Breaking Down the US-Bangladesh Reciprocal Trade Agreement: 19% Tariff Cuts & Duty-Free Benefits

Explore the US-Bangladesh trade deal with reciprocal tariffs cut to 19%. Get full details on the US-Bangladesh tariff agreement, US tariff cuts for Bangladesh, and updated US Bangladesh bilateral trade.

On February 9, 2026, the United States and Bangladesh finalized a landmark Agreement on Reciprocal Trade that redraws the contours of economic engagement between the two countries. Under the deal, the U.S. has agreed to reduce its tariff on Bangladeshi exports to a flat 19%, from previously threatened or applied higher levels, while Bangladesh has committed to preferential market access for U.S. goods across a range of industrial and agricultural sectors. According to the latest US export data & Bangladesh import data, the total value of the US-Bangladesh trade reached $10.99 billion in 2024 and over $11 billion in 2025.

This agreement arrives in a period of dynamic global trade politics, marked by rising protectionism, geopolitical competition, and geopolitical shifts in the global apparel and goods market. It also follows intense negotiations, both commercial and strategic, between Dhaka and Washington over tariffs, trade balances, and regulatory alignments.

This blog unpacks the key components of the agreement, the motivations behind it, how it alters the trade relationship between the two countries, and what it means for businesses, workers, and regional trade dynamics.

Historical & Policy Background

From High Tariffs to Negotiated Relief

Before the new deal, Bangladesh’s exports to the U.S. were under a reciprocal tariff regime that had escalated significantly due to U.S. trade policy changes. In April 2025, the U.S. introduced a reciprocal tariff framework (Executive Order 14257) applying punitive tariffs to exports from several trading partners, including Bangladesh, based on the notion that countries should impose on U.S. imports tariffs equivalent to what the U.S. faced abroad.

While Bangladesh initially averted the steepest tariff hikes, which could have climbed above 35–37%, through earlier negotiations (bringing rates to around 20% last year), this latest agreement represents a further negotiated cut to 19%.

These tariff changes did not occur in isolation; they coincided with broader U.S. trade policy moves affecting multiple countries (including India and other South Asian exporters) aimed at narrowing U.S. trade deficits and bolstering American industrial competitiveness.

What the New Agreement Actually Changes

The US-Bangladesh trade deal marks a significant shift in bilateral commerce, with the US-Bangladesh trade agreement focusing heavily on manufacturing and apparel, making the US-Bangladesh trade deal textile provisions especially important for exporters as the US Cuts Tariffs on Bangladesh to improve market access and rebalance trade flows.

As Bangladesh export to USA volumes continue to grow, particularly in ready-made garments, the revised US tariffs on bangladesh textile are expected to play a central role in shaping sourcing decisions, pricing competitiveness, and long-term supply chain strategies for both countries. At its core, the U.S.-Bangladesh reciprocal trade agreement makes three major changes to baseline trade conditions:

1. Tariff Reduction to a Flat 19%

Under the new deal, the U.S. has formally reduced the tariff on Bangladeshi exports to the U.S. market to 19%. This is a slight reduction from the roughly 20% rate Bangladesh secured in earlier negotiations, but still significantly below the punitive tariffs initially proposed under the earlier U.S. policy.

This cut affects a wide range of products, particularly in Bangladesh’s key export sectors such as ready-made garments (RMG), textiles, leather goods, and other manufactured goods.

2. Duty-Free Access for Select Apparel Made with U.S. Inputs

A standout provision of the agreement is the mechanism that enables certain categories of Bangladeshi apparel and textile goods to enter the U.S. market duty-free, provided they are manufactured using U.S.-produced cotton or man-made fibers. This is a conditional duty-free entry, determined by volume and certification mechanisms established under the trade deal.

This provision effectively incentivizes Bangladeshi manufacturers and the U.S. buyers and brands that source from them to increase backward integration of US materials, particularly cotton and fibers.

3. Expanded Market Access for U.S. Goods in Bangladesh

Reciprocity means Bangladesh is also reducing barriers for U.S. exports. Under the agreement, Dhaka has agreed to offer preferential market access to thousands of U.S. industrial & agricultural products, both duty-free and at lower tariffs, compared with pre-existing levels.

Bangladesh reportedly granted duty-free or reduced duty status to around 2,500 Bangladeshi products in the U.S., and in return has opened its own market to roughly 4,400 U.S. products without or with reduced tariffs.

These include a range of industrial goods (machinery, chemicals, medical devices), agricultural items (soy products, dairy, beef, poultry), pharmaceuticals, and other consumer products.

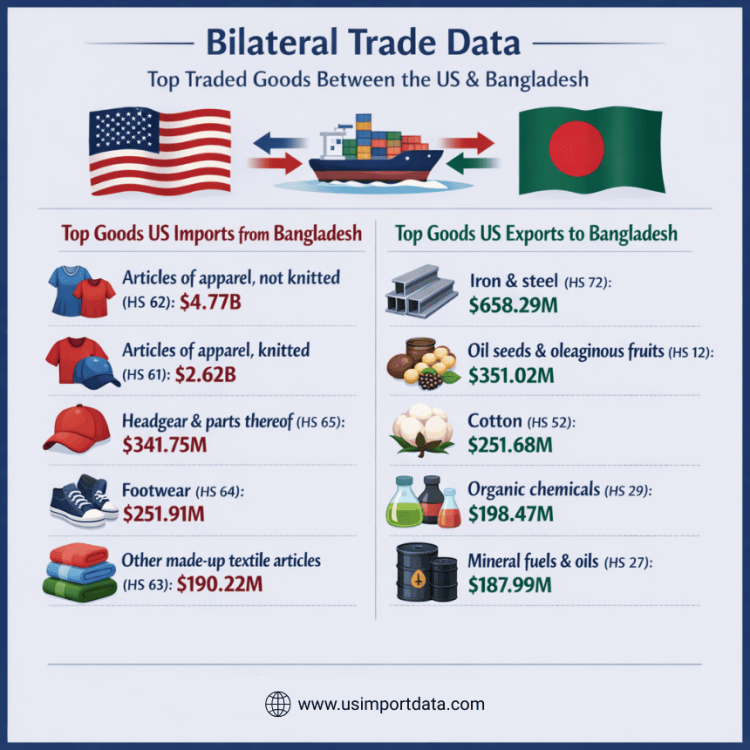

Bilateral Trade Data: Top Traded Goods Between the US & Bangladesh

The bilateral trade data between the United States and Bangladesh reveals key insights into the top traded goods between these two nations. The exchange primarily revolves around textiles, ready-made garments, machinery, agricultural products, and electronics. According to the latest US import data, the total value of US imports from Bangladesh reached $8.80 billion in 2025. The US exports to Bangladesh accounted for $2.22 billion in 2025.

Under the new framework, US tariffs on Bangladesh have been lowered through targeted US Bangladesh tariff cuts, prompting renewed interest in questions like What does the US trade with Bangladesh?, which spans apparel, textiles, leather goods, and select manufactured products. The following are the top traded goods between the US & Bangladesh in terms of imports & exports in 2025:

Top Goods US Imports from Bangladesh

-

Articles of apparel, not knitted (HS code 62): $4.77 billion

-

Articles of apparel, knitted (HS code 61): $2.62 billion

-

Headgear & parts thereof (HS code 65): $341.75 million

-

Footwear (HS code 64): $251.91 million

-

Other made-up textile articles (HS code 63): $190.22 million

Top Goods US Exports to Bangladesh

-

Iron & steel (HS code 72): $658.29 million

-

Oil seeds & oleaginous fruits (HS code 12): $351.02 million

-

Cotton (HS code 52): $251.68 million

-

Organic chemicals (HS code 29): $198.47 million

-

Mineral fuels & oils (HS code 27): $187.99 million

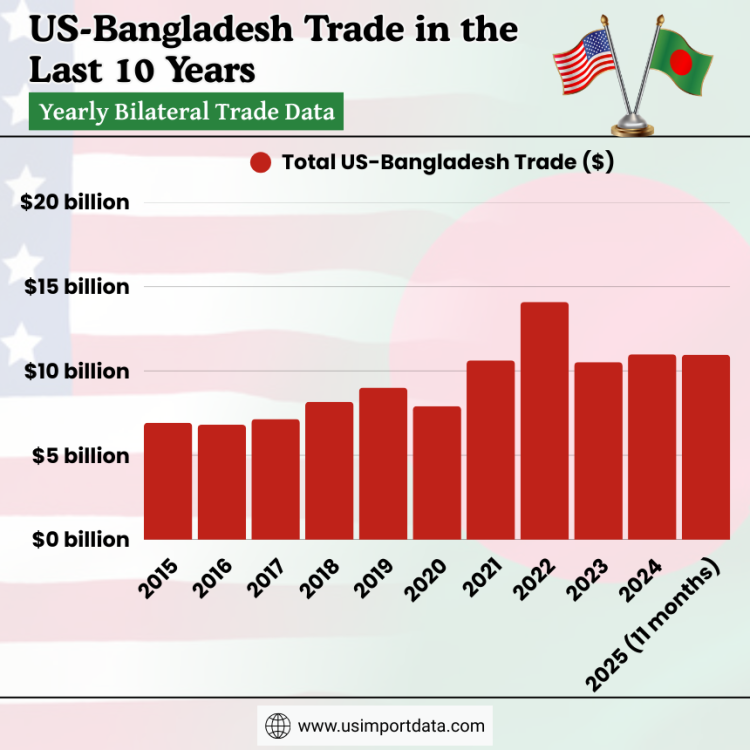

US-Bangladesh Trade in the Last 10 Years: Yearly Bilateral Trade Data

|

Year of Trade |

Total US-Bangladesh Trade ($) |

|

2015 |

$6.93 billion |

|

2016 |

$6.81 billion |

|

2017 |

$7.15 billion |

|

2018 |

$8.17 billion |

|

2019 |

$9.01 billion |

|

2020 |

$7.91 billion |

|

2021 |

$10.63 billion |

|

2022 |

$14.09 billion |

|

2023 |

$10.52 billion |

|

2024 |

$10.99 billion |

|

2025 (11 months) |

$10.96 billion |

Economic & Commercial Impacts of US-Bangladesh Trade Agreement

The economic implications of the agreement are multi-layered and vary across sectors, firms, and workers.

For Bangladesh’s Export-Driven Economy

Apparel and Textiles

The RMG (readymade garment) sector accounts for around 80% of Bangladesh’s export earnings, employing millions of workers, with a large share of the workforce being women from rural and low-income backgrounds.

At a 19% flat tariff with potential duty-free access for US-input apparel:

-

Bangladeshi apparel becomes more competitive, especially in price-sensitive segments of the U.S. market.

-

The duty-free channel effectively gives Bangladeshi exporters a cost advantage over competitors from countries that do not integrate U.S. inputs, including some Indian producers who may still face tariffs under their own trade arrangements.

However, this advantage is contingent on the ability of Bangladeshi firms to source U.S. cotton or fibers and to absorb the trade and compliance costs of managing input origin documentation.

Diversification and Resilience

With tariffs stabilized at a lower rate, exporters may:

-

Seek longer-term contracts with U.S. buyers.

-

Expand product offerings beyond traditional apparel.

-

Invest in quality, compliance, & supply chain transparency to meet US standards.

But firms also face economic exposure to import prices of U.S. inputs and currency volatility, which can squeeze margins if not managed properly.

For U.S. Producers and Exporters

The agreement expands demand for U.S. industrial and agricultural exports into Bangladesh:

Agricultural Markets

By opening duty-free access or reduced tariffs for products such as soybeans, dairy, beef, and poultry, the agreement potentially promises increased export volumes for American farmers and processors.

Bangladesh’s growing population and rising per-capita incomes make it a promising market for U.S. agribusiness exports, especially if tariff costs are eliminated or lowered relative to competitors.

Industrial Goods and Machinery

U.S. exports of machinery, chemicals, medical equipment, and automotive parts could benefit from lower trade barriers in Bangladesh, enhancing the competitiveness of U.S. OEMs and capital goods producers in South Asia, where competition from European and East Asian suppliers is strong.

Strategic and Geopolitical Considerations

Timing and Political Context

The timing of the agreement has geopolitical significance. It was concluded during a period of heightened global economic positioning:

-

Bangladesh is poised for a national election.

-

The U.S. is recalibrating relationships with emerging markets amidst broader trade policy reforms.

-

Regional competitors, such as India and Vietnam, are also negotiating their own trade terms with the U.S.

For both countries, the agreement sends a message of strengthened bilateral ties and mutual economic interest.

Competitive Positioning in Global Apparel Markets

The duty-free provision tied to U.S. inputs may tilt portions of the global sourcing map:

-

Some global brands might channel more orders through Bangladeshi manufacturers that use U.S. cotton to secure tariff benefits.

-

India’s textile exporters, facing different tariff terms (e.g., 18% as noted in India-US arrangements), could see changes in competitive dynamics, particularly where input sourcing strategies differ.

Broader Implications for Trade Policy

Reciprocal Tariffs as a Policy Tool

The U.S. implementation of reciprocal tariffs, a relatively recent trade policy mechanism, reflects a departure from traditional unilateral preferences (like the Generalized System of Preferences) toward negotiated, symmetry-based tariffs that match partner barriers.

This model:

-

Encourages trade partners to harmonize tariff levels,

-

Ties access to negotiated concessions,

-

Pushes structural reform on non-tariff issues (such as standards recognition and regulatory alignment).

Risks, Criticisms, and Limitations

Despite the headline benefits, several risks and criticisms have emerged around the deal:

1. Limited Tariff Reduction

Although a 19% tariff is lower than earlier punitive levels, for many exporters it remains a material cost that could still hinder competitiveness against duty-free or low-duty rivals from other regions.

2. Conditional Duty-Free Benefits

Duty-free access is not automatic for all exports, only for specific products meeting U.S. input requirements. This restricts the benefit to a subset of the export base and may reward only certain buyers and manufacturers able to comply with rules of origin and sourcing documentation.

3. Sovereignty and Regulatory Alignment

Some critics, particularly in Bangladesh, caution that trade conditionalities tied to regulatory standards, intellectual property alignment, and import liberalization could dilute domestic regulatory autonomy and policy flexibility.

There are also concerns about dependency on U.S. market demand and U.S. sourcing rules, which may influence Bangladesh’s broader strategic positioning with other trading partners.

Sectoral Winners and Losers

Winners

-

RMG and Textile Exporters (who can leverage duty-free access with U.S. inputs).

-

U.S. Agricultural Exporters (gains from expanded market access).

-

Machinery and Industrial Goods Producers (competitive tariff conditions in Bangladesh).

-

Global Brands that can optimize input sourcing across markets.

Looking Forward: What Comes Next?

1. Implementation and Certification

Both governments must now operationalize the tariff cuts and duty-free mechanisms:

-

Finalize lists of eligible duty-free categories.

-

Set up certification and origin verification systems.

-

Monitor compliance and dispute avoidance frameworks.

2. Monitoring Trade Flows and Balance

One key aim of the deal is to rebalance the trade relationship. Bangladesh exports significantly more to the U.S. than vice versa, creating a trade deficit that both sides seek to narrow through reciprocal access and import expansion.

3. Potential Expansion of the Agreement

Trade deals often evolve, and future negotiations might include services, digital trade, investment protections, or further tariff reductions on sensitive product groups, depending on economic priorities and political conditions.

Key Highlights of the US–Bangladesh Trade Deal

-

Tariff reduction: The United States agreed to lower its reciprocal tariff on Bangladeshi exports to 19% from the previous 20% under a new bilateral trade agreement.

-

Earlier rate changes: The tariff had originally been set much higher at 37% before being reduced to 20% in August 2025.

-

Zero-tariff provisions: Certain textile and apparel goods from Bangladesh made with US-produced cotton and man-made fibers can qualify for zero reciprocal tariff access under a special mechanism established by the deal.

-

Mechanism tied to US exports: The duty-free volume for those garments is linked to the amount of US textile exports (like cotton and fibers) supplied to Bangladesh.

-

Exports and market significance: Bangladesh’s garment and textile industry accounts for a major portion of exports to the US.

-

Negotiations timeframe: The agreement followed more than nine months of negotiations since April 2025.

-

Non-tariff commitments: Bangladesh agreed to reduce non-tariff barriers, including accepting US vehicle safety standards and FDA certifications for medical devices and pharmaceuticals.

-

Bilateral commercial deals: The trade pact is accompanied by planned commercial deals, including purchases of US agricultural goods and energy products over the next decade.

-

Signing and implementation: The agreement was signed by representatives from both sides and will take effect once official notifications are exchanged.

Conclusion and Final Verdict

The US-Bangladesh Reciprocal Trade Agreement of 2026 is a complex blend of modest tariff reductions, conditional duty-free incentives, and expanded market access in both directions. By locking in a 19% tariff & opening avenues for zero-duty access on qualifying apparel, the deal reflects a strategic and economic alignment aimed at fostering deeper bilateral trade ties.

For Bangladesh, it secures continued access to the largest consumer market in the world at a more competitive cost, especially for garments, its export mainstay. For the U.S., it opens new markets for industrial and agricultural goods, while embedding its economic footprint in one of Asia’s fastest-growing economies. As implementation begins, the true impact of the deal, for businesses, workers, and broader economic relations, will become clearer. What is certain is that both nations chose engagement over isolation, and in doing so have reshaped a significant piece of their economic relationship.

If you want to access the latest US trade data or search live US import-export data by country, visit USImportdata. Contact us at info@tradeimex.in for customized US trade database reports & market insights.

What's Your Reaction?