US Green Coffee Imports Report 2025: Top Green Coffee Importers in the USA

Explore US green coffee imports with the latest import data. Access green coffee beans importers, import trends, values & green coffee importers in USA.

Introduction

The United States is the world’s largest coffee-consuming market by value and one of the largest by volume. Yet despite its enormous appetite for coffee, the country produces virtually no commercial coffee at scale. As a result, the U.S. is entirely dependent on imported green coffee beans to supply its roasting industry, which ranges from global corporations to thousands of independent specialty roasters. According to the latest US import data and green coffee import data of the USA, the total value of US green coffee imports reached $6.31 billion in 2024, an 11% increase from the previous year. According to the US green coffee import data, the US imported green coffee beans worth $7.78 billion in the first three quarters of 2025, representing a significant increase from the same period in the previous year.

The USA is the largest coffee exporter in the world, as per the global trade data. The period covering 2024 through early 2025 marks a critical phase for the U.S. green coffee import market. After hitting multi-year lows in 2022–23 due to price shocks, inflation, logistics disruptions, & cautious buying, imports rebounded strongly. However, this recovery came with new challenges: higher prices, climate-driven supply risks, tariff uncertainty, and shifting sourcing strategies.

This report provides a deep, data-driven analysis of U.S. green coffee imports, covering:

-

Import volumes and values

-

Country-wise supplier rankings

-

Shipment and importer dynamics

-

Pricing and cost drivers

-

Structural changes in the importer landscape

-

A forward-looking outlook for 2025 and beyond

Size of the U.S. Green Coffee Import Market

Total Import Volume

In 2024, the United States imported approximately 1.33 to 1.35 million metric tons of green coffee, equivalent to 22–23 million 60-kg bags. This represented a 5–6% year-on-year increase compared with 2023, when imports fell to their lowest level in more than a decade.

The rebound was driven by:

-

Restocking by major roasters after inventory drawdowns

-

Stabilization of shipping routes and container availability

-

Strong domestic coffee consumption, especially in out-of-home channels

Import Value

While volumes rose moderately, import value increased at a much faster pace.

-

Total U.S. green coffee import value in 2024 exceeded USD 8.5 billion

-

Early 2025 quarterly data showed import values rising above USD 2.2 billion per quarter

-

Average landed prices were significantly higher than pre-2021 levels

This widening gap between volume growth and value growth highlights the impact of higher global coffee prices, not just increased demand, as per the National Coffee Association reports.

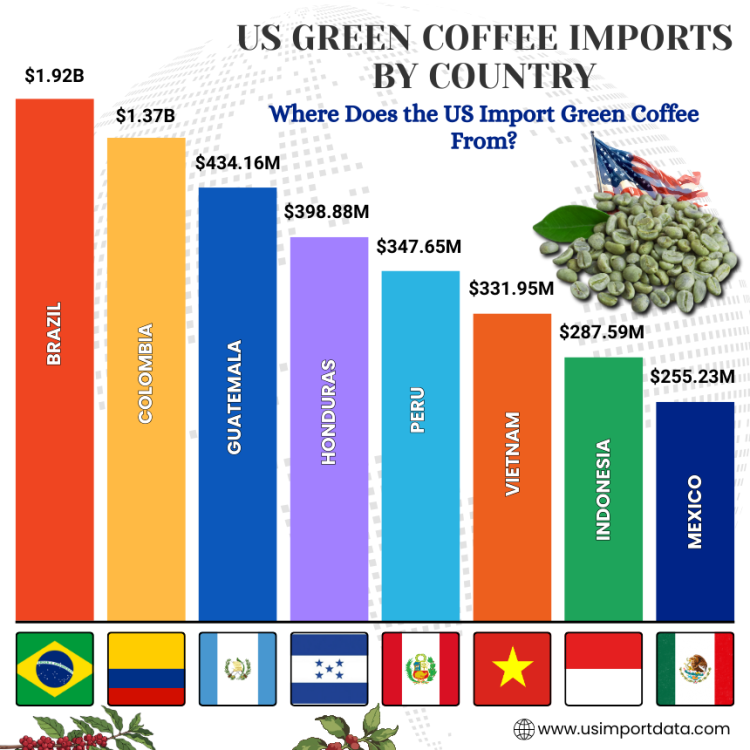

US Green Coffee Imports by Country: Where Does the US Import Green Coffee From?

When it comes to green coffee imports, the United States is one of the largest consumers in the world. With a growing demand for high-quality coffee, the US imports a significant amount of green coffee beans from various countries across the globe. US Green Coffee Imports by Country play a critical role in understanding the origin of green coffee in the US market.

The United States sources green coffee from various countries worldwide, with major importers being Brazil, Colombia, Vietnam, and Ethiopia. Each country's unique coffee beans contribute to the diverse flavors and profiles found in the US coffee industry. The top 10 green coffee supplier countries to the US, as per the US shipment data for 2024-25, include:

1. Brazil: $1.92 billion (30.4%)

Brazil is by far the largest source of green coffee imports for the United States, accounting for 30.4% of the total imports, as per the data on US green coffee imports from Brazil by HS code. Known for its rich and flavorful coffee beans, Brazil produces a wide variety of coffee beans that are highly sought after by US consumers. The favorable climate and soil conditions in Brazil make it an ideal location for coffee cultivation, resulting in high-quality beans that are popular among coffee enthusiasts.

2. Colombia: $1.37 billion (21.7%)

Colombia is another major player in the green coffee market, accounting for 21.7% of the US green coffee imports, as per the data on US green coffee imports from Colombia. Colombian coffee is known for its mild flavor profile and high acidity, making it a favorite among those who prefer a more balanced and nuanced cup of coffee. The coffee-growing regions in Colombia benefit from high altitudes and abundant rainfall, which contribute to the unique flavor profile of Colombian coffee beans.

3. Guatemala: $434.16 million (6.9%)

Guatemala is a rising star in the green coffee market, with a 6.9% share of the US green coffee imports. Guatemalan coffee is prized for its complex flavors, which range from chocolatey and nutty to fruity and floral. The diverse microclimates in Guatemala produce a wide range of coffee beans with unique flavors and characteristics, making it a popular choice among specialty coffee roasters in the US.

4. Honduras: $398.88 million (6.3%)

Honduras is another key player in the green coffee market, accounting for 6.3% of the US green coffee imports. Honduran coffee is known for its smooth and well-balanced flavor profile, with notes of caramel, citrus, and chocolate. The fertile soil and ideal growing conditions in Honduras make it a prime location for coffee cultivation, resulting in high-quality beans that are in demand among US coffee consumers.

5. Peru: $347.65 million (5.5%)

Peru is a rising star in the green coffee market, with a 5.5% share of the US green coffee imports. Peruvian coffee is prized for its mild and nutty flavor profile, with hints of chocolate and citrus. The high altitudes and diverse microclimates in Peru produce coffee beans with unique flavors and characteristics that are gaining popularity among US coffee lovers.

6. Vietnam: $331.95 million (5.3%)

Vietnam is a major player in the green coffee market, accounting for 5.3% of the US green coffee imports, as per the data on Vietnam green coffee exports to the USA by HS code. Vietnamese coffee is known for its bold and robust flavor profile, with hints of chocolate, spice, and earthiness. The tropical climate and rich soil in Vietnam make it an ideal location for coffee cultivation, resulting in coffee beans that are prized for their distinctive flavors.

7. Indonesia: $287.59 million (4.6%)

Indonesia is a significant supplier of green coffee to the US, with a 4.6% share of the total imports. Indonesian coffee is known for its full-bodied and earthy flavor profile, with notes of herbs, spices, and tobacco. The unique processing methods used in Indonesia, such as wet-hulling and dry processing, contribute to the distinctive flavors of Indonesian coffee beans that are popular among US coffee drinkers.

8. Mexico: $255.23 million (4%)

Mexico is a key player in the green coffee market, accounting for 4% of the US green coffee imports. Mexican coffee is known for its bright acidity and balanced flavor profile, with notes of nutty and fruity flavors. The high altitudes and volcanic soil in Mexico produce coffee beans with a unique and nuanced flavor profile that is favored by US consumers.

9. Nicaragua: $239.54 million (3.8%)

Nicaragua is another important source of green coffee imports for the US, with a 3.8% share of the total imports. Nicaraguan coffee is known for its smooth and creamy flavor profile, with hints of chocolate, citrus, and floral notes. The unique microclimates and volcanic soil in Nicaragua produce coffee beans with a distinct flavor profile that is gaining popularity among US coffee enthusiasts.

10. Ethiopia: $166.70 million (2.6%)

Ethiopia is a renowned coffee-producing country, accounting for 2.6% of the US green coffee imports. Ethiopian coffee is known for its fruity and floral flavor profile, with hints of berries, jasmine, & citrus. The diverse and ancient coffee-growing regions in Ethiopia produce coffee beans with unique & complex flavors that are highly prized by US coffee connoisseurs.

Top Green Coffee Importers in the USA: US Green Coffee Importers Database

The US Green Coffee Importers Database is a valuable resource for businesses looking for reputable partners in the coffee industry. This database showcases the leading green coffee bean importers in the United States, providing detailed insights into their experience and expertise in sourcing high-quality green coffee beans from around the world. The leading green coffee importers & buyers in the USA, as per the US green coffee importers data & buyers list for 2025, include:

|

Rank |

Company Name |

Approx. Green Coffee Import Value (2025) |

Primary Import Sources |

|

1 |

Starbucks Coffee Company |

USD 2.6 billion |

Brazil, Colombia, Costa Rica, Ethiopia |

|

2 |

USD 1.4 billion |

Brazil, Colombia, Honduras, Vietnam |

|

|

3 |

Keurig Dr Pepper (Coffee Division) |

USD 1.1 billion |

Brazil, Colombia, Central America, Vietnam |

|

4 |

Nestlé USA (Coffee Imports) |

USD 1 billion |

Brazil, Vietnam, Colombia, Indonesia |

|

5 |

J.M. Smucker Company |

USD 900 million |

Brazil, Colombia, Honduras, Peru |

|

6 |

Volcafe USA (ED&F Man) |

USD 800 million |

Brazil, Colombia, Guatemala, Honduras |

|

7 |

Sucafina North America |

USD 750 million |

Brazil, Colombia, Ethiopia |

|

8 |

Olam Food Ingredients (ofi) – Coffee |

USD 700 million |

Brazil, Vietnam, Uganda, Indonesia |

|

9 |

Mercon Specialty / Mercon Coffee Group USA |

USD 600 million |

Nicaragua, Honduras, Guatemala, Brazil |

|

10 |

Royal Coffee Inc. |

USD 450 million |

Brazil, Colombia, Ethiopia, Panama, Peru |

How This Should Be Interpreted

1. Import Value vs. Market Visibility

Some companies with strong consumer brands (like Starbucks or Folgers) import directly at a massive scale, while others (like Volcafe or Sucafina) operate primarily as B2B traders, supplying dozens or hundreds of roasters.

2. Why Brazil and Colombia Dominate

Across all top 10 importers:

-

Brazil appears in 100% of sourcing portfolios

-

Colombia appears in 90%. This reflects supply reliability, Arabica quality, and trade efficiency.

3. Vietnam’s Role

Vietnam is heavily represented among:

-

Nestlé

-

JDE Peet’s

-

Keurig Dr Pepper. Primarily for Robusta used in instant coffee, blends, and capsules.

4. Specialty vs. Commercial Importers

-

Royal Coffee, Mercon, and Sucafina lean heavily toward specialty and traceable lots

-

Nestlé, Smucker’s, and Keurig prioritize scale, price stability, and blending flexibility

Market Concentration Insight

-

The top 10 importers control 65–70% of the total US green coffee import value.

-

The top 3 alone account for nearly 35%.

-

Hundreds of smaller importers exist, but most handle limited volumes

This concentration gives large importers significant influence over:

-

Origin pricing

-

Sustainability standards

-

Long-term supply contracts

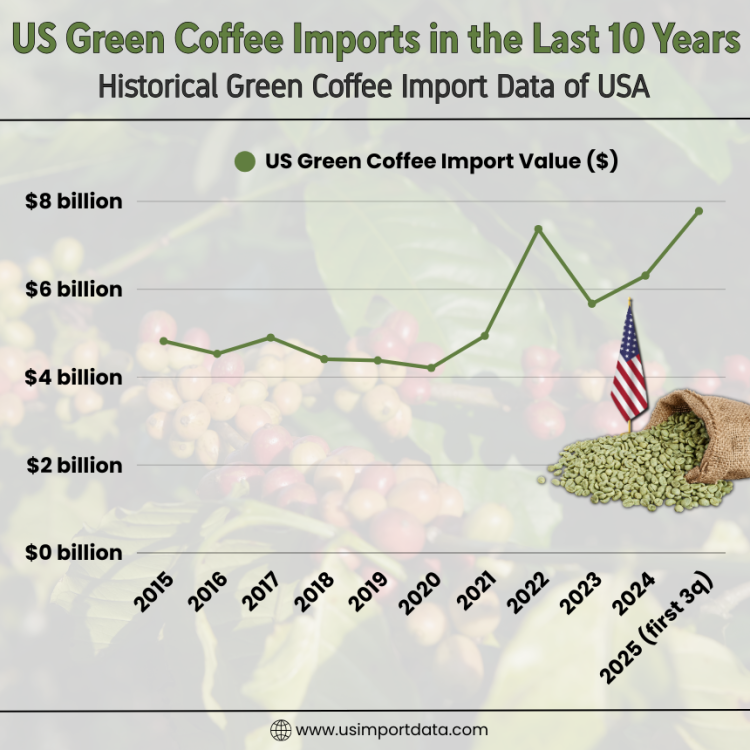

US Green Coffee Imports in the Last 10 Years: Historical Green Coffee Import Data of USA

|

Year of Imports |

US Green Coffee Import Value ($) |

|

2015 |

$4.82 billion |

|

2016 |

$4.53 billion |

|

2017 |

$4.90 billion |

|

2018 |

$4.41 billion |

|

2019 |

$4.38 billion |

|

2020 |

$4.21 billion |

|

2021 |

$4.94 billion |

|

2022 |

$7.37 billion |

|

2023 |

$5.67 billion |

|

2024 |

$6.31 billion |

|

2025 (first 3 quarters) |

$7.78 billion |

Average Import Prices and Cost Trends

Price Inflation

Between 2023 and 2025:

-

Average U.S. green coffee import prices rose 18–25%, depending on origin.

-

Arabica prices increased more sharply than Robusta due to supply tightness.

-

Freight & insurance costs, while lower than pandemic peaks, remained elevated.

Key contributors to price pressure included:

-

Weather disruptions in Brazil, Colombia, and Central America.

-

Higher farmgate prices are driven by labor and input costs.

-

Currency fluctuations in producing countries.

-

Increased financing costs for exporters and traders.

Impact on Import Strategy

As a result:

-

Importers reduced spot buying and favored longer-term contracts.

-

Roasters increasingly blended origins to manage cost.

-

Demand for lower-priced Arabica grades rose, especially among commercial roasters.

Green Coffee Supplier Rankings to the US by Shipment Volume

Shipment data paints a more granular picture of trade activity.

During the 12 months ending mid-2025:

-

Over 10,000 individual green coffee shipments entered the U.S.

-

More than 1,600 foreign exporters supplied U.S. buyers

-

Shipments were received by approximately 500 U.S. importers and roasters

Top origins by shipment count:

-

Brazil

-

Colombia

-

Panama

-

Honduras

-

Guatemala

Panama’s prominence reflects the growth of micro-lot and specialty coffee imports, where shipment count matters more than volume.

Structure of U.S. Green Coffee Importers

Importer Categories

The U.S. importer landscape falls into four main groups:

-

Multinational Trading Houses

-

Handle large volumes

-

Supply major commercial roasters

-

Operate long-term supply contracts

-

Integrated Roasters

-

Import directly for in-house roasting

-

Control quality and sourcing

-

Increasingly common among mid-size roasters

-

Specialty Coffee Importers

-

Focus on traceable, high-quality lots

-

Smaller volumes, higher prices

-

Serve independent roasters

-

Niche and Direct-Trade Buyers

-

Work directly with producers or cooperatives

-

Emphasize sustainability and storytelling

-

Growing but still a small share of total volume

Concentration of Imports

Despite hundreds of active importers:

-

The top 20 U.S. importers control more than half of the total import volume

-

Smaller importers dominate shipment count but not volume

-

Market power remains concentrated at the top

Changes in Origin Strategy and Diversification

Emerging and Fast-Growing Suppliers

Several origins showed notable growth:

-

Uganda: Rapid expansion in washed Arabica exports

-

Ethiopia: Stable growth despite logistics challenges

-

Indonesia: Recovery after weather-related declines

While these countries still represent a smaller share of total imports, they are increasingly important for:

-

Specialty roasters

-

Risk diversification

-

Flavor innovation

Why Diversification Matters

U.S. buyers are reducing dependence on any single origin due to:

-

Climate volatility

-

Political risk

-

Price swings

-

Supply chain disruptions

Impact of Policy, Tariffs, and Regulation

Tariff Uncertainty

Trade policy discussions in 2024–25 introduced uncertainty around:

-

Import duties on agricultural goods

-

Cost pass-through to consumers

-

Competitiveness of certain origins

Although green coffee historically enjoys low tariff barriers, even small changes can significantly affect margins in a low-margin industry.

Sustainability and Compliance

U.S. importers increasingly face:

-

Stricter traceability requirements

-

Sustainability disclosures

-

Supplier compliance audits

These requirements raise costs but also favor organized exporters and long-term partnerships.

What This Means for U.S. Roasters and Consumers

For Roasters

-

Higher green coffee costs are now structural, not temporary

-

Blending strategies are becoming more sophisticated

-

Direct sourcing is growing but remains complex

For Consumers

-

Retail coffee prices are likely to remain elevated

-

Greater variety of origins and flavor profiles

-

Increased focus on ethical and sustainable sourcing

Outlook for 2026 and Beyond

Key Expectations

-

Moderate growth in import volumes

-

Continued high import values due to price support

-

Greater diversification of origins

-

More direct importer-producer relationships

Long-Term Trend

The U.S. green coffee import market is shifting from a purely volume-driven model to a value- and resilience-driven model, where supply security, quality, and sustainability matter as much as price.

Conclusion and Final Thoughts

The US Green Coffee Imports Report 2025 shows a market that has recovered from recent lows but entered a new phase of complexity. Imports are rising again, yet higher costs, climate risk, and policy uncertainty are reshaping how coffee is sourced, traded, and priced. Brazil and Colombia remain foundational suppliers, but the future points toward diversification, tighter importer-producer relationships, & more strategic buying. For stakeholders across the supply chain, from exporters to roasters to retailers, understanding these trends is no longer optional. It’s essential.

We hope that you liked our data-driven and insightful blog on the US green coffee imports report 2025. To access the latest US export-import data, or to search live US green coffee import data by country, visit USImportdata. Contact us at info@tradeimex.in for customized trade reports, market insights, and a verified database of the top green coffee importers in the US, tailored to your requirements.

What's Your Reaction?