US Caustic Soda Export Data 2025: USA Sodium Hydroxide Manufacturers & Caustic Soda Suppliers Database

Discover leading caustic soda manufacturers in USA, sodium hydroxide suppliers & exporters, & lye suppliers data. Explore US caustic soda exports by country for market insights.

Caustic soda, scientifically known as sodium hydroxide (NaOH), is among the most widely used industrial chemicals on the planet. The United States remains a dominant force in global caustic soda exports due to its large production capacity, advanced manufacturing base, and strong international trade links. According to the latest US export data and the Caustic Soda or Sodium Hydroxide export data of the USA, the US caustic soda exports reached $1.30 billion in 2024, a 19% decline from the previous year. According to the US caustic soda export data, the US exported caustic soda or sodium hydroxide worth $1.41 billion in the first 11 months of 2025.

Used across industries such as pulp and paper, alumina production, detergent manufacture, textiles, water treatment, and more, NaOH is essential for modern manufacturing and trade. The USA is the largest caustic soda exporter in the world, as per the global trade data. This blog dives into the latest US caustic soda export data, top destinations, supply chain dynamics, and a detailed overview & database of the leading USA sodium hydroxide manufacturers & suppliers.

Overview: US Caustic Soda Export Landscape in 2025

Export Value & Trends

According to international trade databases, the US has been one of the top global exporters of sodium hydroxide in aqueous solution, a common commercial form of caustic soda classified under HS code 2815. In 2024, the value of caustic soda exports from the United States was over $1.30 billion, making it one of the largest exporters in the world. Notably, the US accounted for about 32% of global exports of sodium hydroxide in aqueous solution that year.

US export data by HS code 2815 and international trade flows (including shipments through 2025) indicate that the United States continues to hold a leading share of the global caustic soda export market in both volume and value, with over $1.40 billion worth of caustic soda exports in 2025, building on its strong performance from 2023 onward.

These exports include both aqueous sodium hydroxide solutions and, to a smaller degree, solid caustic soda (flakes or pellets). Solid NaOH exports from the US are comparatively smaller. In 2024, solid NaOH exports were valued at around $15.5 million, with Canada and Mexico as significant destinations.

Export Directions: Top Markets

The most significant export destinations for US caustic soda (aqueous NaOH) as per the US sodium hydroxide exports by country, include:

-

Brazil – by far the largest importer, accounting for over 40% of total US exports of caustic soda solution.

-

Canada – roughly 15–16% of export value.

-

Mexico – around 6–8% of export value.

-

Chile, Jamaica, and Uruguay – among other smaller but consistent market destinations.

These figures highlight how Latin America is a major destination for US caustic soda, likely due to geographic proximity, existing trade agreements, and industrial demand in sectors like mining, pulp & paper, and chemical processing.

In 2024-2025 trade data (May 2024–April 2025), detailed shipment records show that Brazil, Chile, and Mexico together accounted for nearly 86% of US caustic soda solution exports by shipment count, with Brazil alone making up around 36%.

US Caustic Soda Exports by Country: Where Does the US Export Sodium Hydroxide?

Caustic soda, also known as sodium hydroxide, is a key chemical used in various industries such as paper, textiles, and petroleum. The United States is one of the largest producers of caustic soda in the world, and it also exports a significant amount of this chemical to various countries around the globe. The United States is a significant player in the global caustic soda market, exporting sodium hydroxide to various countries worldwide. With precise data on US caustic soda exports by country, it is evident that the US distributes sodium hydroxide to key trading partners such as Canada, Mexico, Brazil, and various European and Asian countries. The top 10 export destinations for American sodium hydroxide, as per the US shipment data for 2025, include:

1. Brazil: $521.28 million (39.9%)

Brazil is the top destination for US caustic soda exports, accounting for nearly 40% of the total exports. The strong trade relationship between the US and Brazil, along with the growing industrial sector in Brazil, has led to a significant demand for caustic soda in the country.

2. Canada: $201.04 million (15.4%)

Canada is another major importer of US caustic soda, making up 15.4% of the total exports. The proximity between the US & Canada, as well as the thriving manufacturing sector in Canada, has contributed to the steady demand for caustic soda from the US.

3. Jamaica: $78.56 million (6%)

Jamaica is a significant market for US caustic soda exports, accounting for 6% of the total exports. The chemical industry in Jamaica relies heavily on imports of caustic soda for various processes, which has created a stable market for US exporters.

4. Chile: $74.29 million (5.7%)

Chile is another important destination for US caustic soda exports, with a share of 5.7% of the total exports. The mining industry in Chile, which is one of the largest in the world, requires a considerable amount of caustic soda for mineral processing and extraction, driving the demand for imports from the US.

5. Mexico: $62.52 million (4.8%)

Mexico is a key market for US caustic soda exports, with 4.8% of the total exports. The manufacturing sector in Mexico, particularly in industries such as automotive and chemicals, relies on caustic soda for various operations, leading to a consistent demand for imports from the US.

6. Uruguay: $52.47 million (4%)

Uruguay is a growing market for US caustic soda exports, accounting for 4% of the total exports. The expanding industrial sector in Uruguay, coupled with the need for chemicals in various manufacturing processes, has created opportunities for US exporters to tap into this market.

7. Australia: $48.91 million (3.7%)

Australia is a significant importer of US caustic soda, making up 3.7% of the total exports. The mining and metallurgical industries in Australia are major consumers of caustic soda for ore processing and refining, contributing to the demand for imports from the US.

8. Ireland: $45.29 million (3.5%)

Ireland is another important destination for US caustic soda exports, with a share of 3.5% of the total exports. The chemical industry in Ireland relies on imports of caustic soda for various applications, creating opportunities for US exporters to supply this essential chemical.

9. Finland: $29.27 million (2.2%)

Finland is a growing market for US caustic soda exports, accounting for 2.2% of the total exports. The strong industrial base in Finland, particularly in sectors such as pulp and paper, has created a consistent demand for caustic soda from the US.

10. Belgium: $24.57 million (1.9%)

Belgium is a key importer of US caustic soda, making up 1.9% of the total exports, as per the data on US sodium hydroxide exports to Belgium. The chemical industry in Belgium, which is one of the largest in Europe, relies on imports of caustic soda or sodium hydroxide for various processes, driving the demand for this chemical from the US.

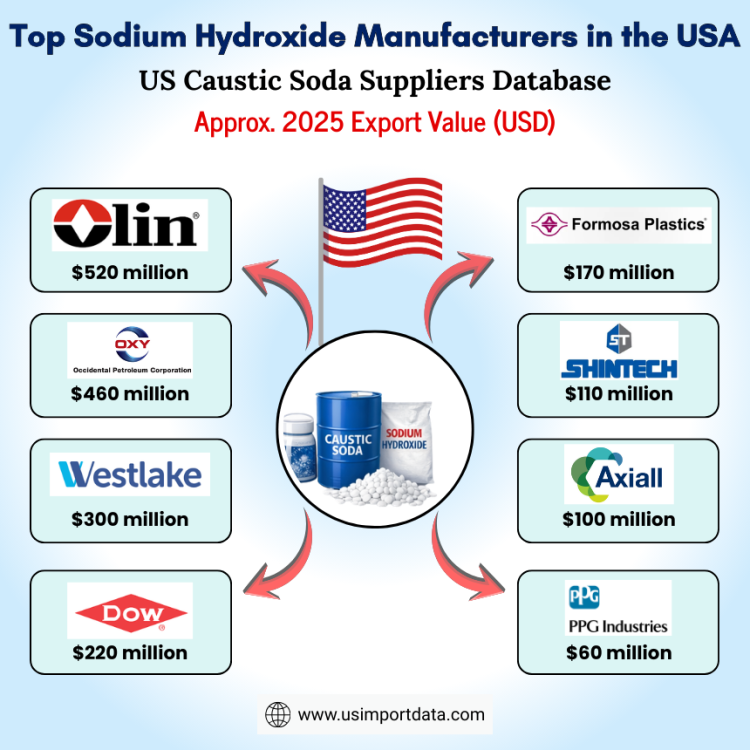

Top Sodium Hydroxide Manufacturers in the USA: US Caustic Soda Suppliers Database

Many industries rely on trusted caustic soda manufacturers in USA for consistent quality and large-scale supply, while choosing a reliable caustic soda supplier is essential for maintaining efficient operations across sectors such as chemicals, textiles, and water treatment. Leading caustic soda exporters play a vital role in global trade, and businesses often prefer a dependable caustic soda supplier in USA to ensure timely delivery and compliance standards.

Alongside this, top sodium hydroxide manufacturers and well-established sodium hydroxide manufacturers USA continue to support growing industrial demand, offering stable sourcing options through every major sodium hydroxide supplier network. Companies also search for trusted lye suppliers and specialized caustic soda lye suppliers, especially when looking for a certified caustic soda lye manufacturer capable of meeting both domestic and international requirements.

Below is a data-focused database of major caustic soda manufacturers and suppliers in the United States, useful for sourcing, market research, or business development. The leading caustic soda suppliers & sodium hydroxide manufacturers in the US, according to the latest US exporters data for 2025, include:

|

Rank |

Company Name |

Approx. 2025 Export Value (USD) |

Top Exported Types |

Top Export Destination |

|

1 |

Olin Corporation |

$520 million |

Liquid Caustic Soda (50% membrane grade), Diaphragm grade |

Brazil |

|

2 |

Occidental Chemical Corporation |

$460 million |

Liquid Caustic Soda (50%), Rayon grade |

Brazil |

|

3 |

Westlake Corporation |

$300 million |

Liquid Caustic Soda, Solid Flakes |

Mexico |

|

4 |

Dow Inc. |

$220 million |

Membrane Grade Liquid Caustic |

Canada |

|

5 |

Formosa Plastics Corporation USA |

$170 million |

Liquid Caustic Soda (Industrial Grade) |

Mexico |

|

6 |

Shintech Inc. |

$110 million |

Liquid Caustic (byproduct of PVC production) |

Brazil |

|

7 |

Axiall Corporation (Westlake subsidiary) |

$100 million |

Liquid Caustic Soda |

Chile |

|

8 |

PPG Industries |

$60 million |

Specialty & Technical Grade Caustic |

Canada |

|

9 |

Univar Solutions |

$40 million |

Solid Flakes, Liquid Distribution |

Latin America |

|

10 |

Brenntag North America |

$35 million |

Repacked Liquid & Flake Caustic |

Caribbean |

Primary Caustic Soda Manufacturers

These companies operate large chlor-alkali facilities in the U.S. and are critical players in both domestic supply and export markets:

-

Olin Corporation

-

Olin Corporation is one of the world’s largest producers of membrane-grade sodium hydroxide.

-

Facilities across multiple states, including Louisiana, Texas, Tennessee, and New York.

-

Focused on bulk caustic soda production for industrial and export markets.

-

The Dow Chemical Company

-

Major global chemical company with significant NaOH production capacity.

-

Supplies a wide range of grades, including industrial and high-purity caustic soda.

-

Occidental Chemical Corporation (often known as OxyChem)

-

Large North American manufacturer of sodium hydroxide and related chlor-alkali products.

-

Westlake Corporation

-

Operates significant caustic soda production facilities across Louisiana and Kentucky.

-

Produces both liquid and solid forms for domestic and international markets.

-

PPG Industries Inc.

-

Diversified chemical and coatings company with historical involvement in caustic soda production.

-

Brenntag North America Inc.

-

A key distributor of caustic soda from multiple manufacturers to industrial buyers.

Supplementary Suppliers & Distributors

In addition to producers, the United States has a network of bulk chemical suppliers and distributors offering sodium hydroxide in various forms and packaging:

-

Industrial chemical wholesalers and brokers providing tailored supply solutions.

-

Specialized distributors offering technical grade, food grade, and water treatment grades of NaOH.

These companies often serve markets that require consistent small- to mid-volume supply, or technical assistance with handling and storage.

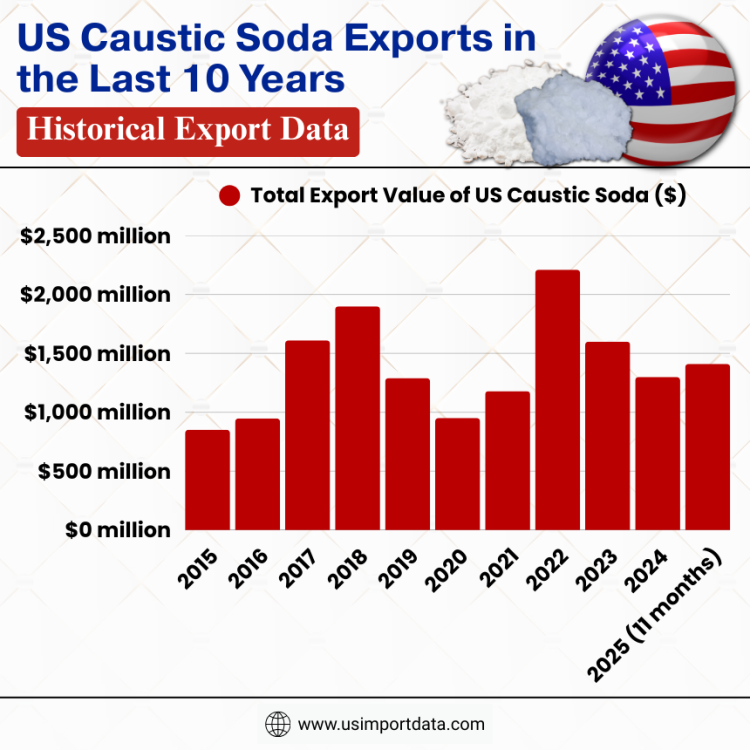

US Caustic Soda Exports in the Last 10 Years: Historical Export Data

|

Year of Exports |

Total Export Value of US Caustic Soda ($) |

|

2015 |

$851.82 million |

|

2016 |

$947.55 million |

|

2017 |

$1.61 billion |

|

2018 |

$1.90 billion |

|

2019 |

$1.29 billion |

|

2020 |

$950.67 million |

|

2021 |

$1.18 billion |

|

2022 |

$2.21 billion |

|

2023 |

$1.60 billion |

|

2024 |

$1.30 billion |

|

2025 (11 months) |

$1.41 billion |

Caustic Soda Forms and US Export Composition

Caustic soda exports from the US broadly fall into two major categories:

1. Aqueous NaOH (Liquid Caustic Soda)

-

This is by far the dominant export form from the United States, accounting for the bulk of value & volume exported, as per the US caustic soda exports by HS code.

-

US manufacturers typically ship concentrated solutions (often 50% NaOH) via specialized tanker trucks and ocean vessels.

-

Liquid NaOH is widely used in industrial processes like pulp bleaching, alumina refining, and wastewater treatment due to its ease of handling compared to solid forms.

Exports of liquid caustic soda constitute the majority of US trade activity in 2025, driven by long-term contracts and strong demand from Latin American chemical, mining, and industrial sectors.

2. Solid NaOH (Flakes / Pellets)

-

Although significant in global trade, solid sodium hydroxide exports from the US are smaller in volume compared with liquid exports.

-

Typical solid shipments serve specialized industrial needs, such as dry formulations for soap and detergent production, or applications where liquid handling infrastructure isn’t ideal.

-

The 2024 export value for solid NaOH was modest, around $15.5 million, reflecting niche trade volumes relative to the liquid market.

Drivers of US Caustic Soda Export Growth

Several key factors sustain and fuel the strength of US caustic soda exports:

1. Domestic Production Dominance

The United States hosts several large-scale NaOH manufacturers with robust production capacity and technology. This ensures a consistent supply for both domestic consumption and export markets.

2. Strategic Port and Rail Networks

Key export hubs in the Gulf Coast region (including ports in Louisiana and Texas) are strategically located for efficient marine export to Latin America, Europe, and Asia, lowering trade costs and facilitating competitive pricing.

3. Industrial Demand in Export Markets

Major importing countries, especially Brazil, have strong industrial sectors like alumina refining, mining, and chemical manufacturing, creating persistent demand for imported caustic soda.

Market Challenges & Risks

Despite strong export performance, the US caustic soda industry is not without challenges:

1. Price Volatility and Trade Disputes

Commodity markets, particularly for industrial chemicals like NaOH, are susceptible to price swings. In past years, there have been legal challenges involving pricing practices, illustrating competitive tensions within the industry. For example, federal litigation in the U.S. around alleged pricing practices involving major producers has made headlines, though outcomes are ongoing.

2. Raw Material Costs

Energy and chlorine feedstock costs, tied to salt and electricity prices, remain key cost drivers. Efficient production facilities that adopt modern membrane cell technology gain advantages in energy efficiency and cost per ton of NaOH produced.

3. Global Competitive Pressures

US manufacturers compete with producers in Europe, Asia, and the Middle East. Countries like China and Belgium also rank high among global NaOH exporters.

Future Outlook & Forecast (Post-2025)

Industry analysts expect continued resilience and moderate growth in the global caustic soda trade through the remainder of the decade, driven by:

-

Expansion of downstream industries (textiles, aluminum, pulp & paper).

-

Growth in the mining and wastewater treatment sectors.

-

Increased demand for chemical intermediates linked to green technologies.

Trade patterns may evolve as new infrastructure and environmental regulations influence global competitive positioning. However, the United States is projected to remain one of the top sources of high-quality caustic soda exports due to its mature manufacturing base and export advantages.

Conclusion and Final Thoughts

In conclusion, the US caustic soda export story in 2025 reflects:

-

Strong export volumes and value, building on leadership in global trade data.

-

Major export markets in Latin America and North America.

-

A robust manufacturing ecosystem anchored by major chemical producers and distributors.

-

Ongoing industry evolution in technology, supply chains, and regulatory landscapes.

For buyers, suppliers, and market analysts, the US sodium hydroxide trade remains a cornerstone of global chemical commodity flows, offering rich data signals and clear business opportunities.

Note for Our Readers

We hope you liked our data-driven and insightful blog report on the US caustic soda export data 2025. For more information on the latest US import-export data, or to search live US caustic soda export data by country, visit USImportdata. Contact us at info@tradeimex.in for customized trade reports & market insights. Get exclusive and verified USA caustic soda exporters & suppliers data to skyrocket your business today!

What's Your Reaction?