USA Computer Exports by Country 2024-25 and Export Report

Discover the latest insights on USA computer exports by country for 2024-25. Explore key trade partners, top exporters, market trends, and future projections in the US computer export industry.

The United States has established itself as a global leader in the technology sector in today's fast-paced digital age. With cutting-edge innovations and a competitive edge in the market, USA computer exports by country have witnessed exponential growth in recent years, paving the way for a promising future in the export industry. The USA is the 4th largest computer exporter in the world. The tech hardware market continues to grow as computer suppliers in USA expand their networks to meet rising demand from businesses and consumers. With global computer exporting activities increasing, the U.S. relies on both domestic and international partners to maintain a steady flow of high-quality devices and parts.

Many personal computer suppliers now focus on customized systems for gaming, education, and enterprise use, while specialized computer component suppliers provide everything from processors and memory to storage and peripherals. Together, these pc suppliers form a critical backbone of the American digital economy, supporting innovation across multiple industries.

According to the latest US export data and US computer export data, US computer exports reached a total value of $40.09 billion in 2024, an increase of 31% from the previous year. The US is the third-largest computer exporter in the world, according to US exporters' data and US trade data. This article for the US computer export report 2024-25 will delve into the key players in the international market, emerging markets, top computer exporters, and projections for the future.

US Computer Exports by Country 2024-25: Top US Trade Partners for Computer Exports

When examining US computer exports by country, it is evident that the United States has strong trade partnerships in the tech sector with leading countries worldwide. The Netherlands, China, Mexico, and Canada are among the top US trade partners for computer exports, showcasing the significant global market presence of US technology products. The top 10 US export partners for computer exports from the USA in 2024-25, as per the US shipment data, include:

1. Canada: $6.11 billion (15.3%)

Canada emerged as the top trade partner for the United States in computer exports in 2024, accounting for 15.3% of the total export market, as per the US computer export data to Canada by HS code. The strong economic ties between the two countries have paved the way for robust trade in the computer sector.

2. Mexico: $4.81 billion (12%)

Mexico secured the second spot among the US trade partners for computer exports in 2024, with a contribution of 12% to the total export market. The close proximity of Mexico to the United States has facilitated seamless trade in computers between the two nations.

3. Netherlands: $3.46 billion (8.7%)

The Netherlands emerged as a significant player in the US computer export market, capturing 8.7% of the total share in 2024. The favorable business environment and strong logistics infrastructure in the Netherlands have attracted US computer exporters.

4. Japan: $2.25 billion (5.6%)

Japan maintained its position as a key US trade partner for computer exports in 2024, contributing 5.6% to the total export market. The demand for cutting-edge technology in Japan has created lucrative opportunities for US computer exporters.

5. Malaysia: $2.03 billion (5.1%)

Malaysia secured a notable share in the US computer export market in 2024, accounting for 5.1% of the total export market. The strategic location of Malaysia in Southeast Asia has made it a preferred destination for US computer exports.

6. Singapore: $1.71 billion (4.3%)

Singapore emerged as a significant trade partner for the United States in computer exports, capturing 4.3% of the total share in 2024. The advanced technology ecosystem and business-friendly policies in Singapore have fueled the growth of US computer exports.

7. United Arab Emirates: $1.69 billion (4.2%)

The United Arab Emirates continued to be a key player in the US computer export market in 2024, contributing 4.2% to the total export market based on the export data of US computer exports to the UAE by HS code. The thriving business hub of Dubai has facilitated strong trade relations between the US and the UAE in the computer sector.

8. Australia: $1.44 billion (3.6%)

Australia secured a significant share in the US computer export market, accounting for 3.6% of the total export market in 2024. The demand for high-quality computers in Australia has led to increased trade partnerships with the United States.

9. United Kingdom: $1.43 billion (3.6%)

The United Kingdom remained a key trade partner for the United States in computer exports, contributing 3.6% to the total export market. The strong historical ties between the US and the UK have laid the foundation for continued trade in the computer sector.

10. Taiwan: $1.41 billion (3.5%)

Taiwan rounded off the list of the top 10 US trade partners for computer exports in 2024, capturing 3.5% of the total export market. The advanced technology manufacturing capabilities in Taiwan have attracted US computer exporters looking to expand their market reach.

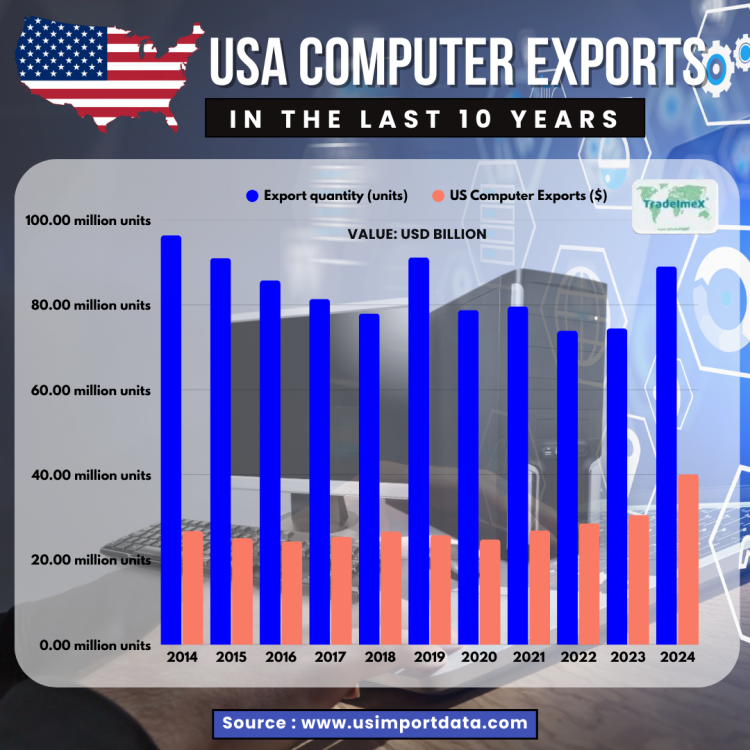

USA Computer Exports in the Last 10 Years: Yearly US Computer Export Data

|

Year of Trade |

US Computer Exports ($) |

Export quantity (units) |

|

2014 |

$26.78 billion |

96.36 million units |

|

2015 |

$25.05 billion |

91.01 million units |

|

2016 |

$24.32 billion |

85.74 million units |

|

2017 |

$25.39 billion |

81.39 million units |

|

2018 |

$26.66 billion |

77.97 million units |

|

2019 |

$25.80 billion |

91.16 million units |

|

2020 |

$24.78 billion |

78.77 million units |

|

2021 |

$26.91 billion |

79.63 million units |

|

2022 |

$28.56 billion |

73.89 million units |

|

2023 |

$30.55 billion |

74.42 million units |

|

2024 |

$40.09 billion |

89.04 million units |

List of Top Computer Exporters in the US: USA Computer Exporters Database

The USA Computer Exporters Database showcases the leading companies contributing to the computer export industry in the United States. This database not only highlights key players but also provides valuable insights into market trends and emerging opportunities. Top Companies like Apple and Dell take centerstage as the biggest US computer exporters. The biggest computer exporters in the USA, as per the US computer suppliers list and US export shipment data for 2024, include:

1. Apple Inc.: 50 million units (total shipments in 2024)

2. Dell Technologies: 40 million units

3. Hewlett Packard Enterprise (HPE): 35 million units

4. Lenovo Group: 30 million units

5. Microsoft Corporation: 25 million units

6. Acer Inc.: 20 million units

7. ASUS Computer International: 18 million units

8. Razer Inc.: 15 million units

9. Corsair Gaming, Inc.: 12 million units

10. Western Digital Corporation: 10 million units

Understanding the Scope of USA Computer Exports

The USA's computer exports have been on a steady rise, with the country exporting a wide range of computer hardware and software products to countries around the world. From laptops and desktops to servers and networking equipment, the USA has a diverse portfolio of computer exports that cater to the needs of various industries and consumers. The USA is the biggest exporter of computers in the American continent according to the North America Trade Data.

Key Players in USA Computer Exports

When it comes to computer exports, the USA boasts of some of the biggest players in the industry. Companies like Apple, Microsoft, Dell, HP, and IBM are among the top exporters of computer products from the USA. These companies have a strong global presence and a reputation for delivering high-quality products that meet the demands of consumers worldwide.

Emerging Trends in USA Computer Exports by Country 2024-25

Looking ahead to the years 2024-25, USA computer exports are expected to continue on their upward trajectory. With advancements in technology and the increasing demand for digital devices, the export of computers from the USA is projected to grow significantly in the coming years. Countries like China, Japan, Germany, and the UK are expected to be key destinations for USA computer exports, thanks to their booming tech industries and consumer markets.

US Computer Export Trends & Shipments

|

Quarter/Month |

Total Exports (USD) |

Year-on-Year Growth |

Primary Export Destinations |

Key Drivers |

|

January 2025 |

$3.53 billion |

+50.8% from January 2024 |

Canada, Mexico, EU, Asia |

Surge in demand due to AI advancements |

|

Q3 2024 |

17.9 million units |

+7% YoY growth |

North America, Western Europe, APAC |

Strong demand from businesses for PC upgrades |

|

Q3 2024 (Notebooks) |

+9% Year-on-Year |

+12% Commercial demand |

Corporate sector, SMBs |

Corporate PC refresh cycle, hybrid working trends |

|

Q3 2024 (Desktop PCs) |

Slight Increase |

Stabilizing after pandemic-driven surge |

Government contracts, Schools |

Back-to-office trend, government procurement |

Key Highlights

-

Canada and Mexico remain top trading partners due to proximity, with cross-border trade benefiting from NAFTA/USMCA agreements.

-

Export growth fueled by AI capabilities integrated into PCs and business-driven demand for remote working solutions.

Pricing Dynamics & Influencing Factors

|

Factor |

Impact on Export Pricing |

Forecast for 2025 |

|

Tariffs & Trade Policies |

Increased costs due to tariffs on computer components (e.g., motherboards, semiconductors) |

5-20% price increase in tech exports |

|

Supply Chain Disruptions |

Shipping delays, higher raw material costs (e.g., rare earth elements) |

Prices for components like memory chips may rise by 10-15% |

|

Geopolitical Tensions |

Increased pricing pressure due to uncertain trade environments (e.g., trade tensions with China) |

Heightened risks of price volatility, especially in China-bound exports |

|

Technological Advancements (AI/5G) |

Higher pricing for AI-powered PCs and 5G-ready devices |

Premium pricing for high-end tech (AI/5G-capable) |

Key Insights

-

Tariff Impact: U.S. exporters could face increased import tariffs from countries like China, which may further escalate the cost of computers and related components.

-

AI & 5G: As AI-powered and 5G-ready PCs gain traction in the market, pricing for these high-demand devices will continue to rise.

-

Supply Chain Concerns: Constraints in the supply of semiconductors, coupled with shipping disruptions, will likely push up prices.

Market Trends & Key Drivers for USA Computer Exports

|

Trend |

Description |

Impact on U.S. Exports |

|

AI Integration into PCs |

Surge in demand for AI-integrated devices like laptops and desktops. |

Increased U.S. computer exports to markets demanding advanced computing solutions. |

|

Shift Towards Hybrid Work |

Continued adoption of hybrid working models, increasing need for personal and professional computing devices. |

Increase in PC shipments to SMBs, home offices, and educational institutions. |

|

AI in Business Solutions |

Businesses adopting AI-driven tools for productivity and automation. |

High export demand for AI-powered workstations, servers, and cloud devices. |

|

Shift to Cloud Computing |

Strong growth in cloud services and remote server use. |

Surge in U.S. server and storage device exports to Asia and Europe. |

|

Windows 11 Refresh Cycle |

Businesses and individuals upgrading to Windows 11 PCs. |

Growth in commercial and consumer PC exports is driven by the refresh cycle. |

AI Integration: By Q4 2024, 23% of PCs sold were AI-capable, signaling a significant trend in advanced technology adoption.

Hybrid Work Trend: With remote work becoming permanent, demand for laptops and cloud-capable PCs surged, particularly in regions with high commercial adoption.

Export Controls & Trade Policies

|

Policy/Control |

Impact on U.S. Computer Exports |

Key Affected Countries |

|

Export Controls on Advanced AI Chips |

Restrictions on cutting-edge AI chips, such as Nvidia GPUs, to certain countries. |

China, Russia, and others in Asia |

|

Tariff Policy (U.S.-China Trade) |

Potential price hikes on exported computers due to trade tariffs. |

China, EU, India |

|

Export Restrictions on Tech |

Potential restrictions affecting semiconductors and high-tech equipment exports. |

China, Iran, North Korea |

|

Supply Chain Policy Changes |

Reconfiguration of supply chains to mitigate risks affecting export timelines. |

Global impact |

Strategic Insights

-

AI Chip Restrictions: Due to national security concerns, the U.S. government placed export controls on Nvidia AI chips. This policy could hurt U.S. exports to China, one of the largest buyers of U.S. tech.

-

Tariff Adjustments: Escalating tariffs between the U.S. and China could raise export prices, dampening the competitiveness of U.S. tech products in Asia.

Key Challenges & Risks for 2025

-

Tariffs & Trade Policies: The possibility of new tariffs, especially related to computer components and semiconductors, could increase production costs and pricing.

-

Global Supply Chain Disruptions: Continued supply chain challenges (including shortages of key components like memory chips) could slow down production and increase the time-to-market for computer products.

-

Geopolitical Risks: Heightened trade tensions and regional instability in critical markets like China and Russia may lead to export uncertainties and potential market access issues.

US Computer Export Forecast for 2025

-

Continued Growth: U.S. computer exports are forecasted to continue growing at 8-12% annually through 2025, driven by strong demand for AI-powered devices and commercial PC upgrades.

-

Pricing Trends: Expect 5-20% increases in prices and price change in computers for key tech exports due to tariffs, supply chain constraints, and geopolitical tensions.

-

Market Resilience: Despite challenges, the U.S. export market for computers remains strong due to technological advancements, with high demand in North America, Europe, and Asia for AI-integrated and cloud computing solutions.

Key Takeaways

-

AI Adoption: The growing integration of AI in computing is a primary driver of U.S. computer export growth.

-

Remote Work Trends: The global shift toward hybrid work spurs demand for laptops and cloud-capable devices.

-

Challenges in Pricing: Anticipate higher prices in 2025 due to trade policies, tariffs, and geopolitical instability.

Challenges and Opportunities in the US Computer Export Industry

While the USA computer exports by country present a promising outlook, some challenges need to be addressed. Competition from other tech giants, trade restrictions, and fluctuating currency values are some of the factors that can impact the export of computer products from the USA. However, with strategic planning and innovation, there are ample opportunities for the USA to maintain its position as a leading exporter of computer products in the global market.

Conclusion and Final Thoughts

In conclusion, the USA computer exports by country 2024-25 are set to continue their growth trajectory, fueled by innovation, demand, and strategic partnerships. As we look towards the future, the potential for USA computer exports remains bright, offering opportunities for growth and success in the years to come. Looking at the upcoming USA Computer Exports by Country 2024-25 and Export Report, one fact is clear: the dynamic relationships between nations play a crucial role in shaping global trade landscapes.

We hope that you liked our insightful blog report on US computer exports by country. For more such market reports and US import-export data, visit USImportdata. Contact us at info@tradeimex.in to get a detailed report on US computer exports and a list of the top computer exporting companies in the US.

What's Your Reaction?