Trump’s Tariff Deadline: Will July 9 Reshape US Trade Policy & Affect Global Trade?

Explore the implications of President Trump's July 9, 2025 tariff deadline on US trade policy and global markets. Understand how these tariffs could reshape bilateral trade deals, impact US imports, exports, and global supply chains, with insights on key countries and economic fallout.

As the deadline for President Trump's proposed tariffs on Chinese goods approaches, the world is watching with bated breath to see how this decision will impact not only the U.S. economy but also global trade as a whole. With tensions escalating between the two economic giants, the outcome of this situation could potentially reshape the international trade landscape and US export data for years to come. With a looming deadline of July 9, 2025, many are wondering how these decisions will impact U.S. trade policy and the broader global economy. Let's delve into the details and explore what this deadline could mean for various stakeholders.

The Stakes Are High

The proposed tariffs, which are set to take effect on July 9, could potentially affect up to $200 billion worth of Chinese goods imported into the United States, as per the data on US imports from China. This move comes on the heels of previous tariffs imposed on steel and aluminum imports, as well as a proposed tariff on automobiles. The goal of these measures is to address what the Trump administration sees as unfair trade practices by China, such as intellectual property theft and forced technology transfers.

The stakes are high for both countries, as well as the global economy. The U.S. stands to lose access to affordable goods and materials, which could drive up prices for consumers and put a strain on businesses. China, on the other hand, could see a significant decrease in exports to one of its largest trading partners, which would have ripple effects throughout its economy.

The July 9 US Tariff Deadline: What Is It?

On April 2, 2025, President Trump announced a sweeping tariff policy dubbed “Liberation Day tariffs.” This included:

-

A 10% baseline tariff on imports from all countries

-

Country-specific “reciprocal tariffs” ranging from 20%–50% on nations with trade imbalances.

-

Enhanced duties of 25% on autos and 50% on steel and aluminum.

He then paused automatic implementation for 90 days, setting the deadline on July 9, 2025, for countries to negotiate bilateral deals or risk facing steeper duties.

By July 9, the plan was:

-

Strike up to 90 bilateral trade agreements in 90 days, ideally replacing broad tariffs.

-

Or let reciprocal tariffs kick in automatically on July 10, 2025.

What’s Happening as the Deadline Nears

As July 9 approaches, the landscape has shifted dramatically:

-

Deadline extended to August 1

On July 7, Trump issued an executive order delaying implementation to August 1, effectively buying more time for dealmaking. -

Trade deals finalized, delayed, or planned:

-

The United Kingdom and Vietnam secured formal deals: tariffs rolled back in exchange for market access terms.

-

China agreed on a framework reducing existing tariffs—e.g., tariffs scaled back to around 30% from up to 145%.

-

The EU is negotiating a “limited” deal to delay or reduce duties on cars, electronics, aluminum, etc., but full resolution remains elusive.

-

Japan, South Korea, India, Canada, and others are in varying negotiation stages

-

Tariff threat letters sent:

The U.S. has dispatched notices to 12–15 countries (including Japan, South Korea, Kazakhstan, Malaysia, South Africa, Laos, and Myanmar), warning them of reciprocal duties set to begin August 1 if no deal is reached. -

Market jitters:

Financial markets have reacted sharply; the Dow dropped 630 points on July 7. Investors now nervously await the week ahead.

What July 9 (and August 1) Means for US Trade Policy

A. From WTO-style multilateralism to piecemeal bilateralism

-

Trump's approach moves away from "most-favored nation" WTO principles, adopting country-specific tariffs and bilateral negotiations instead.

-

The shift suggests a preference for “transactional” trade deals, individually tailored to the U.S. advantage.

B. Executive Authority vs Judicial Limits

-

The April tariffs were challenged and ruled unconstitutional by the U.S. Court of International Trade for exceeding presidential powers under IEEPA, but stayed pending appeal.

-

A looming “major questions” doctrine test is scheduled near July 31 before the Federal Circuit, putting further pressure on Trump’s tariff powers.

-

Congress is responding—Senate Bill 1272, the “Trade Review Act,” is moving through the 119th Congress to require congressional approval for tariffs beyond 60 days.

C. Redefining U.S. leverage

-

The strategy serves as a diplomatic lever, with deadlines and tariff threats to compel negotiations.

-

Whether the tactic is effective or breeds instability depends on each partner’s willingness to negotiate, and on final parliamentary/Tariff’s congressional backing.

Global Trade Implications of US Tariff Deadline: Country by Country

United Kingdom & EU

-

The UK secured a partial deal before June 30; deeper questions over steel and aluminum tariffs remain unresolved in the US-UK trade deal.

-

The EU is eyeing agreements that could shield key sectors, but internal bloc divisions and concerns over “skinny deals” complicate matters.

China

-

A framework reduction in April–May scaled back tariffs from highs of 145% to 30%—but finer details remain vague with the US-China trade deal.

-

The 90-day pause on Chinese tariffs expires July 9, but subsequent implementation is likely part of ongoing negotiations.

India, Japan, South Korea

-

India is still negotiating; retaliation plans are reportedly in preparation.

-

Japan and South Korea have received official letters warning of 25% tariffs beginning August 1 unless deals are made.

Canada and Mexico

-

Canada is in resumed talks—Canada is unlikely to get letters before July 9.

-

Mexico, via USMCA, remains exempt from the US reciprocal tariffs.

Southeast Asia & Others

-

Countries like Vietnam, Laos, Myanmar, Malaysia, and South Africa have received letters warning of rates between 24%–40%.

Economic Impacts & Market Fallout

U.S. Domestic Economy

-

Consumer costs may increase due to higher import prices; studies suggest significant cost burdens may arise.

-

Business planning uncertainty intensifies; capital allocation and long-term contracts are delayed amid tariff ambiguity.

-

The Federal Reserve, OECD, and World Bank have downgraded growth forecasts due to elevated average tariffs (15.8%).

Global Markets

-

Equity volatility: Dow jumped and plunged sharply; markets are watching both tariff actions and extensions.

-

Currency risk: Asian currencies weakened amid risk-off sentiment.

-

Manufacturing & trade chain disruption: Global supply networks face cost recalibrations and cautious investment.

Legal, Policy & Institutional Stakes

Judicial Oversight

-

The May 28 court ruling found the tariffs likely illegal and may block future enforcement if not on hold.

-

The timing, just before the July 31 appeals hearing, means August 1 implementation could hinge on the legal outcome.

Legislative Pushback

-

The Trade Review Act (S.1272) would require Congressional approval for tariffs lasting longer than 60 days.

-

If passed, it could significantly rebalance trade authority between the President and Congress, checking unilateral tariff power.

Diplomatic Credibility

-

Trump’s aggressive “take-it-or-else” uses of tariffs may yield short-term leverage but risk long-term relationships, especially with U.S. allies who value predictability.

-

Countries like Canada might experience stronger reluctance to negotiate; others may push back with retaliatory tariffs.

Future Scenarios

|

Scenario |

Description |

Implication |

|

No deals by Aug 1 due to tariffs applying |

10% baseline + country-specific rates (20–50%) take effect |

U.S. import costs up; global trade slowdown; risk of retaliation |

|

Deals struck before the deadline |

Limited bilateral agreements signed (e.g., UK, EU, India, South Korea) |

Tariffs are delayed, though terms are likely one-sided |

|

Judicial block |

Appeals court voids reciprocal tariffs |

Collapse of current policy; refocus on standard Section 232/301 tariffs |

|

Congress restricts via the Trade Review Act |

Presidential power checked; tariffs need majority approval |

Slower trade policy shifts; multilateral approaches likely to re-emerge |

Will July 9 (or August 1) Redefine U.S. Trade Policy?

Yes. But only if:

-

Deals are struck, signaling a shift from multilateral trade regimes to case-by-case bilateral diplomacy.

-

Courts limit executive tariff powers, forcing reliance on Congress.

-

Congress enacts checks like the Trade Review Act, potentially the most lasting change.

If none happen:

-

Trump’s piecemeal trade strategy continues—unpredictable, inconsistent, but aggressive.

-

Global players adapt, but long-term economic cooperation may suffer.

-

Businesses face continued planning uncertainty.

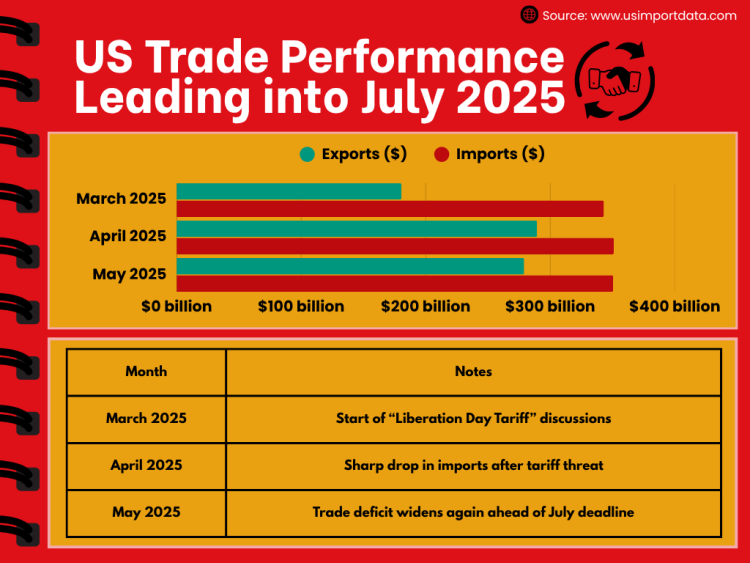

US Trade Performance Leading into July 2025

|

Month |

Exports ($) |

Imports ($) |

Trade Balance ($) |

Notes |

|

March 2025 |

$180.5 billion |

$343 billion |

–$162.5 billion |

Start of “Liberation Day Tariff” discussions |

|

April 2025 |

$289.4 billion |

$351 billion |

–$61.6 billion |

Sharp drop in imports after tariff threat |

|

May 2025 |

$279 billion |

$350.5 billion |

–$71.5 billion |

Trade deficit widens again ahead of July deadline |

Key Insights:

-

April’s import dip was widely interpreted as a pre-tariff pullback by global exporters.

-

Exports peaked in April, driven by strong U.S. energy and aircraft shipments to Europe and Asia.

-

May’s rebound in imports, despite tariff uncertainty, shows sticky global demand for U.S. consumption, especially electronics, machinery, and pharmaceuticals.

Tariff Impact Simulation (August 1 Launch Scenario)

If Trump’s reciprocal tariff policy activates August 1, here’s the projected cost based on May 2025 import levels:

|

Tariff Type |

Rate |

Base (Monthly Imports, $) |

Est. Monthly Tariff Cost ($) |

|

Baseline Tariff |

10% |

$350.5 billion |

$35.05 billion |

|

High-Risk Countries |

25–40% |

$180 billion (50% of total) |

$45–72 billion |

|

Transship Penalty Tier |

40–50% |

$40 billion |

$16–20 billion |

Business & Consumer Impacts

|

Category |

Estimate |

Source |

|

Added Business Costs (YTD) |

$82B |

JPMorgan, June 2025 |

|

Avg. U.S. Household Cost |

$1,200/year |

Tax Foundation |

|

Lost GDP (2025–26 projected) |

0.9% to –2.3% |

Brookings / OECD |

|

Expected Tariff Revenue (2026–2035) |

$2.6 trillion |

U.S. Budget Office |

|

Estimated Global Trade Drag |

–$1.2 trillion (2025–26) |

WTO Forecast |

Summary: Why This Data Matters

-

The May 2025 trade deficit of –$71.5B is a key Trump talking point for demanding reciprocal tariffs.

-

U.S. imports are vast, $350B/month, so even small tariff shifts carry major fiscal and market impacts.

-

Without bilateral deals or judicial restraints, August 1 could unleash nearly $100B in monthly tariffs, reshaping supply chains, inflating consumer prices, and testing U.S. legal boundaries.

A Game of Strategy

The proposed tariffs are part of a larger game of strategy being played out between the U.S. and China. Both countries are vying for dominance in industries such as technology and manufacturing, and each is keen on protecting its interests at all costs. The Trump administration believes that imposing tariffs will force China to come to the negotiating table and make concessions on issues such as intellectual property rights and market access.

However, China has also signaled that it is willing to retaliate if the tariffs are imposed. This could lead to a full-blown trade war between the two countries, with far-reaching consequences for the global economy. Many experts fear that such a scenario would lead to higher prices, reduced economic growth, and increased geopolitical tensions.

The Impact on Global Trade

The outcome of this situation will not only affect the U.S. and China but also the rest of the world. As two of the largest economies on the planet, any disruption in their trade relationship will have a domino effect on other countries and regions. Supply chains will be disrupted, businesses will suffer, and consumers will feel the pinch as prices rise.

Additionally, the uncertainty surrounding the future of international trade could lead to a slowdown in investment and economic growth worldwide. Companies may hold off on making big decisions until they have a clearer picture of how the trade dispute will play out, which could harm job creation and innovation.

The Road Ahead

As July 9 approaches, all eyes are on President Trump and his administration to see how they will proceed. Will the tariffs be implemented as planned, or will there be last-minute negotiations to avoid a full-blown trade war? The answers to these questions remain uncertain, but one thing is clear: the decisions made in the coming days will have far-reaching implications for the future of global trade.

Conclusion: July 9 as Inflection Point or Speed Bump?

In conclusion, the upcoming tariff deadline on July 9 has the potential to reshape U.S. trade policy and have a significant impact on global trade. July 9, 2025, and its extension to August 1, represent more than a ticking clock; they symbolize a broader pivot in U.S. trade policy:

-

A strategic shift toward bilateral, hard‑ball negotiation.

-

A legal battle over the executive scope of power.

-

A test of Congress’s oversight function.

-

A litmus test for U.S. global trade leadership and reputation.

If the administration finalizes meaningful deals and legal challenges are resolved favorably, Trump could rebrand his policy as a new hybrid of tariffs + tailored trade pacts. If not, the U.S. risks heightened market turmoil, renewed global frictions, and a deepening perception of decline in predictable trade governance.

Business leaders, investors, and global policymakers are right to be watching this week closely; its outcome could reverberate across international supply chains, trade norms, and global economic confidence for years to come.

We hope that you liked our insightful blog report on Trump’s tariff deadline on July 9, 2025. To access the latest US import-export data or to search live US trade data by country, visit USImportdata. Contact us at info@tradeimex.in to get a customized database report along with a verified list of the top US exporters & top importers in the US, as per your business needs.

What's Your Reaction?