors are treated not as ordinary commercial goods, but as strategic assets essential to economic stability, technological leadership, and national security. For Taiwanese chipmakers, the deal provides clearer incentives and safeguards for expanding operations in the United States. For US firms, it ensures continued access to Taiwan’s advanced fabrication capabilities while reducing exposure to supply-chain disruptions.

Top Goods the US Imports from Taiwan: What Does the US Import from Taiwan?

Taiwan serves as a vital trading partner for the United States, with a diverse range of goods flowing between the two economies. Taiwan is a major trading partner for the US, and the goods imported from Taiwan play a crucial role in the American economy. Among the top imports from Taiwan to the US are electronic components, machinery, and semiconductors. These products play a crucial role in supporting various industries in the US economy, particularly in the technology sector. The top 10 goods that the US imports from Taiwan, as per the US shipment data for 2025, include:

1. Nuclear reactors & machinery (HS code 84): $57.90 billion

One of the leading categories of goods that the US imports from Taiwan is nuclear reactors and machinery, with a total value of $57.90 billion, as per the data on US machinery imports from Taiwan by HS code. These goods are essential for various industries in the United States, including energy production and manufacturing. Taiwan is known for its high-quality machinery, making it a valuable source for these products.

2. Electrical machinery & equipment (HS code 85): $32.45 billion

Another significant category of goods imported from Taiwan is electrical machinery and equipment, with a total value of $32.45 billion. The US relies on Taiwan for a wide range of electrical products, including semiconductors, consumer electronics, and telecommunications equipment. Taiwan's expertise in this sector has made it a reliable supplier for American companies.

3. Articles of iron or steel (HS code 73): $3.52 billion

While not as high in value as the previous categories, articles of iron or steel still make up a substantial portion of the goods imported from Taiwan, with a total value of $3.52 billion. These products are used in various industries, such as construction, automotive, and manufacturing. Taiwan's high-quality iron and steel products are in demand in the US market.

4. Vehicles (HS code 87): $3.16 billion

Taiwan is also a significant supplier of vehicles to the United States, with a total value of $3.16 billion, as per the data on US vehicle imports from Taiwan. Taiwanese automobiles and automotive parts are popular among American consumers for their quality and affordability. The US imports a wide range of vehicles from Taiwan, including cars, motorcycles, and bicycles.

5. Plastics & articles thereof (HS code 39): $2.94 billion

Plastics and articles thereof are another important category of goods imported from Taiwan, with a total value of $2.94 billion. Taiwan is a leading producer of plastic products, such as packaging materials, containers, and consumer goods. These products play a vital role in various industries in the United States, including food and beverage, healthcare, and retail.

6. Optical, medical, & surgical instruments (HS code 90): $2.59 billion

Taiwan is also a significant supplier of optical, medical, and surgical instruments to the United States, with a total value of $2.59 billion. Taiwanese medical devices and equipment are known for their precision and quality, making them essential for healthcare providers in the US. These products are used in hospitals, clinics, and research facilities across the country.

7. Furniture, bedding, & mattresses (HS code 94): $1.32 billion

Furniture, bedding, and mattresses are another category of goods imported from Taiwan, with a total value of $1.32 billion. Taiwanese furniture manufacturers are known for their craftsmanship and innovative designs, making their products popular among American consumers. These goods are used in homes, offices, and hospitality establishments in the United States.

8. Toys, games, & sports requisites (HS code 95): $1.27 billion

Taiwan is also a leading supplier of toys, games, and sports requisites to the United States, with a total value of $1.27 billion. Taiwanese toy manufacturers produce a wide range of products, including dolls, action figures, board games, and sporting equipment. These products are popular among children and adults alike, contributing to the vibrant entertainment industry in the US.

9. Cutlery, tools, & spoons (HS code 82): $1.19 billion

Cutlery, tools, and spoons are another category of goods imported from Taiwan, with a total value of $1.19 billion. Taiwanese manufacturers produce high-quality kitchenware, hand tools, and utensils that are in demand in the US market. These products are used in homes, restaurants, and commercial kitchens nationwide.

10. Miscellaneous articles of base metal (HS code 83): $1.17 billion

Finally, miscellaneous articles of base metal make up another significant category of goods imported from Taiwan, with a total value of $1.17 billion. These products encompass a diverse range of metal goods, including fasteners, fittings, and hardware. Taiwanese manufacturers are known for their expertise in producing high-quality metal products that meet the needs of American industries.

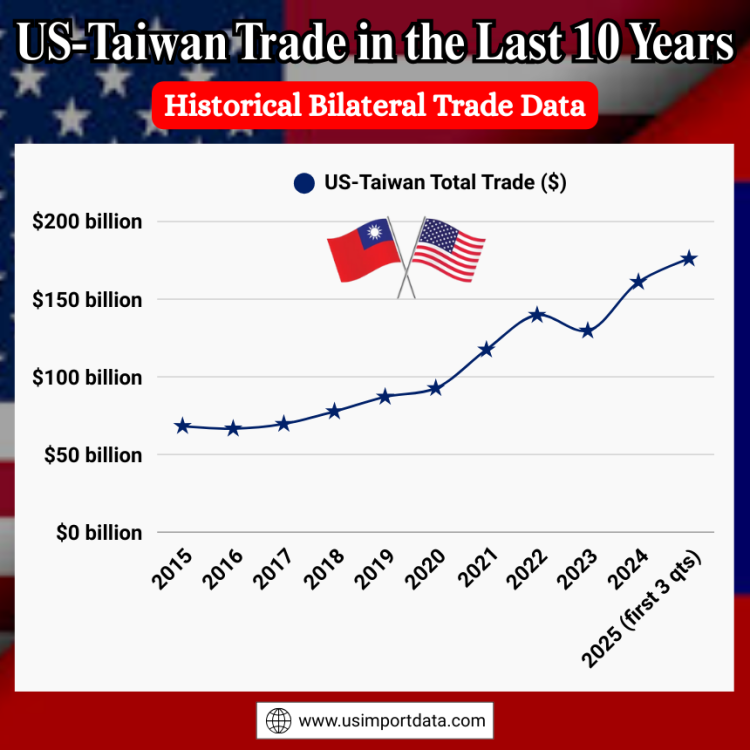

US-Taiwan Trade in the Last 10 Years: Historical Bilateral Trade Data

|

Year of Trade |

US-Taiwan Total Trade ($) |

|

2015 |

$68.27 billion |

|

2016 |

$66.62 billion |

|

2017 |

$69.63 billion |

|

2018 |

$77.70 billion |

|

2019 |

$87.12 billion |

|

2020 |

$92.66 billion |

|

2021 |

$117.48 billion |

|

2022 |

$139.78 billion |

|

2023 |

$129.68 billion |

|

2024 |

$161.06 billion |

|

2025 (first 3 quarters) |

$176.07 billion |

Why Semiconductors Are Central in the US-Taiwan Trade

Taiwan’s role in semiconductors goes beyond straightforward trade values; it affects entire global supply chains.

Taiwan’s Semiconductor Dominance

Taiwan is a leading player in advanced semiconductor manufacturing:

-

Major firms like TSMC, MediaTek, Realtek, and Novatek anchor a vibrant semiconductor ecosystem.

-

Taiwan’s export statistics for chip manufacturing show annual shipments valued at tens of billions of dollars, dominating advanced logic and AI-related circuits.

Taiwan exported approximately $92.5 billion in IC manufacturing goods by mid-2025, reflecting the sheer scale of its chip production.

US Strategic Needs in Chips

While the U.S. remains a global leader in chip design, it lags in fabrication, which Taiwan excels at. This interdependence has shaped policy:

-

The U.S. dominates design market share globally through firms like NVIDIA and AMD, while Taiwan leads in fabrication capacity through TSMC’s foundries.

-

This imbalance motivates U.S. strategies to reshore manufacturing and reduce reliance on foreign factories for national security and economic resilience.

Trade Policy and Tariff Negotiations

Semiconductors have been a flashpoint in U.S. trade policy:

-

In 2025, proposals for 100% tariffs on imported chips were floated as a means to boost the domestic industry, though actual trade agreements opted for nuanced treatments, including tariff reductions tied to investment commitments.

-

The new 2026 US-Taiwan agreement reflects this shift toward cooperation rather than punitive measures, making semiconductors a central axis of economic diplomacy.

Broader Economic & Strategic Implications

Supply Chain Resilience and Security

The semiconductor focus is both economic and strategic:

-

Taiwan’s chip factories are seen as a “silicon shield”, critical to global tech industries and a geopolitical asset given tensions across the Taiwan Strait and with China.

-

By helping build U.S. chip capacity, the deal seeks to diversify global production and reduce risk in critical technologies.

Investment and Job Creation

The $250 billion Taiwanese investment into the U.S. chip and AI sectors signals:

-

Potentially thousands of high-skill jobs in semiconductor fabrication, AI hardware manufacturing, and related industries.

-

A multiplier effect in supply chains, from raw materials and equipment to R&D and workforce development.

Geopolitical Balance

U.S.–Taiwan economic ties now play into broader geopolitical strategies:

-

Deepening commercial ties can counterbalance China’s regional influence and shift supply chains away from over-dependence on Asia’s mainland markets.

-

At the same time, both sides must manage sensitivities around technology transfer and sovereignty.

What Comes Next? Future Prospects

Looking ahead, analysts project further growth in US–Taiwan trade:

-

Some forecasts see bilateral trade potentially exceeding $200 billion by 2030 if current trends continue. This is driven mainly by semiconductor demand, cloud computing infrastructure, AI deployment, and advanced manufacturing sectors.

-

Ongoing negotiations will likely refine tariff treatments and investment incentives, reflecting both economic and strategic priorities.

Conclusion and Final Verdict

In conclusion, the United States and Taiwan now stand at a pivotal moment in their economic relationship. What started as a robust trade partnership has evolved into a strategic alliance centered on innovation, technology, and supply chain resilience. The landmark 2026 trade deal, featuring tariff adjustments and massive Taiwanese investment, signals both confidence and complexity in future commerce.

As global demand for semiconductors accelerates and geopolitical tensions continue to shape supply chains, the U.S.–Taiwan trade relationship will remain a key barometer of how advanced economies balance market growth, national security, and international cooperation.

We hope you liked our interactive blog report on the US-Taiwan trade relations, trade deal, & semiconductor chips' role in bilateral trade. For more information on the latest US export-import data, or to search live data on US imports by country, visit USImportdata. Contact info@tradeimex.in for exclusive customized US trade reports & market insights.

What's Your Reaction?