Top US Exports to Chile: Exploring the US-Chile Free Trade Agreement & Trade Insights 2025

Explore the US–Chile Free Trade Agreement with insights into US exports to Chile, bilateral trade data, & key products traded between both countries.

Chile may be a relatively small economy by global standards, but from a US trade perspective, it plays an outsized role. It is one of the United States’ most stable trade partners in Latin America, a long-standing free trade agreement (FTA) partner, and a gateway market for US exporters targeting South America’s Pacific corridor. According to the latest US export data & Chile import data, the total value of US exports to Chile reached $18.16 billion in 2024, a 1% decline from the previous year. The total value of the US-Chile trade reached $35.57 billion in 2024 and $32.02 billion in the first 10 months of 2025.

Chile is the 27th largest trade partner of the USA, as per the global trade data. As of 2025, US–Chile trade reflects two decades of deep integration under the US–Chile Free Trade Agreement, which entered into force in 2004. The agreement eliminated most tariffs, reduced regulatory friction, and created a predictable framework for goods, services, & investment flows. Today, Chile consistently ranks among the top US export destinations in Latin America, punching above its economic weight in terms of trade intensity and reliability.

This article examines top US exports to Chile, the structure of US-Chile bilateral trade, how the FTA shapes market access, and what current trade data reveals about opportunities and risks heading into 2026.

US–Chile Trade Overview: The Big Picture

The United States and Chile maintain a balanced, mature, and rules-based trade relationship.

Headline Trade Metrics

Based on the most recent full-year data:

-

Total US–Chile goods trade: $35 billion

-

US exports to Chile: $18 billion

-

US imports from Chile: $17 billion

-

Trade balance: relatively balanced, fluctuating year to year

Chile consistently ranks as:

-

One of the top three US export destinations in South America

-

One of the most open economies in the Western Hemisphere

-

A leading Latin American importer of US-manufactured and agricultural goods

Unlike many trade relationships, the US–Chile trade is characterized by low political friction, minimal tariff barriers, and strong institutional alignment, making it attractive for US exporters seeking predictability.

Top Goods US Exports to Chile: What Does the US Export to Chile?

The United States exports a variety of goods to Chile, with some of the top goods being vehicles, machinery, equipment, chemicals, and electronics. These products contribute significantly to the economic relationship between the two countries, fostering trade and partnership. According to the latest US trade data, the total value of US exports to Chile accounted for $15.70 billion in the first 10 months of 2025. The US exports to Chile not only benefit the American economy but also help support Chile's industrial and technological development. The top 10 products that the US exports to Chile, as per the US shipment data for 2025, include:

1. Mineral fuels & oils (HS code 27): $6.59 billion

Mineral fuels and oils are the top goods exported by the US to Chile, reaching a staggering $6.59 billion. These products are essential for various industries, including transportation, manufacturing, and energy production. Chile relies on these imports to meet its energy needs and fuel its economy. Energy is a cornerstone of US exports to Chile.

Key products include:

-

Refined petroleum products

-

Liquefied natural gas (LNG)

-

Distillates and fuel oils

Chile lacks domestic fossil fuel resources and relies heavily on imports. US LNG exports, in particular, have grown as Chile diversifies away from regional pipeline dependence.

The FTA facilitates:

-

Zero tariffs

-

Transparent energy trade rules

-

Long-term supply contracts

Energy exports also support the US strategic goals of strengthening energy security among partners.

2. Nuclear reactors & machinery (HS code 84): $2.83 billion

Nuclear reactors and machinery are another significant export category for the US, with a total value of $2.83 billion, as per the data on US machinery exports to Chile by HS code. These high-tech products are crucial for Chile's infrastructure and industrial development. The US is known for its advanced technology in this sector, making it a key supplier for Chile. Machinery is one of the largest US export categories to Chile, driven by Chile’s mining-intensive economy.

Key products include:

-

Mining machinery

-

Construction equipment

-

Industrial pumps and compressors

-

Agricultural machinery

-

Material handling equipment

Chile is the world’s largest copper producer, and US firms supply:

-

High-performance equipment

-

Replacement parts

-

Maintenance technology

-

Automation systems

The FTA ensures US machinery enters Chile tariff-free, giving US suppliers an edge over non-FTA competitors, particularly in capital-intensive mining projects.

3. Vehicles (HS code 87): $1.15 billion

The US also exports vehicles to Chile, with a total value of $1.15 billion. Whether it's cars, trucks, or other types of vehicles, Chile relies on US exports to meet its transportation needs. This sector represents a significant portion of the trade between the two countries.

US automotive exports to Chile include:

-

Passenger vehicles

-

SUVs and pickup trucks

-

Commercial vehicles

-

Auto parts and components

Chile has one of the highest vehicle ownership rates in Latin America, and consumers show strong brand preference for US vehicles, particularly in the pickup and commercial segments.

Tariff-free access under the FTA allows US vehicles to compete effectively with Asian and European brands.

4. Electrical machinery & equipment (HS code 85): $1.05 billion

Electrical machinery and equipment are essential for Chile's modernization and technological advancement. With a total export value of $1.05 billion, these products play a crucial role in various industries, including electronics, telecommunications, and renewable energy.

This category includes:

-

Power generation equipment

-

Electrical components

-

Transmission and distribution equipment

-

Industrial electronics

Chile’s ongoing investments in:

-

Renewable energy

-

Grid modernization

-

Energy storage

-

Industrial electrification

These have sustained a strong demand in Chile for US electrical exports. US suppliers are favored for reliability, safety standards, and after-sales support.

5. Aircraft, spacecraft, & parts thereof (HS code 88): $1.01 billion

The aerospace sector is another important export category for the US, with a total value of $1.01 billion. Aircraft, spacecraft, and their parts are in high demand in Chile, as the country seeks to improve its air transportation infrastructure and expand its aerospace industry.

US Aerospace exports to Chile are a high-value category, including:

-

Commercial aircraft

-

Aircraft engines

-

Maintenance and repair parts

-

Avionics

Chile’s major airlines and defense sector rely heavily on US aerospace technology. The FTA’s strong intellectual property protections are critical in this sector, supporting long-term service contracts and lifecycle maintenance agreements.

6. Optical, medical, surgical instruments (HS code 90): $543.45 million

Optical, medical, and surgical instruments are vital for Chile's healthcare system and medical industry. The US exports these high-quality products, totaling $543.45 million, to support Chile's healthcare professionals and improve the quality of medical care in the country.

Key products include:

-

Optical instruments and lenses

-

Diagnostic imaging equipment

-

Surgical and dental instruments

-

Laboratory and testing equipment

-

Measurement and precision control devices

Demand is driven by:

-

Expansion of private hospitals and clinics

-

Modernization of public healthcare infrastructure

-

Growth in diagnostic and preventive care

Under the US–Chile FTA, optical and medical instruments enter Chile duty-free, supporting consistent import growth and long-term procurement contracts for US manufacturers.

7. Plastics & articles thereof (HS code 39): $459.30 million

Plastics and plastic articles are common export items from the US to Chile, with a total value of $459.30 million. These versatile products are used in various industries, including packaging, construction, and automotive, making them essential for Chile's economy. US plastic exports to Chile are primarily used as inputs, not finished consumer goods, making them essential to Chile’s domestic production chains. Plastics are a critical intermediate export supporting Chile’s manufacturing, construction, packaging, and mining industries.

Key products include:

-

Plastic resins and polymers

-

Plastic sheets, films, and packaging materials

-

Industrial plastic components

-

Construction-related plastic products

Demand is supported by:

-

Construction activity

-

Food and beverage packaging needs

-

Mining and industrial applications

-

Agricultural supply chains

The FTA eliminates tariffs on US plastic products, ensuring competitive pricing and stable access compared to non-FTA suppliers.

8. Pharmaceutical products (HS code 30): $386.99 million

Pharmaceutical products are crucial for maintaining public health and well-being in Chile. The US exports these essential medicines and healthcare products, totaling $386.99 million, to support Chile's healthcare system and ensure access to quality medications.

Key products include:

-

Prescription medicines

-

Specialty and biologic drugs

-

Vaccines

-

Active pharmaceutical ingredients (APIs)

US pharmaceutical exporters benefit from:

-

Robust intellectual property protections under the FTA

-

Regulatory alignment with international standards

-

High trust in US drug quality and safety

As Chile’s population ages and healthcare spending rises, demand for US pharmaceutical products is expected to remain resilient.

9. Inorganic chemicals (HS code 28): $370.02 million

Inorganic chemicals play a vital role in various industries, including agriculture, manufacturing, and healthcare. The US exports these chemicals to Chile, with a total value of $370.02 million, to support the country's industrial and agricultural sectors. Inorganic chemicals are a key supporting input for Chile’s mining, energy, and industrial sectors.

Key products include:

-

Industrial acids and bases

-

Chemical compounds used in mineral processing

-

Water treatment chemicals

-

Specialty inorganic compounds

Chile’s mining-intensive economy creates sustained demand for inorganic chemicals used in:

-

Copper extraction and processing

-

Refining and smelting operations

-

Environmental and waste treatment

The FTA supports smooth cross-border trade by eliminating tariffs and simplifying customs procedures, which is especially important for time-sensitive industrial inputs.

10. Organic chemicals (HS code 29): $359.58 million

Organic chemicals are essential for the production of various goods, including pharmaceuticals, plastics, and agricultural products. With a total export value of $359.58 million, the US provides Chile with high-quality organic chemicals to support its industries and economic growth. Organic chemicals are among the most economically embedded US exports to Chile, feeding directly into manufacturing, agriculture, and industrial processing.

Key products include:

-

Alcohols and solvents

-

Petrochemical derivatives

-

Specialty organic compounds

-

Chemical intermediates

These products are widely used in:

-

Agricultural chemicals and fertilizers

-

Plastics and polymer production

-

Pharmaceuticals and cosmetics

-

Industrial manufacturing

Demand is relatively stable because organic chemicals are production inputs, not discretionary purchases.

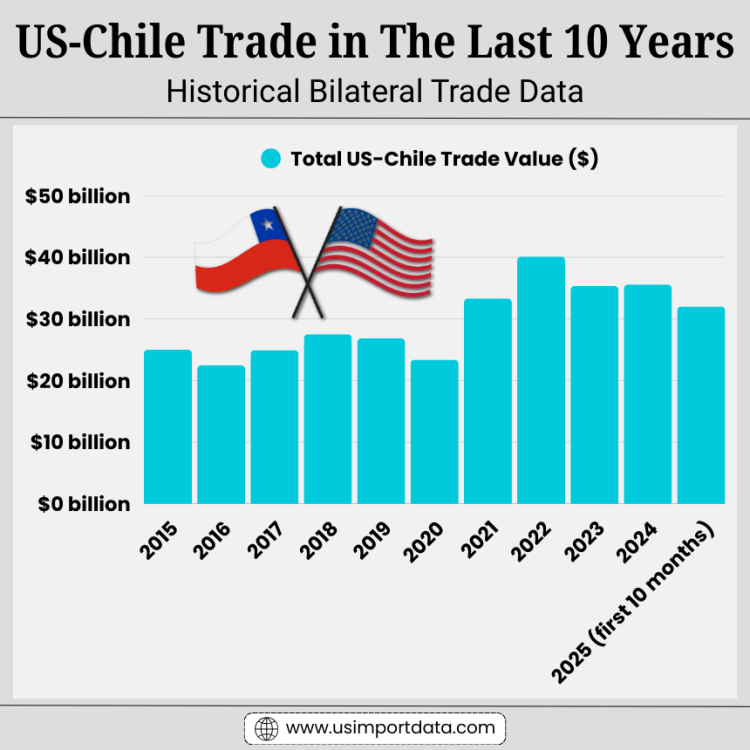

US-Chile Trade in The Last 10 Years: Historical Bilateral Trade Data

|

Year of Trade |

Total US-Chile Trade Value ($) |

|

2015 |

$25.02 billion |

|

2016 |

$22.47 billion |

|

2017 |

$24.92 billion |

|

2018 |

$27.50 billion |

|

2019 |

$26.84 billion |

|

2020 |

$23.39 billion |

|

2021 |

$33.30 billion |

|

2022 |

$40.12 billion |

|

2023 |

$35.34 billion |

|

2024 |

$35.57 billion |

|

2025 (first 10 months) |

$32.02 billion |

The US–Chile Free Trade Agreement: Why It Matters in 2025

The US–Chile FTA is one of the earliest modern US trade agreements, and its longevity is a strength. The US–Chile Free Trade Agreement (FTA) is one of the United States’ longest-standing and most comprehensive bilateral trade agreements. Signed on June 6, 2003, and implemented in 2004, the agreement was designed to establish a high-standard, rules-based framework covering goods, services, investment, intellectual property, government procurement, and dispute settlement.

At the time of implementation, Chile was already among Latin America’s most open economies. The FTA accelerated integration by committing both countries to the progressive elimination of tariffs, with the vast majority of US exports to Chile receiving immediate duty-free access upon entry into force. All remaining tariffs were phased out over time, and by 2015, nearly 100% of bilateral trade in goods became tariff-free.

Key Features of the Agreement

The FTA provides:

-

Duty-free access for nearly all US industrial and consumer goods

-

Elimination of most agricultural tariffs

-

Strong protections for intellectual property

-

Transparent customs procedures

-

Liberalized trade in services

-

Investment protections and dispute resolution mechanisms

By 2015, virtually all tariffs on bilateral trade were eliminated, giving US exporters a structural advantage over competitors from non-FTA countries.

Why the FTA Still Delivers Value

In 2025, the FTA remains relevant because it:

-

Reduces landed costs for US exporters

-

Simplifies customs clearance

-

Limits regulatory surprises

-

Encourages long-term contracts and investment

-

Supports US participation in Chile’s mining, energy, and infrastructure sectors

In an era of growing trade uncertainty globally, the stability of the US–Chile framework stands out.

Trade Stability and Risk Factors in 2025

Strengths of the Relationship

From a US trade perspective, Chile offers:

-

Political stability

-

Strong rule of law

-

Transparent trade rules

-

Low corruption

-

Consistent macroeconomic policy

These factors reduce trade risk and support long-term planning.

Emerging Challenges

Despite its strengths, the relationship faces some challenges:

-

Slower global growth is affecting commodity-driven demand

-

Currency volatility is impacting import affordability

-

Domestic political debates in Chile over mining royalties and regulation

-

Increased competition from Asian suppliers

However, these risks are manageable and structural, not systemic.

Why Chile Matters for US Export Strategy

Chile plays three strategic roles for US exporters:

-

A high-income Latin American market with strong purchasing power.

-

A regional hub for companies expanding into South America.

-

A proof-of-concept FTA partner, demonstrating how rules-based trade can work long-term.

For US trade policymakers, Chile is evidence that comprehensive FTAs can:

-

Support US manufacturing

-

Expand export opportunities

-

Maintain balanced trade relationships

Outlook for 2025 and Beyond

Looking ahead, US exports to Chile are likely to be supported by:

-

Continued investment in mining modernization

-

Expansion of renewable energy projects

-

Infrastructure upgrades

-

Growing demand for US technology and capital goods

Sectors with the strongest growth potential include:

-

Mining automation and equipment

-

Energy and LNG

-

Electric vehicles and charging infrastructure

-

Aerospace services

-

Medical technology

Conclusion and Final Thoughts

In conclusion, the US–Chile trade relationship stands out in the current global environment. It is deep, balanced, and rules-based, anchored by a free trade agreement that continues to deliver tangible benefits more than two decades after its launch.

For US exporters, Chile offers:

-

Tariff-free access

-

Regulatory predictability

-

Strong demand for US goods

-

A reliable platform for regional expansion

In 2026, as global trade becomes more fragmented and politicized, partnerships like the US–Chile demonstrate the enduring value of stable trade frameworks. The trade data shows that when barriers are low and rules are clear, trade flows follow. For US businesses and policymakers alike, Chile remains not just a trading partner but a benchmark for successful US trade engagement in Latin America.

We hope that you liked our data-driven and interactive blog report on the US-Chile Trade Relations & Top US exports to Chile in 2025. For more insights into the US import-export data, or to search live data on US exports by Country, visit USImportdata. Contact us at info@tradeimex.in for customized trade reports & market insights.

What's Your Reaction?