Does the US Import Russian Fertilizer? Top Fertilizer Importer in USA

Discover whether the US imports fertilizer from Russia, explore the role of Russian fertilizer in US markets, and learn about the top fertilizer importer in USA.

With the ongoing geopolitical tensions between the US and Russia, many may wonder if the US continues to import fertilizer from its European counterpart. According to the US import data and USA fertilizer import data, the US fertilizer imports reached a total value of $9.37 billion in 2024, a 5% decline from the previous year. The US imports the most fertilizers from Canada, followed by Russia. In recent years, there has been growing concern about the United States’ dependency on foreign countries for key resources such as fertilizers. With Russia being a major player in the global fertilizer market, many are wondering: Does the US import fertilizer from Russia in 2024-25, and how much fertilizer does the US import?

Yes, the US imports fertilizers from Russia as per the US-Russia bilateral trade data. The US fertilizer imports from Russia in 2024 accounted for $1.30 billion, a 2% decline from 2023, as per the Russia export data and US trade data. Let's take a closer look at the current situation and prospects. In this article, we will dive into the current status of fertilizer imports from Russia to the United States, specifically focusing on the years 2024-25.

Current Scenario of US-Russia Fertilizer Trade

The United States is one of the world's largest consumers of fertilizers, using them extensively in agriculture to boost crop yields. However, the country relies heavily on imports to meet its fertilizer needs. In 2024, the US imported over 15 million metric tons of fertilizers, with a significant portion coming from countries like Russia, Canada, and China.

Russia, in particular, is a key supplier of fertilizers to the US, as per the customs data on Russia fertilizer exports to the US. The country is rich in natural gas reserves, which are a major raw material used in the production of fertilizers such as nitrogen-based urea. As a result, Russia has become a leading exporter of fertilizers to the global market, including the United States.

US Fertilizer Imports from Russia: 2024 Snapshot

|

Metric |

Value (USD) |

Period |

Notes |

|

Total U.S. fertilizer imports from Russia |

$1.30 billion |

2024 |

15% of total U.S. fertilizer imports |

|

Nitrogenous fertilizers |

$1.04 billion |

2024 |

Dominant category |

|

Potassic fertilizers |

$388.27 million |

2024 |

Significant share |

|

Phosphatic fertilizers |

$59.04 million |

2024 |

Smaller portion |

US Fertilizer Imports by Country: Top 10 Fertilizer Import Sources of the US

In the realm of US fertilizer imports, understanding the top 10 fertilizer import sources is crucial for stakeholders in the agricultural sector. The United States sources its fertilizers mainly from Canada, Russia, China, Morocco, and the Netherlands, among others. This data provides valuable insights into the global fertilizer market and highlights the strategic partnerships that ensure a steady supply of essential nutrients for American farmers. The top 10 countries from which the US imports fertilizers, as per the US shipment data and fertilizer import data on US imports by country in 2024, include:

1. Canada: $3.86 billion

2. Russia: $1.30 billion

3. Saudi Arabia: $797.09 million

4. Qatar: $362.10 million

5. Israel: $339.53 million

6. Mexico: $248.39 million

7. Trinidad and Tobago: $205.25 million

8. Morocco: $195 million

9. Egypt: $175.58 million

10. Algeria: $170.92 million

US Fertilizer Imports from Russia Under HS Code 31: US Imports by HS Code

US fertilizer imports from Russia play a significant role in the US imports by HS Code. The import of fertilizers is crucial for sustaining agricultural productivity and meeting the demands of the domestic market. The top US fertilizer imports under HS code 31 from Russia, as per the US import data by HS code and US shipment data for 2024, include:

-

Mineral or chemical nitrogenous fertilizers (HS code 3102): $761.32 million

-

Mineral or chemical potassic fertilizers (HS code 3104): $477.86 million

-

Chemical phosphatic fertilizers (HS code 3103): $55.13 million

-

Mineral or chemical fertilizers containing fertilizing elements (HS code 3105): $9.67 million

-

Animal or vegetable fertilizers (HS code 3101): $6K

Top 10 Fertilizers Imported by the U.S. from Russia in 2024

|

Rank |

Fertilizer Name |

HS Code |

Import Value (USD) |

Share of Total (%) |

|

1 |

Urea (Granular / Prilled) |

310210 |

$410 million |

31.5% |

|

2 |

Ammonium Nitrate |

310230 |

$235 million |

18.1% |

|

3 |

Urea Ammonium Nitrate Solution (UAN) |

310280 |

$190 million |

14.6% |

|

4 |

Potassium Chloride (Muriate of Potash – MOP) |

310420 |

$160 million |

12.3% |

|

5 |

Ammonium Sulfate |

310221 |

$95 million |

7.3% |

|

6 |

Monoammonium Phosphate (MAP) |

310510 |

$80 million |

6.2% |

|

7 |

Diammonium Phosphate (DAP) |

310530 |

$50 million |

3.8% |

|

8 |

Calcium Nitrate |

310260 |

$30 million |

2.3% |

|

9 |

Compound NPK Fertilizers |

310520 |

$25 million |

1.9% |

|

10 |

Magnesium Nitrate / Mixed Micronutrients |

310590 |

$25 million |

1.9% |

Quick Insights

-

Nitrogen-based fertilizers dominate the US import portfolio from Russia, accounting for over 65% of the total value.

-

Potash (KCl) still plays a big role despite diversification from Canada and Belarus.

-

The U.S. continues importing phosphate fertilizers, though at a lower scale.

-

Imports of NPK blends and specialty fertilizers are limited but essential for precision agriculture.

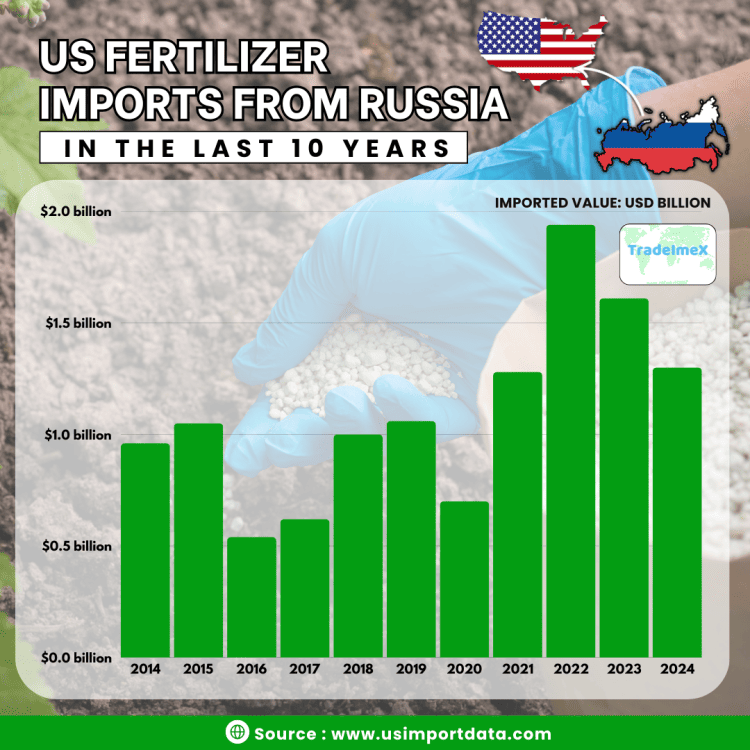

US Fertilizer Imports from Russia in the Last 10 Years: Yearly Bilateral Trade Data

|

Year of Trade |

Value of US fertilizer imports from Russia ($) |

|

2014 |

$0.96 billion |

|

2015 |

$1.05 billion |

|

2016 |

$0.54 billion |

|

2017 |

$0.62 billion |

|

2018 |

$1 billion |

|

2019 |

$1.06 billion |

|

2020 |

$0.70 billion |

|

2021 |

$1.28 billion |

|

2022 |

$1.94 billion |

|

2023 |

$1.61 billion |

|

2024 |

$1.30 billion |

Import & Pricing Trends

-

Steady Import Volumes: Despite sanctions, the U.S. continues to import substantial quantities of fertilizers from Russia, with nitrogenous and potassic fertilizers leading the imports.

-

Pricing Dynamics:

-

Urea (Nitrogenous): Average FOB price increased by 23% year-over-year to $310 per ton as of June 2024.

-

Monoammonium Phosphate (MAP): Prices rose by 38% to $572 per ton.

-

Diammonium Phosphate (DAP): Prices increased by 10% to $521 per ton.

-

Potash: Prices decreased by 31% to an average of $253 per ton compared to June 2023.

Top U.S. Importers of Russian Fertilizers

While specific company names are not publicly disclosed, major U.S. agricultural and fertilizer companies are likely among the top importers:

-

The Mosaic Company (MOS): A leading producer and marketer of concentrated phosphate and potash crop nutrients.

-

CF Industries Holdings Inc. (CF): A global leader in nitrogen fertilizer manufacturing and distribution.

-

Nutrien Ltd. (NTR): The world's largest provider of crop inputs and services.

These companies play a significant role in the U.S. fertilizer market and are likely to be involved in importing fertilizers from various global sources, including Russia.

Tariff and Sanction Considerations

-

Sanction Status: As of early 2025, fertilizers are not subject to U.S. sanctions against Russia, allowing continued imports with help from Trump’s leverage with the Russian fertilizer deal.

-

Potential Tariff Risks: There have been discussions about imposing tariffs on Russian imports, including fertilizers. However, such measures have not been implemented, and fertilizers remain exempt from current sanctions.

Global Context

-

Russia's Export Growth: In the first half of 2024, Russia's potash exports increased by 70% year-over-year, reaching 6.7 million tons. Urea exports also rose by 23% to 4.6 million tons.

-

Major Buyers: The United States, along with Brazil and India, remains one of the top importers of Russian fertilizers, collectively accounting for about 60% of Russia's fertilizer exports.

Impact of Fertilizer Imports on US Agriculture

The US's dependency on fertilizer imports, including those from Russia, has both benefits and challenges for the country's agriculture sector. On one hand, access to foreign fertilizers ensures a stable supply of nutrients for crops, supporting agricultural productivity. This can help meet the growing demand for food in the US and beyond.

However, relying on imports also exposes the US to potential risks. Price fluctuations in the global fertilizer market, trade disputes, and supply chain disruptions can all affect the availability and cost of fertilizers in the country. This underscores the importance of diversifying the sources of fertilizers to mitigate risks and ensure food security.

Final Takeaway

Despite geopolitical tensions and sanctions in other sectors, the United States continues to import significant quantities of fertilizers from Russia in 2024–25. The consistent demand, coupled with the exemption of fertilizers from sanctions, underscores the critical role these imports play in supporting U.S. agriculture. However, potential policy changes and market dynamics warrant close monitoring to anticipate future shifts in this trade relationship.

Future Projections

Looking ahead to 2025, the US is likely to continue importing fertilizers from Russia. Despite efforts to boost domestic production, the country's reliance on imports is expected to persist due to the significant cost advantages offered by foreign suppliers like Russia. Additionally, geopolitical factors could influence the US fertilizer trade with Russia. Tensions between the two countries may impact the flow of goods, potentially leading to disruptions in the supply chain. However, given the mutual economic interests at stake, both parties are likely to strive for continued trade relations in the fertilizer sector.

Conclusion

In conclusion, the question of whether the US will import fertilizer from Russia in 2024-25 is likely to be answered in the affirmative. Given the current landscape of the global fertilizer market and the US reliance on imports, it is expected that the country will continue to source fertilizers from key suppliers like Russia. However, efforts to enhance domestic production and strengthen trade relations will play a crucial role in shaping the future of the US fertilizer industry.

In the end, we hope that you liked our blog report on US fertilizer import from Russia (2024-25). Visit USImportdata for more such market trends on the US import-export data. Contact us at info@tradeimex.in and get a customized report. Subscribe to get a list of the top US fertilizer import companies buying fertilizers from Russia.

What's Your Reaction?